Top Shops Benchmarking: Providing Direction, Gaging Performance

Top Shops benchmarking data helps guide shops’ improvement efforts and enables them to gage where they rank among industry-leading machining businesses.

Share

There are a couple of primary reasons hundreds of companies each year participate in our Top Shops benchmarking survey. One reason is because the survey highlights the technologies, processes and strategies that leading companies are applying, both on the shop floor and in the front office. Another is that the participation in the survey enables shops to see how their key performance metrics compare to industry leaders.

For this our program’s seventh edition, responses from 356 surveys were considered in the data calculations. The benchmarking group we established (the top 20 percent of shops based on tallying scores of select survey questions) is what we call the “Top Shops.” What’s exciting about this year is that, in addition to conducting another successful survey, we will be hosting our inaugural Top Shops Conference, September 5 to 7, in Indianapolis, Indiana, where we’ll present this year’s findings as well as host discussions about a range of machining- and business-related topics (see my commentary, “Top Shops: Live in Indianapolis,” for more information about the conference).

Responses to all of this year’s survey questions are available in the Top Shops Executive Summary that can be accessed at mmsonline.com/topshops. Here are some highlights from the responses in the survey’s four main categories, including a key performance indicator, a top practice and a noticeable trend for each.

Machining Technology

Screw-machine shops were the first to adopt multifunction CNC Swiss-type lathes. Today, an increasing number of “traditional” shops are considering this machining platform to, in some cases, produce complex parts complete, reducing setups, secondary operations and work-in-process. The goal in using this equipment is to minimize the number of times a part is touched during production. In fact, 32 percent of this year’s Top Shops use this equipment, up from 19 percent last year.

In addition, more than half of them use HMCs, which can offer higher spindle uptime than VMCs thanks to their dual-pallet design that enables a new job to be set up on one pallet while machining is performed on the other pallet. Other equipment Top Shops are more likely to use include five-axis machines (more for positioning in five axes not full contouring) and multiple-turret lathes, and they also are more likely to perform advanced operations such as hard milling, hard turning and high-speed machining.

As with capital equipment, Top Shops also tend to adopt more sophisticated tooling technology and strategies compared to other shops. A higher percentage use custom/specialty tools, balanced tool assemblies, and tools with internal coolant delivery. In addition, 71 percent of Top Shops, compared to 47 percent of other shops, have on-machine probing capability to automatically measure tools and/or check for tool breakage.

Leading shops also use workholding equipment such as quick-change devices, multiple-workpiece fixturing, vacuum chucks and tombstones to maximize spindle utilization.

Key Performance Indicator

Top Shops report a spindle utilization of 72 percent compared to 60 percent for others, while using newer equipment, too. Average age for CNC machines at Top Shops and other shops is 7 and 10 years, respectively.

Top Practice

Nearly 60 percent of Top Shops use tool presetters compared to only 36 percent of other shops. This is one example of shopfloor automation that doesn’t involve a robot.

Trend

There was a considerable increase in the percentage of Top Shops that use additive manufacturing/3D printing equipment. This year, 37 percent of them reported having this equipment compared to 19 percent in last year’s survey. Virtually all of those shops use this capability for prototyping, but 74 percent of them also use it to 3D print tooling and fixturing for their own use on the shop floor.

Shopfloor Practices

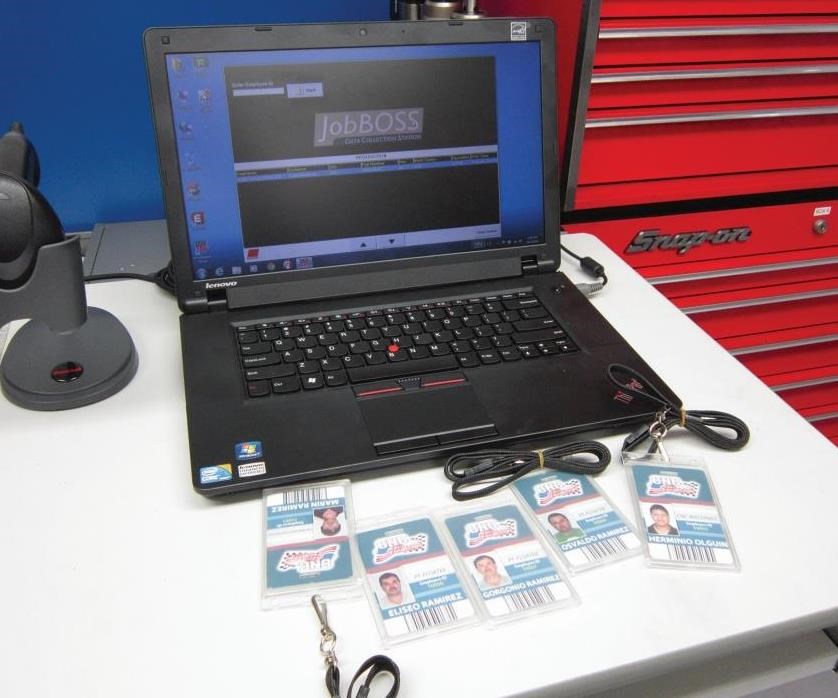

This year, there was a significant increase in the number of Top Shops using enterprise resource planning (ERP) software. In past surveys, this percentage has ranged from 50 to 60 percent, but 83 percent of this year’s Top Shops use it. This software offers a number of benefits, including estimating production time/cost, job scheduling, in-process job tracking, logging each step in a part’s progress through the shop and offering historical view of resources used on prior jobs (which can be helpful in planning new work).

