Share

For one of the recurring part numbers that R&D Manco machines, a part that begins as a casting, obtaining this part from the foundry requires a lead time of one year. An entire year!

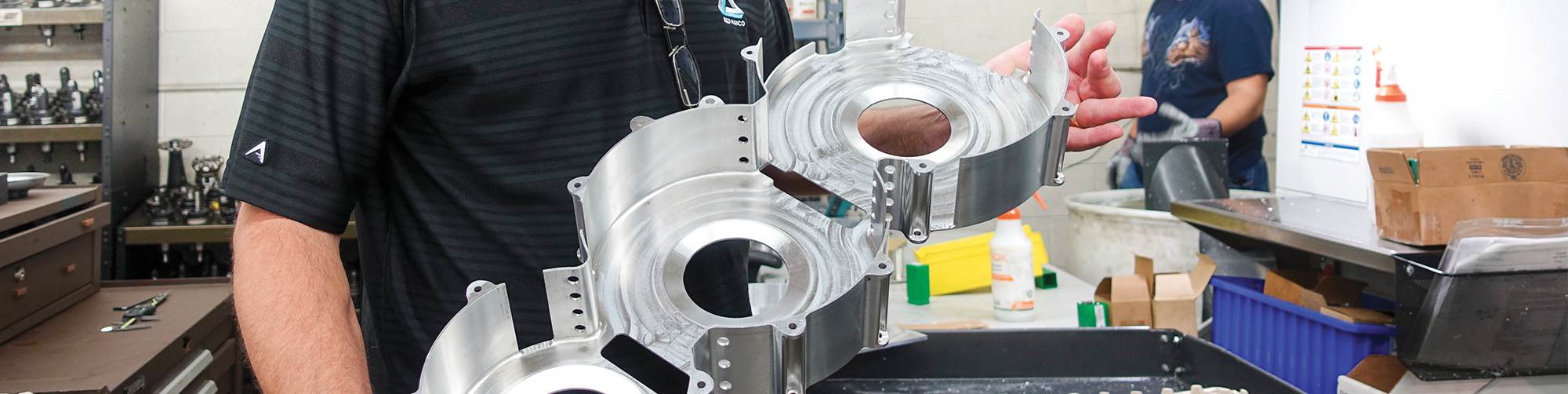

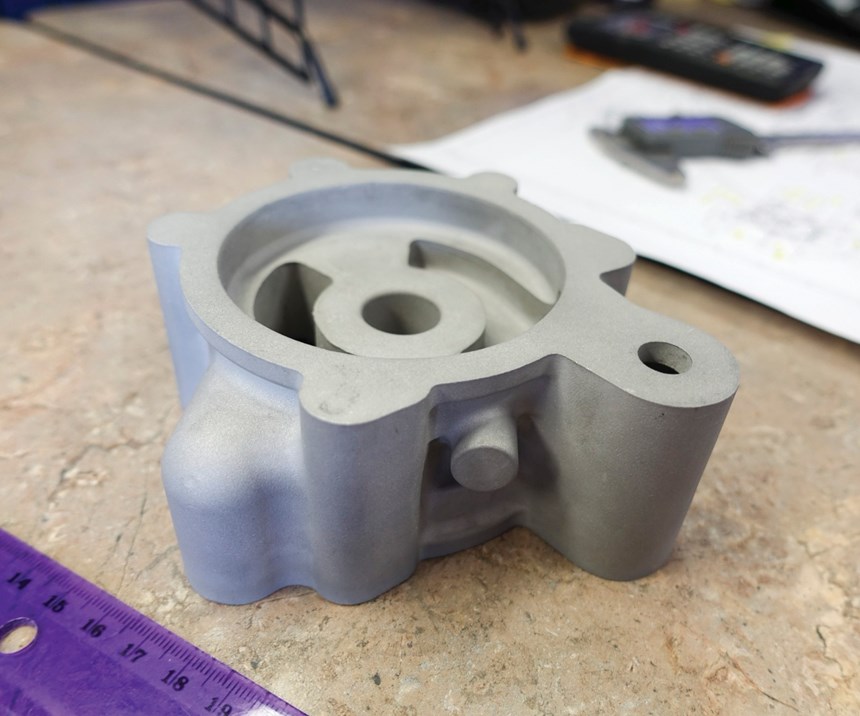

The part number in question is an extreme example when it comes to casting lead times, but not terribly extreme. R&D Manco is a Phoenix, Arizona, machining subcontractor serving prime contractors in the aerospace industry. The parts it machines include certified, highly engineered components of aircraft fuel and control systems. For its parts that begin as castings, a typical total lead time is 32 weeks. But when this shop can avoid casting altogether by instead machining the part’s precise form out of a solid block or bar, it can typically cut the total lead time its customer sees by more than 60 percent, and it can typically cut the cost of the part by 20 percent. As a result, the shop has pursued a long-standing mission—the effort has lasted about a decade now—to convert as many parts as it can from castings to hogouts.

The effort has the encouragement of customers. One large customer has a regular specification attached to some of its jobs noting that the machining supplier is free to replace that part’s casting with a hogout if the shop is able to do so. An equally large customer has a hogout team involved in analyzing its cast parts in search of hogout opportunities. Not all parts are candidates for this conversion; the one-year-lead-time part cannot be made as a hogout because the part’s geometry includes deeply recessed features that the shop (as yet) sees no way to reach through machining. But over time, this shop has been able to convert half of its recurring part numbers that formerly were castings into jobs that no longer involve a foundry.

By bypassing the foundry, the shop is consolidating the customer’s supply chain and bringing more of that supply chain into its own operation.

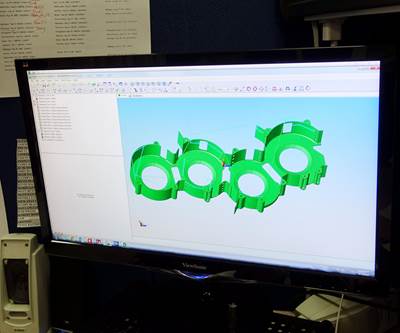

Five-axis machining is the most important capability for realizing this success, say John Bloom, president of R&D Manco, and Kevin Beach, general manager. That much is probably obvious. The complex forms that are no longer cast have to be realized instead through elaborate contour milling.

