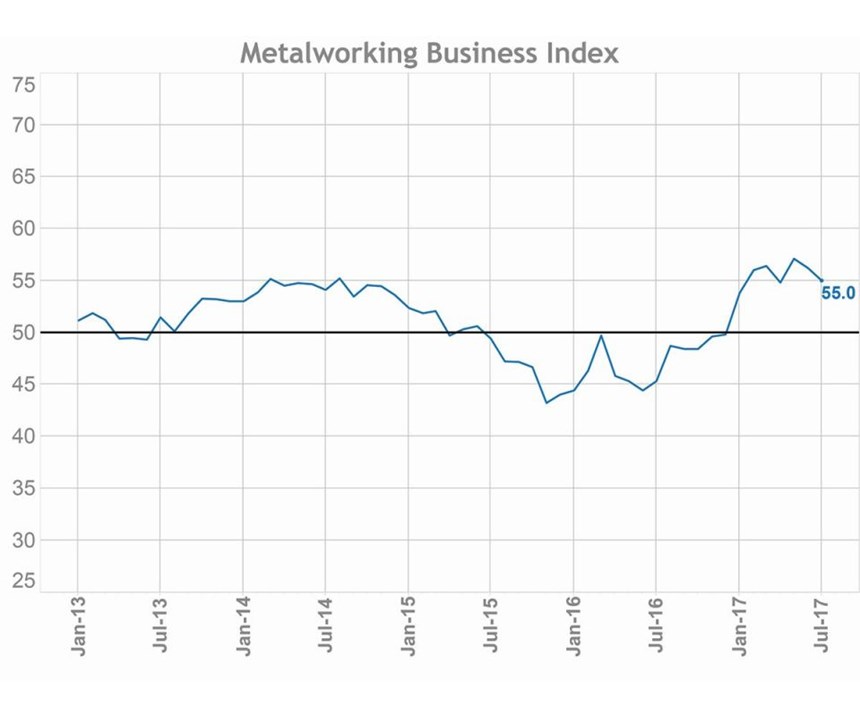

Gardner Business Intelligence: Metalworking Business Index July 2017 – 55.0

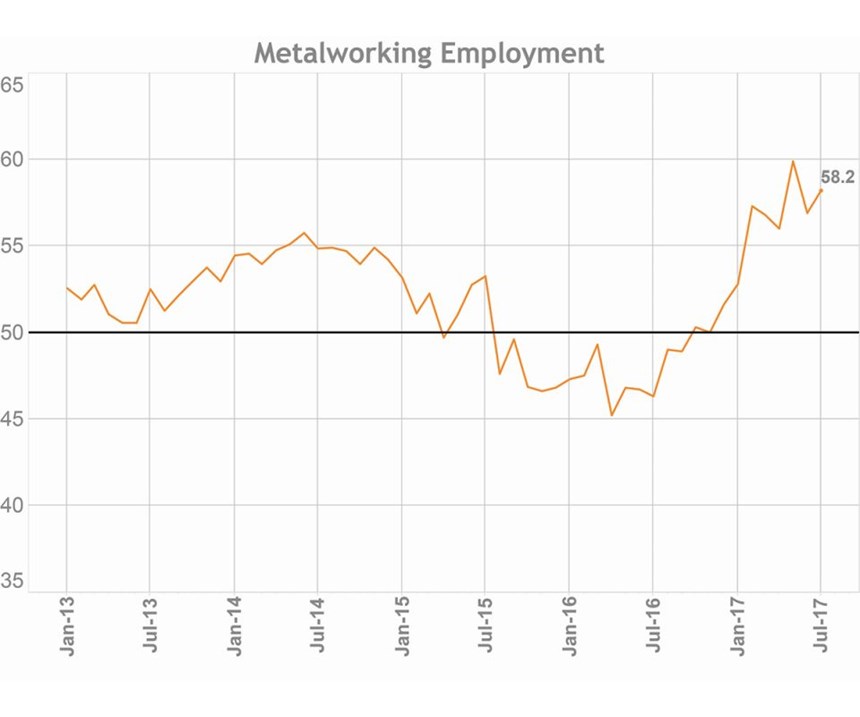

Employment in metalworking is seeing five-year highs.