The use of machine-tending robots among Top Shops had steadily increased over the first three years we offered the survey, but it has seemed to plateau in recent years. This year, 26 percent of those shops use robots. It will be interesting to see if collaborative robot technology, which enables robots and humans to safely work in the same area, will push this percentage higher.

Key Performance Indicator

Top Shops turn jobs faster than other shops. Their order lead time (receipt of order to order delivery) is 20 days compared to 25 days for other shops, and they report having a higher on-time delivery rate of 95 versus 90 percent.

Top Practice

Many shops start their lean manufacturing journey by implementing 5S workplace organization tactics. This year, 54 percent of Top Shops cite using this practice compared to 46 percent of other shops. Those higher-performing shops also tend to implement other lean initiatives more so than the others, such as value-stream mapping and cellular manufacturing.

Trend

In each of our seven surveys, a higher percentage of Top Shops reported having quality certifications, such as ISO, AS and NADCAP. This year was the highest report at 68 percent (compared to only 49 percent of other shops). That said, a certificate to ISO 9001:2008 will no longer be valid after the end of September 2018, and its ISO 9001:2015 replacement requires that shops establish procedures for comprehensive risk management. This means shops registered only to ISO 2001:2008 will have to address risk management as in their efforts to become certified to the new standard.

Business Strategy

The primary industries this year’s Top Shops support include aerospace (56 percent), equipment manufacturing (53 percent) and automotive (45 percent). In serving those and other industries, Top Shops consistently invest more in new equipment than other shops. In 2016, their median investment in capital equipment was $388,500 versus $150,000 for other shops. This investment in new technology is one reason why they achieved a higher growth rate of 9 percent than other shops at 1.5 percent.

In addition, Top Shops were also able to achieve higher sales per machine last year, reporting a median value of $300,000 versus $160,000. Top Shops also get more value out of their shopfloor employees. Last year, their median sales per employee was $180,000 compared to $141,000 for other shops.

Key Performance Indicator

In every survey, Top Shops have reported a higher profit margin, which is the most significant indicator of overall business health. Top Shops reported a profit margin of 15 percent compared to 8 percent for other shops.

Top Practice

Adding engineering staff is becoming more important for Top Shops as more OEMs outsource their machining work. Shops that can offer design for manufacturability (DFM) advice can suggest design changes to simplify machining work and reduce production costs. This year, 45 percent of Top Shops said they offer DFM services to customers compared to

34 percent of other shops.

Trend

An increasing number of leading shops say social media is an effective sales and marketing tool. This year, 37 percent of Top Shops affirm this compared to 24 percent of other shops. The most common platforms used include Facebook, LinkedIn and Twitter, with growing interest being shown in Instagram.

Human Resources

Although the hourly pay offered to shopfloor employees by Top Shops and other shops has historically been similar, this year’s Top Shops pay a dollar more per hour for operators and setup personnel ($19) and $2 more per hour for CAM programmers ($28). That said, leading shops are more likely to offer other benefits to entice and retain good employees. One is a profit-sharing plan in which both the company and its employees can benefit, because it spurs the workforce to look for ways to improve efficiencies, thereby improving production rates and profits. Forty-five percent of Top Shops offer this compared to 33 percent of other shops.

In addition, 56 percent of Top Shops have developed some style of formal, in-house training program compared to 36 percent for other shops. In some cases, a general shop training curriculum is adequate, but sometimes customization is necessary for shops having specialized machining and manufacturing processes. This type of training also leads to standardize processes, eliminating any person-to-person variation from the way the tasks are supposed to be performed.

Key Performance Indicator

In terms of workforce development, Top Shops do a better job of preparing its future leaders, given that 52 percent of them have a supervisor development program compared to 40 percent of other shops.

Top Practice

Top Shops are more likely to offer paid medical benefits than other shops (83 percent versus 68 percent). That said, the percentage of shops outside the benchmarking group that offer these benefits has increased recently, largely due to government-mandated health care laws.

Trend

The percentage of Top Shops offering educational reimbursements continues to trend higher. In the 2016 survey, 61 percent of the Top Shops offered these reimbursements. For this year’s survey, that percentage is 78 percent.

Related Content

How to Mitigate Chatter to Boost Machining Rates

There are usually better solutions to chatter than just reducing the feed rate. Through vibration analysis, the chatter problem can be solved, enabling much higher metal removal rates, better quality and longer tool life.

Read MoreHow this Job Shop Grew Capacity Without Expanding Footprint

This shop relies on digital solutions to grow their manufacturing business. With this approach, W.A. Pfeiffer has achieved seamless end-to-end connectivity, shorter lead times and increased throughput.

Read MoreERP Provides Smooth Pathway to Data Security

With the CMMC data security standards looming, machine shops serving the defense industry can turn to ERP to keep business moving.

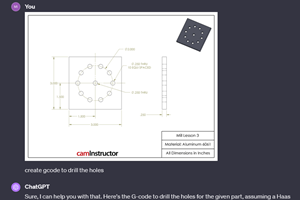

Read MoreCan ChatGPT Create Usable G-Code Programs?

Since its debut in late 2022, ChatGPT has been used in many situations, from writing stories to writing code, including G-code. But is it useful to shops? We asked a CAM expert for his thoughts.

Read MoreRead Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More