However, there are other important aspects of thriving at machining hogouts that relate to the increased importance that any shop takes on when it agrees to do this work. The shop doing hogouts is agreeing to more than just heavier milling. By bypassing the foundry, it is consolidating the customer’s supply chain and bringing more of that supply chain into its own operation. The shop is taking on a dramatically larger role in determining the ultimate cost and delivery of the part. It is accepting the entirety of any pressure for future cost and lead-time reductions. In short, the shop doing hogouts is stepping up to do more.

Therefore, beyond the machine tool capability, at least two other aspects of R&D Manco’s formula have also been important to its continued success at hogout machining. One has to do with the people and the other has to do with the process. For hogout machining, it has been valuable for this shop to implement both a culture and capabilities that, in essence, aim toward a higher and higher metal removal rate.

Competitiveness in the Culture

R&D Manco operates in two adjacent plants totaling 30,000 square feet and employing more than 70 people. Its unusual name is the result of the merger of two shops, Manco and R&D Specialty. That merger was long ago, but the name remains, perhaps in part because a number of employees on the staff remember that origin.

“We employ some extremely experienced machinists,” Mr. Bloom says. The experience is significant to the way the shop uses five-axis machining. Continuing to convert castings to hogouts means the shop is routinely crafting new processes to realize the intricate, organic forms of parts that were not originally designed to be made through milling. In the development of a machining process such as this, there almost always comes a point in which engineering intersects with craft and skill. For example, a five-axis milling cycle that is seemingly viable in simulation might be beset with squeals or broken tolerances in actual practice resulting from the setup being not quite rigid enough to accommodate a particular tool path wending through a particular contour. In these cases, deferring to the judgment of an experienced team member at the machine generally offers the most effective way to find the process refinement that best addresses the problem.

