An Easy Way To Maximize Your Investment Income

More from the “how to make it, how to keep it” series.

Share

Takumi USA

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View MoreThis article continues my quest to educate my readers in the areas of “how to make it” and “how to keep it.” Today’s subject matter, private placement life insurance (PPLI), is an income tax saver, an estate tax destroyer and an asset protection device for those falling into the top 1 percent of taxpayers carrying the brunt of Federal income taxes.

PPLI is a form of variable universal life insurance that is offered privately, rather than through a public offering. Variable life insurance has cash value that is dependent on the performance of one or more investment accounts in the policy. Since the insurance company cannot know the specific investment goals of each traditional policy purchaser, the carrier often settles for registering a set offering, including a selection of mutual funds or hedge funds, as investment options within the policy. On the other hand, the carrier customizes the investment options to meet the needs of each PPLI owner/investor.

The prime purpose of PPLI is to make your investment profits (whether capital gains, dividend income or interest income) tax-free. Simply put, all policy investments are wrapped in a tax-free insurance envelope.

Just how significant are the wealth accumulation results of taxable versus tax-free? The example in the table below, which was created by Lewis Schiff, a lawyer from Austin, Texas, will astound you.

A PPLI policy insures a 45-year-old male paying $2.5 million in premiums for 5 years for a total of $12.5 million. The assumed rate of return is 10 percent (net of investment-management fees), taxed as ordinary income (at 40 percent, including Federal and State taxes).

Two advantages stand out:

• The death benefit is always king.

• In the long run, use every opportunity available to get into an income-tax-free environment. Note the larger amount in “cash value” after 20 years compared to “taxable investment.” Neither the increase in “cash value” nor the “death benefit” is subject to income tax.

PPLI premiums start from a low of $1 million (for example, $250,000 per year paid over 4 years) to a more typical $5 to $10 million or more (paid in the early years). They can range to even more, which can be paid as a single premium at inception.

Other advantages of PPLI include:

• Liquidity. When needed, you can borrow a portion of the “cash value,” which can be paid back at any time or out of the “death benefit.”

• Asset protection. Your investments are placed in separate accounts, avoiding any risk of insurance company illiquidity.

• Risk minimization. Insurance is a risk-shifting strategy in the event of a premature death, always supplementing the tax-free investment results (at any age).

• Estate tax free. The PPLI arrangement can be set up so the ultimate death benefit is not subject to estate taxes.

• Investment flexibility. You can, with the help of the insurance company, select from a large number of hedge funds. Or, you can work with a third-party adviser of your choice. You can even switch advisers or have more than one. It’s also permissible to invest in a private equity deal (maybe one of your own companies or someone else’s) that you think has great upside potential.

• Low investment cost. Traditional agent’s commissions are eliminated, letting more funds “work” inside your policy. Typically, PPLI is placed with an offshore insurance company, further reducing the policy costs. Also, there are no surrender charges or other insurance company penalties.

What if your health or age prevents you from getting insurance, including PPLI? Then you can purchase a private placement deferred variable annuity (PPDVA). This type of annuity is similar to a PPLI, except the income is deferred until the policy owner takes a distribution, which is taxable at ordinary income tax rates.

If you have a large investment portfolio, whether CDs, municipal bonds, hedge funds, stocks or bonds, or any other options in the endless parade of investment vehicles, then PPLI is something you should consider. Your investment wealth is sure to compound at an accelerated pace because you won’t lose one cent in income taxes.

Related Content

What are Harmonics in Milling?

Milling-force harmonics always exist. Understanding the source of milling harmonics and their relationship to vibration can help improve parameter selection.

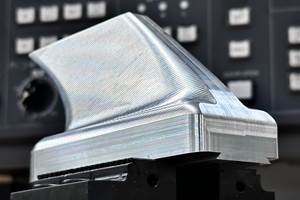

Read MoreCustom Workholding Principles to Live By

Workholding solutions can take on infinite forms and all would be correct to some degree. Follow these tips to help optimize custom workholding solutions.

Read MoreTips for Designing CNC Programs That Help Operators

The way a G-code program is formatted directly affects the productivity of the CNC people who use them. Design CNC programs that make CNC setup people and operators’ jobs easier.

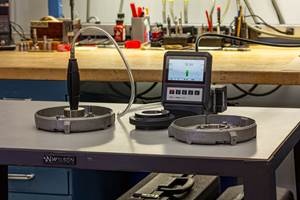

Read MoreHow to Choose the Correct Measuring Tool for Any Application

There are many options to choose from when deciding on a dimensional measurement tool. Consider these application-based factors when selecting a measurement solution.

Read MoreRead Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)