Manufacturers Experience Fewer Changes with Less Impact from the Coronavirus

In the second week of a survey on COVID-19, manufacturers reported fewer changes to their business with less severe impact on their supplier lead times and parts availability with the lone exception of travel-related activities.

Share

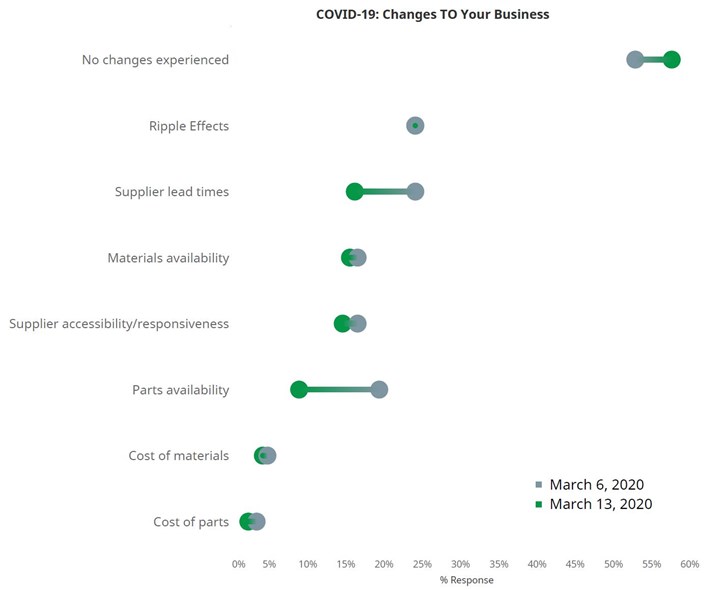

Fewer manufacturers reported experiencing changes to their business in the second week of the survey. Notably, there was a clear reduction in manufacturers experiencing changes to supplier lead times and parts availability.

During the week of March 9th, Gardner Intelligence, the research arm of Modern Machine Shop publisher Gardner Business Media, conducted for the second time a short survey to gage the effects of COVID-19 on discrete parts manufacturers across all the industries that our publisher covers. The survey asked two basic questions:

- What changes has your business experienced as a result of COVID-19?

- What adjustments has your business made as a result of COVID-19?

For each of those questions, respondents were asked to rank the severity of the change or adjustment from minimal to moderate to major.

Of note, the second survey had 50% more respondents (slightly more than 300 vs. slightly more than 200) than first survey.

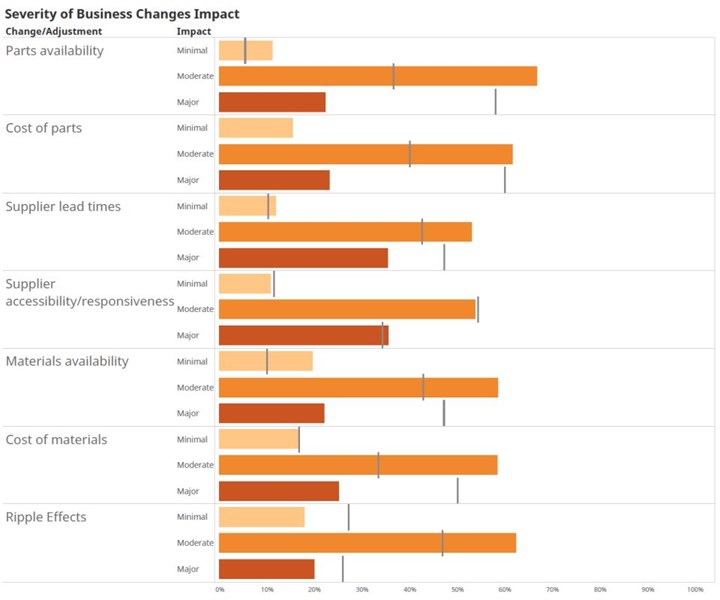

In addition to fewer manufacturers reporting changes to supplier lead times and parts availability, there was a significant drop in the severity of those changes.

In the charts illustrating this blog post, the percent of respondents as of March 13th are green dots and the percent of respondents as of March 6th are gray dots. The orange bars indicated the severity of the impact of March 13th and the gray hashes were the severity of impact as of March 6th.

According to this last week’s survey, 58% of manufacturers experienced no change in their business, which was up from 53% in the first survey. This improvement indicates that conditions did not worsen from the first survey and may have improved.

All but two of the changes experienced by manufacturers were unchanged in the second week of the survey. The two experiences that did change, supplier lead times and parts availability, both saw a smaller percent of respondents experiencing that change. This week just 16% of manufacturers were experiencing changes in supplier lead times versus 24% last week. And, just 9% of manufacturers were experiencing changes in part availability this week versus 19% last week.