The chance to realize ongoing incremental efficiency improvements represents one of the most important reasons to take ownership of the job by making it a hogout.

The company management makes clear to the production staff that this kind of judgement is valuable. Indeed, process refinements of this nature on an ongoing basis are valuable. After all, the chance to realize ongoing incremental efficiency improvements for any given job represents one of the most important reasons to take ownership of that job by making it a hogout. To engage this shopfloor experience toward the aim of ongoing process improvement—meaning increased speed and effectiveness at hogging out the metal—a culture of competitiveness is deliberately fostered among the employees. In fact, that aspect of the culture might be the most apparent not in the five-axis area, but in the shop’s area for 50-taper machining. Large, high-powered machining centers in this area are applied toward maximizing the metal removal rate in hogging aluminum and titanium. Machinists in this area, as in other parts of the shop, are encouraged to initiate process improvements by working with programmers to investigate different choices in tool path and cutting tool. The distinction of this area is that the power of the machines makes possible some extreme advances, particularly in aluminum. In the case of one aluminum part that is informally called the “three ball” (its shape suggests this), the first-operation cycle that mills away almost 90 percent of this part’s initial stock has been reduced from more than eight hours down to two hours and 43 minutes through various improvements in feed rate and depth of cut the employees here have managed to achieve. These improvements were driven by wanting to do better, and even (good naturedly) by wanting to do better than one another.

“If one guy is tearing it up, I want others to see this. I want them to want to tear it up, too,” Mr. Bloom says.

Of course, experienced machinists are a resource that a great many shops wish they had in greater supply. This experience is getting harder to find. R&D Manco faces the same challenge. In its effort to grow the talent pool today that will deliver experience tomorrow, it founded an apprenticeship program built on a curriculum from the National Tooling & Machining Association, and it has three people in this program at present, with more to come. One meaningful detail of the program at this shop relates to where employees begin. Here, every employee starts in the inspection area, Mr. Bloom says. Yes, there is an ongoing aim toward reducing cycle time and lead time, and yes, there is a culture of competitiveness aimed at getting employees to pursue that aim. But this objective starts with an appreciation for the objective that is even more important. Namely, at this shop, every employee learns first and foremost just what constitutes a good part.

Machine Monitoring Reveals Capacity

Machine tool monitoring has been another important factor in R&D Manco’s success. Gathering basic data on machine status, and studying the data to diagnose and remedy the causes of non-cutting time, has been the shop’s most powerful resource for realizing machining capacity improvements. The connection between hogouts and machine monitoring might not be immediately clear, but in fact, there is a direct link. That connection comes down to this: Each time R&D Manco eliminates casting from a part’s process, it eliminates a gigantic bottleneck formerly impeding that part’s production. Attention then must turn to whatever bottlenecks remain, and from that point forward, those bottlenecks are to be found in machining.

The first step in implementing machine monitoring is squarely facing machine utilization numbers that are disappointingly low.

Many of the shop’s machine tools are from Okuma. These machines are assets when it comes to machine monitoring, the company notes, because the builder’s Windows-based control makes it easy to implement systems for gathering real-time status information from the machine. For older machines or for machines from builders not providing this openness, the company has retrofitted the controls with MTConnect adapters from Shop Floor Automations in order to also get these machines into the shop-wide machine-monitoring system. Software from Predator consolidates the machine data, organizing it into the displays and reports the shop then analyzes.

The first step in implementing machine monitoring is squarely facing machine utilization numbers that are disappointingly low, the company leaders say. Machine shops almost always assume their machine tools spend more time productively cutting than they actually do. However, knowing the real utilization, even if it is disappointing, is powerful, Mr. Beach says. First, this number allows a shop to know what its capacity actually is. The enterprise resource planning (ERP) software used for planning does not necessarily know this, which is why jobs can be shipped late even if they are scheduled in ERP. Knowing real capacity lets the shop know at what point it needs to outsource to augment its capacity. Second, knowing the real utilization number allows the shop to clearly see the scope of the potential for improvement and begin working to realize that potential.