Share

Takumi USA

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View MoreRegistering 55.0 in July, the Gardner Business Intelligence (GBI) Metalworking Business Index was down slightly from the previous month, falling slightly below the year-to-date average value of 55.6. For the year-to-date and 12-month periods, the index is up 1.8 percent and 20 percent, respectively.

The backlog component of the index is closely monitored by GBI, as backlog readings are considered a bellwether to capacity utilization and, ultimately, machine tool sales. In July, this backlog component recorded a value of 53.2, slightly above the year-to-date average.

Movements in backlogs often are a result of changes in production and new orders. The production and new orders components of the index both fell during July from their respective five-year highs, reached during the first quarter of 2017. Both measures are currently registering values seen during 2014, when the manufacturing industry was in the final stages of recovering from the great recession and demand for new machinery was very strong.

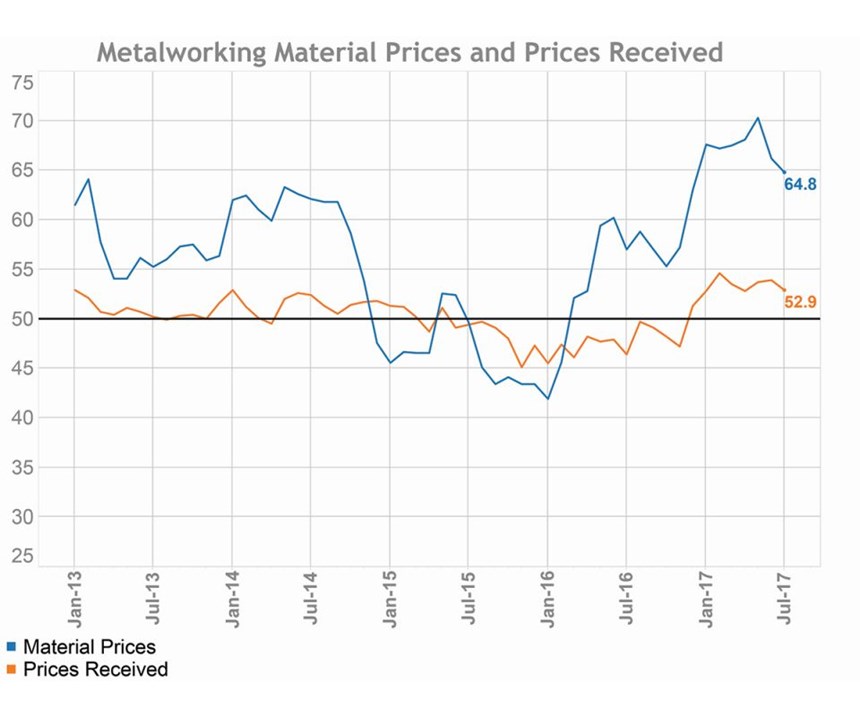

In early 2016, GBI saw a significant spread between material prices and the prices received by machine shops for their goods. This gap grew for the next 14 months as material prices rose sharply. By May 2017, the spread had reached 16.6 points. However, a rapid turnaround ensued the following two months, with the spread contracting to 11.9 points. By comparison, the five-year historical average spread is 9.1 points. The recent closure of this gap has been a result of material prices falling while prices received have held steady. As the U.S. economy grows and consumption of durable goods increases, GBI expects that the metalworking industry will find that it has greater ability to pass along price changes to customers.

“Employment readings for most of 2017 have exceeded the previous five-year highs.”

Economic growth also is impacting employment in the metalworking industry. The employment component of the index has significantly increased since the start of 2017. Except for January, the employment readings for each month of the year have exceeded the previous high point of the past five years, 55.8, reached in June 2014.

Related Content

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=150)