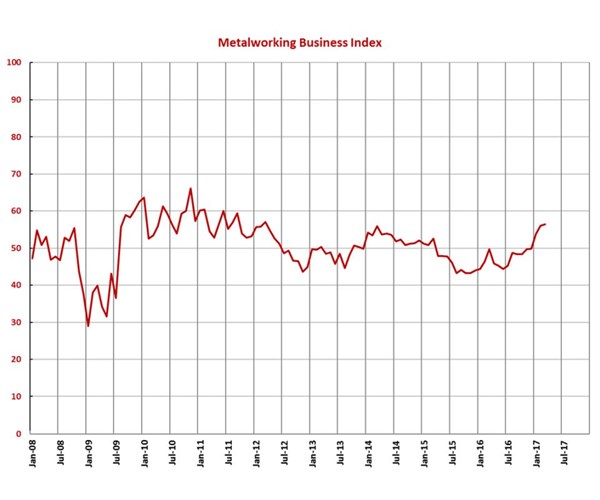

GBI: Metalworking March 2017 – 56.4

A third month of expansion reflects growth in virtually every significant metalworking sector.

Share

With a reading of 56.4, the Gardner Business Index showed that the metalworking industry grew at an accelerating rate in March for the third month in a row, again reaching its highest point since March 2012.

New orders increased for the fifth straight month and at a similar rate to February’s. The same was true for the production subindex, which also grew for the fifth consecutive month but at its fastest rate since June 2011. The backlog subindex grew for the second month in a row, a trend that indicates that capacity utilization should increase in 2017. Employment increased for the fifth time in six months, although at a slightly slower rate. Exports continued to contract, but this subindex did reach its highest level since December 2014. Supplier deliveries lengthened at their fastest rate since April 2012.

Material prices have increased at a constant rate this year, and their rate of increase is the fastest since February 2012. Prices received increased in March for the fourth month in a row and at their fastest rate since March 2012. Future business expectations remained strong, posting an index above 80 for the third straight month. However, this index dipped slightly from the previous month for the first time since June 2016.

While responses were limited, the oil/gas-field/mining machinery industry grew at an accelerating rate for the third month. The medical industry grew at its fastest rate since the survey began in December 2011, and industrial motors/hydraulics/mechanical components and pumps/valves/plumbing products also had indices above 60. Virtually every significant metalworking industry grew in March, most with indices above 55.

The North Central-West was the fastest growing region for the second month in a row and grew at an accelerating rate for the fourth consecutive month. It is the only region of the country to ever record an index above 60. Its growth was followed closely by that of the Southeast, which grew for the eighth month in a row, Northeast, North Central-East, West, and South Central.

Plants with more than 250 employees grew for the sixth month in a row and had an index above 60 for the first time since March 2012. Facilities with 100-249 employees expanded for the fourth straight month, while companies with 50-99 employees recorded an index of 60 or more for the first time. Shops with 20-49 grew for the fifth time in six months, and shops with fewer than 20 employees expanded for the third month in a row.

Related Content

-

Optimism Grows as Metalworking Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

.JPG;width=70;height=70;mode=crop)