The work is not necessarily easy, but it need not be complicated. Mr. Beach says, “When we first started using machine monitoring, I had all these different codes for identifying the reasons for downtime.” The graphic display became a rainbow that identified (or claimed to identify) an entire spectrum of different reasons why a machine might not be cutting. “It was too much,” he says. His out-of-cut definitions did not necessarily provide a good fit with what was actually happening at the machine. He realized instead that, essentially, “out-of-cut time is out-of-cut time.” In any situation where there is too much of it, the reason ought to be found and addressed. Today the shop’s machine monitoring system describes all of the activity of all of the machines using not just two states, cutting and not cutting, but three. One of those defined causes of delay did prove to be dramatic enough in its impact that it deserved to be kept and monitored.

Waiting on first-article inspection proved to be the most significant source of production interruption the shop faced.

That cause is first-article inspection. Waiting on first-article inspection proved to be the most significant source of production interruption the shop faced. This discovery was perhaps the earliest major finding of the implementation of machine monitoring. Seeing the scope of the problem, the shop has made various moves to address it. An additional CMM and an additional technician were added to the inspection room solely for the sake of first articles. In addition, the shop is exploring the potential of performing this inspection without the part leaving the machine. “Productivity+” software from Renishaw allows the machine tool itself to measure the part through probing and compare the measurements to the original CAD file. Some parts have already successfully shifted to firstarticle inspection being run in this way, with no delay at all for a trip to the inspection department.

Other Finds from Machine Monitoring

Mr. Bloom and Mr. Beach point to various other discoveries about efficient machining that machine monitoring has taught the shop, discoveries the shop leadership would never have come to so quickly if not for the data helping to make these discoveries plain. The lessons include:

- A horizontal favors not just certain parts, but certain jobs. The shop installed a sixpallet horizontal machining center in 2017, but utilization numbers at first did not show the machine to be productive. Mr. Bloom says the problem was that the shop was thinking about this machine primarily in terms of its machining capabilities. Jobs were sent to the HMC that could benefit from four-axis machining. That practice was fine as far as it went, but considering only the machining opportunity failed to recognize that the capacity of this machine is actually determined by how many jobs the operator can set up before leaving for the day. The very best jobs for the HMC are the ones for which the setup can remain in place because the job repeats. So, at first it was the machining opportunity the shop considered when assigning work to this machine, but now work is chosen according to the combination of machining opportunity plus the order quantity plus whether or not the job is part of a contract that will make the work consistent.

- Moving big parts is a big productivity drain. In the case of a two-machine cell for turning parts that are too large to lift manually, the digital analysis of machining performance led to a very low-tech hardware investment. When it was seen that even more time than anticipated was being spent to move parts from one machine to the other in this cell, the shop addressed the inefficiency by installing a gantry rail for a crane to serve these two machines solely.

- On the question of seven-axis-turning cell utilization, one opinion had it right. For its most sophisticated turning work, the shop established a turning cell consisting of three seven-axis turning centers. Given that these are such highly automated machines that aim to run an entire part complete in one handling, it was assumed that one operator ought to be enough to keep all the machines producing. Some disagreed, however; a different line of thinking among the shop’s leadership said that the cell actually justifies two operators. This disagreement might have passed back and forth indefinitely except that the machine-monitoring data settled it. The two-operator position was correct. Utilization numbers for the machines in this cell were the lowest of any equipment in the shop when, if anything, they ought to have been the highest. The addition of more staffing here dramatically increased the amount of machining this cell can do.

The shop now has one employee fully dedicated to finding more of these lessons. The company’s Luis Hernandez, a manufacturing engineer, has been named the leader of the company’s continuous improvement team. The potential return on improved capacity utilization resulting from discoveries like the insights above easily justifies the commitment of his time. And a role like his is needed, the company says, because the ultimate cause of any particular period of unproductive time is not necessarily clear and might be the result of multiple factors at once. Indeed, Mr. Hernandez alone can’t figure it all out. Part of his job is to bring in others’ perspectives, asking team members questions about non-cutting periods in order to search for what the cause and the solution might be. He says, “I’ve been talking a lot to Engineering, and now I’ve turned my attention to talk to the shop foreman. The next step will be that I’ll talk about the data with individual machinists to identify the causes of delay that stand in their way.”

