Manufacturers Adjusting in Third Week of Coronavirus Survey

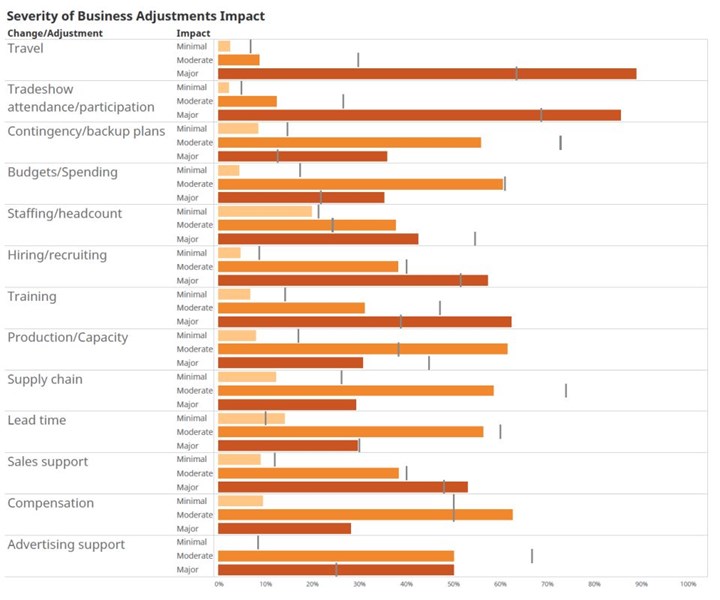

In the third week of the of the COVID-19 survey, manufacturers started making more significant adjustments to contingency plans, budgets/spending and staffing/hiring. However, production and capacity were relatively unchanged.

Share

Takumi USA

Featured Content

View More

In the third week of the survey, the most significant change experienced was ripple effects, effects that manufacturers could not tie directly to COVID-19 but believed to be a result of the pandemic. The percent of respondents experiencing ripple effects increased to 35% from 24%.

During the week of March 16th, Gardner Intelligence conducted for the third time a short survey to gage the effects of COVID-19 on discrete parts manufacturers across all the industries that Modern Machine Shop’s publisher Gardner Business Media covers. The survey asked two basic questions:

- What changes has your business experienced as a result of COVID-19?

- What adjustments has your business made as a result of COVID-19?

For each of those questions, respondents were asked to compare the current state of their business to the norm prior to COVID-19 and rank the severity of the change or adjustment from minimal to moderate to major.

In the second and third weeks of the survey, there were more than 300 respondents each week. Of note, during the week of March 16th, most of the responses were received prior to automotive OEMs closing their facilities and Pennsylvania, California, and other states closing all non-essential businesses.

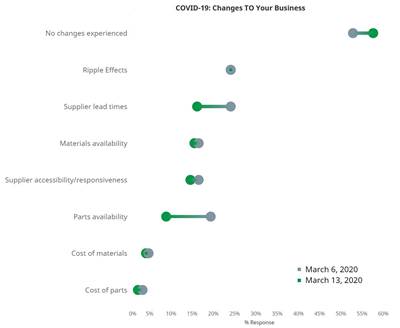

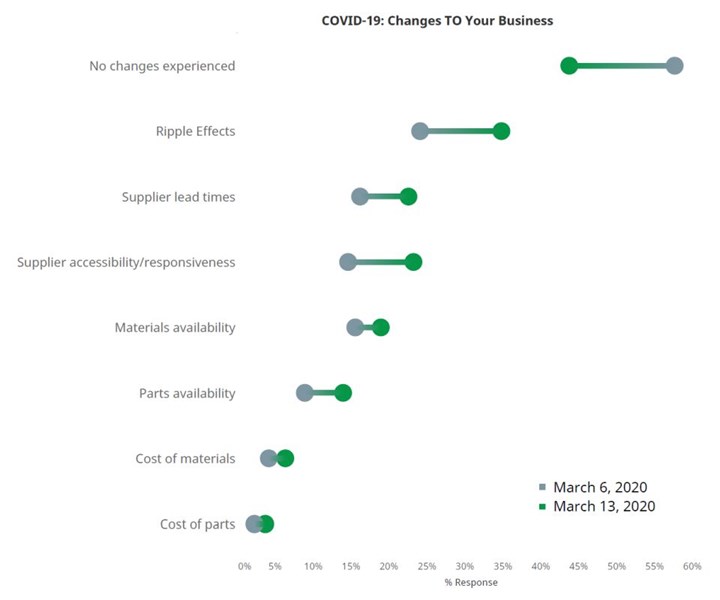

In the charts on this blog post, the percent of respondents as of March 20th are green dots and the percent of respondents as of March 13th are gray dots. The orange bars indicate the severity of the impact of March 20th and the gray hashes were the severity of impact as of March 13th.

According to this last week’s survey, 44% of manufacturers experienced no change in their business, which was down from 58% in the previous week. Significantly more manufacturers saw their business affected by COVID-19 in the third week of the survey.

The most significant change experienced was ripple effects, effects that manufacturers could not tie directly to COVID-19 but believed to be a result of the pandemic. The percent of respondents experiencing ripple effects increased to 35% from 24%. Ripple effects were more severe in the third week compared with the second week as those indicating the effects were major increased to 26% from 20% while those responding the effects were minimal decreased by a similar percent.

The most direct changes experienced by manufacturers were related to suppliers, in terms of accessibility/responsiveness and lead times. In both cases, about 23% of respondents reported experiencing these changes, which was up from the mid-teens the previous week. There was a notable shift to moderate from severe impact for supplier accessibility/responsiveness while the severity of supplier lead times was generally unchanged.

In the third week of the survey, just 17% of respondents reported making no adjustments to their business. This was down from 39% in the first week and 34% in the second week.

The severity of contingency/backup plans increased to 36% major from 13% major the previous week. The adjustments to budgets/spending and hiring/recruiting were more severe while the adjustments to staffing/headcount were somewhat less severe.

The most significant adjustments continued to be to travel and tradeshow attendance/participation. The largest percent change was to contingency/backup plans with 45% making such plans compared with 25% the previous week. Also, there were significantly more manufacturers adjusting budgets/spending, staffing/headcount and hiring/recruiting. In the third week of the survey, there were still relatively few manufacturers that had adjusted the production capability and capacity of their facilities. This may change next week with the automotive OEMs closing their facilities and several states closing all non-essential businesses.

Regarding travel and trade shows, 85-90% of respondents indicated the severity of their changes were major. The severity of contingency/backup plans increased to 36% major from 13% major the previous week. The adjustments to budgets/spending and hiring/recruiting were more severe while the adjustments to staffing/headcount were somewhat less severe.

For more information on Gardner Intelligence’s COVID-19 coverage, keep up to date with our blog at gardnerintelligence.com.

Read Next

Manufacturers Experience Fewer Changes with Less Impact from the Coronavirus

In the second week of a survey on COVID-19, manufacturers reported fewer changes to their business with less severe impact on their supplier lead times and parts availability with the lone exception of travel-related activities.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=150)

.png;maxWidth=300;quality=90)