The first factor to consider is the length of time you have been dealing with a customer. In a perfect world, you would have a mixture of new and repeat customers. The repeat customers are your foundation: They help you pay most of the bills, and they give you a sense of stability. On the other hand, new customers present new challenges, but they also provide business growth opportunities. Although the ideal mix depends on many factors, most companies would be happy with 80 to 90 percent repeat customers and 10 to 20 percent new customers.

Whereas the length of time you have dealt with a customer is important, the percentage of your total business coming from that customer is equally important. If one customer represents a large percentage of your business, you have a greater exposure to risk. Again, there is no hard and fast rule, but most companies do not want any single customer to account for more than 10 percent of their business.

Another factor in your decision to accept new business is how long that customer has been in business, doing what it is doing now. It is much riskier to deal with a start-up than a long-established company with a performance history.

The customer’s success, in terms of sales growth, should also be considered. Most of us would prefer to deal with a customer whose sales are increasing, or at least remaining stable, rather than one whose business is declining. If your customer’s customers are not buying, you will eventually be impacted.

A customer’s payment history must also factor into decisions about future business. A customer who pays invoices in a timely manner is one you tend to go out of your way to satisfy. On the other hand, customers who stretch out every payment and require endless collection calls are burdens most companies eventually would like to shed.

How a customer provides order commitments is also important. Your ability to plan your resources can often mean the difference between profit and loss. A customer who can provide visibility of future needs can make your planning easier. Blanket purchase orders with specified release dates are an effective means of providing this visibility.

As valuable as a customer who provides visibility can be, that value can quickly erode when schedule changes become the norm. Customers with highly volatile schedules can disrupt an entire organization and adversely impact your ability to satisfy other customers.

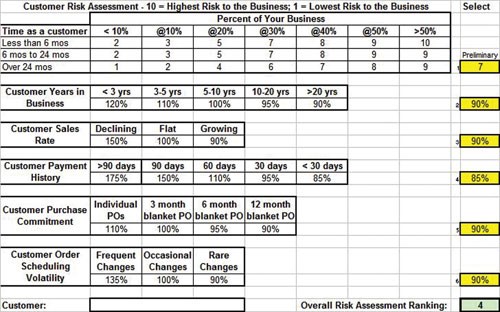

A simple risk assessment tool, like the one shown on page 34, can prove useful in gaining an understanding of the risk associated with any customer (or potential customer). Such an understanding will lead to better business decisions.

The tool, which easily can be converted to a spreadsheet to perform all calculations, requires you to input a preliminary risk assessment (highlighted in box 1) based on how long you have dealt with a particular customer and the percentage of your business the customer represents. “1” is considered to be the lowest risk and “10” the highest. Boxes 2 through 6 require the input of percentages that best describe the customer’s years in business, sales rate, payment history, purchase commitment and scheduling volatility.

The overall risk assessment ranking is calculated by multiplying the preliminary risk assessment by the percentages associated with the five other risk factors. In some cases, the overall risk assessment ranking will be lower than the preliminary risk assessment (if the customer has performed well on the other risk factors—as shown in the example) and in other cases, the overall risk assessment ranking will be higher than the preliminary risk assessment (if the customer has performed poorly on the other risk factors).

The tool is helpful when used to assess the risk associated with one customer; however, it may prove to be of greater value when used to compare the risk levels associated with each of your customers. Such a comparative analysis may ultimately lead to baselines for risk tolerance and increased confidence when making the decision to say “yes” or “no.”

.jpg;maxWidth=300;quality=90)