For both supplier lead times and parts availability, the severity of the impact in the second week was much lower than the first. For supplier lead times, the percent of respondents reporting the impact as major decreased to 35% from 47%. For parts availability, the percent of respondents reporting the severity as major decreased to 22% from 58%. The severity of almost every other change experienced by businesses decreased in the second week of the survey as well.

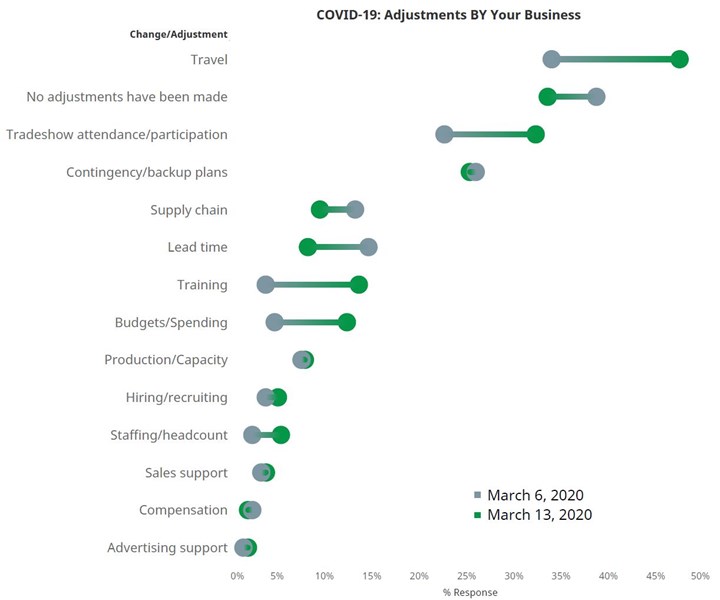

A not surprising result is that there was a significant increase in the percent of manufacturers making adjustments to their travel and tradeshow attendance/participating in the second week of the survey. Also, more manufacturers are starting to make adjustments to training and budgeting.

Regarding adjustments made by businesses in the last week, the most significant change was travel or travel related. Last week, 47% of businesses adjusted travel versus 34% in the first week. And, 32% of businesses adjusted their tradeshow attendance or participation versus 23% in the first week. However, the severity of the impact decreased somewhat in both cases.

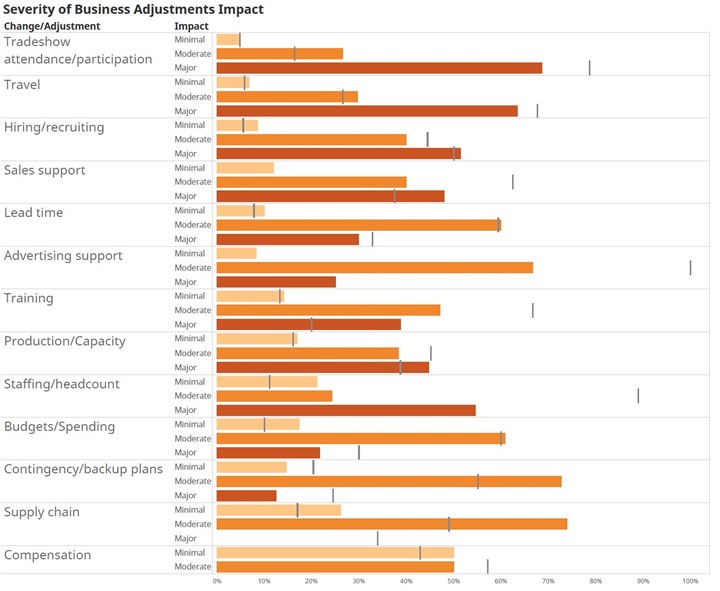

Fewer manufacturers reported major impacts to travel, tradeshow attendance/participation, and budgets. Significantly more manufacturers reported major impacts to the adjustments in their training.

In addition, more manufacturers adjusted their training and budgets last week than the first week. Noticeably more respondents indicated the adjustment to training was major last week compared with the first week. Meanwhile, more manufacturers reported the severity of their budget adjustments in the second week as minimal compared with major in the first week.

Finally, fewer manufacturers reported making adjustments to their supply chains (down to 9% from 13%) and lead times (down to 8% from 15%) in the second week of the survey. Not one respondent in the second week reported the adjustment to the supply chain as major, signifying less severe impacts on supply chains overall in the second week versus the first week. The severity of the impact on lead times was relatively unchanged.

The reduced effects on supply chains and lead times according to this survey are supported by data from MachineMetrics, which shows a steady increase in capacity utilization through the first two-and-a-half months of 2020 at machine shops that defies the cycles of the previous two years. This seems to suggest that manufacturers are ramping up production to make up for lengthened lead times and stretched supply chains.

Read Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read More

.JPG;width=70;height=70;mode=crop)