But as a final point, Mr. Bloom notes that this drive toward analyzing data and responding to inefficiencies applies beyond the shop floor as well. It applies in the office, too, he says. It applies to quoting, for example. Even before machine monitoring, the company recognized the value of routinely analyzing finished jobs in terms of “how did we quote versus how did we do,” he says. One lesson that has come of this practice recently: The company has been too aggressive in quoting steel. In essence, the shop assumes it machines steel faster than it actually does. Maybe there is an opportunity for process improvement here, but for now, steel work is being quoted more accurately, because it is quoted with a slower expectation of cutting speed.

When a customer would inquire about the status of its open orders, he saw that frequently the answer to the inquiry would be obsolete by the time all of the information necessary to answer the query had been gathered.

In fact, just obtaining needed information can be a source of inefficiency and a source of significant lost time. Mr. Bloom first realized this about seven years ago, he says. When a customer would inquire about the status of its open orders, he saw that frequently the answer to the inquiry would be obsolete by the time all of the information necessary to answer the query had been gathered. The information was too scattered, the pieces of it located in too many different places.

He began working with a software developer at that time to build, in his words, a “grand view” that would provide enough information at a glance to answer any customer’s inquiry. Some of the data needed for this was in the shop’s ERP system, and some was in local spreadsheets. The custom utility therefore pulled from different systems. And as he went forward, he says he came to recognize how valuable this unified view could be not just for answering customer questions, but also for clarifying his own understanding, and for overseeing the shop’s increasingly sophisticated and increasingly time-constrained process.

In the past, the machining work dominated by processing castings required far less process control. The wait for the casting would drive a long lead time no matter what the shop was able to do, and the shop would know to begin machining simply when the castings arrived. Today, things are different. Now, in a much larger number of cases, the work begins and ends with R&D Manco, and this company is entirely responsible for promising and keeping a tight delivery date. The increased responsibility demands more informed oversight, and so Mr. Bloom has adapted his grand-view utility to provide this. By querying the ERP system’s database to pull a part’s cycle time, the custom utility is now able to automatically calculate and display to management the date by which a job has to begin in order to meet its promised timing. By querying the shop’s digital inventory record, the utility can now display as well whether sufficient stock is available or if stock has to be ordered.

This is the kind of crucial information that can easily be overlooked. For the shop that consolidates more of the work of its customers’ supply chains, one of the requirements is systems that are increasingly sophisticated at keeping this information organized and visible so that, even as the shop works at a higher level, the progress of the work remains straightforward and plain.

Related Content

Orthopedic Event Discusses Manufacturing Strategies

At the seminar, representatives from multiple companies discussed strategies for making orthopedic devices accurately and efficiently.

Read MoreWhere Micro-Laser Machining Is the Focus

A company that was once a consulting firm has become a successful micro-laser machine shop producing complex parts and features that most traditional CNC shops cannot machine.

Read MoreLean Approach to Automated Machine Tending Delivers Quicker Paths to Success

Almost any shop can automate at least some of its production, even in low-volume, high-mix applications. The key to getting started is finding the simplest solutions that fit your requirements. It helps to work with an automation partner that understands your needs.

Read MoreInside a CNC-Machined Gothic Monastery in Wyoming

An inside look into the Carmelite Monks of Wyoming, who are combining centuries-old Gothic architectural principles with modern CNC machining to build a monastery in the mountains of Wyoming.

Read MoreRead Next

In Hogout Machining, the CAD File Becomes Critical

To serve customers by helping them bypass casting, this shop first needs a close-enough relationship with the customer that it can count on getting good CAD data. Here is why.

Read MoreHardware for High Metal Removal Rates

Spindle power and shrink-fit toolholding are two assets this shop seeks to use to the extremes of their capabilities.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read More