Timely Investments

When and how to acquire equipment depends on a variety of important factors.

Share

On the surface, the recent slowdown in manufacturing activity might be viewed as a justification for delaying capital investments. But a cooler economy presents some valuable opportunities for machine shop managers to prepare for better times to come. When a shop is operating near its maximum capacity, it’s difficult for managers to think about cultivating new business or buying equipment. But a decline in one industrial sector may coincide with increased activity in another. Thus, pursuing a new direction is often beneficial for a company’s long-term development, and shifting gears may require equipment upgrades.

A related opportunity in a cool economy is the reduced cost of financing. As the Federal Reserve Board continues to cut short-term interest rates to stimulate consumer spending, loans for metalworking equipment (typically amortized over 5-7 years) have become substantially more attractive. As a result, it’s a propitious time for businesses to finance or refinance capital equipment. This situation enhances the resources of borrowers and creates additional options for obtaining the equipment necessary to keep pace with current technology. Furthermore, astute managers understand that seeds planted in difficult market conditions can represent the distinction between tomorrow’s winners and losers.

The Psychology Of Buying

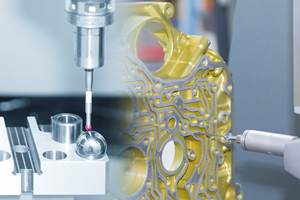

The most obvious reason why machine tools are purchased is because a shop owner or manager has identified an important and immediate need to enhance the production process. This decision may be motivated by a change in the type of work a shop is handling or by ongoing efforts to improve the productivity of an existing process.

According to John Grove, vice president of Tipton Machinery Co. (Cincinnati, Ohio), another key factor is price. The overcapacity of machine tools that has thinned the ranks of builders in recent years has also created many opportunities for customers to acquire more sophisticated equipment at lower prices. In an environment where high-quality, used machines are often available at attractive discounts, Mr. Grove says that some purchasing decisions are based primarily on price, apart from any immediate needs.

Machine shop managers understand that any equipment purchase represents a calculated risk. But according to Jim Tipton, president of Tipton Machinery, this risk is connected more closely with what happens after the sale. “In machine tools today, the price and quality gap between Brand ‘A’ and Brand ‘B’ has narrowed considerably,” he says. “Things have changed a lot since the 1970s, when choosing the wrong brand of machine could put someone out of business.” For this reason, Mr. Tipton finds that the most effective sales strategy is to help customers eliminate the uncertainty that accompanies the time gap between a purchase and the first day that the new equipment begins running parts.

“I frequently tell our salespeople never to forget that the buyer’s risk is always greater than the seller’s,” says Mr. Grove. Thus, the decisive step in many equipment purchases occurs when the buyer reaches an understanding of how cash generated from a new machine can finance the expenditure in the short term and increase profitability over a longer term. To assist with this assessment, the equipment builder or dealer breaks the machine’s cost down to an hourly rate that gives the customer a better conception of the short-term cost of ownership. When a customer combines this information with an accurate estimate of the quantity of parts that the machine can run within a specific time period, a purchasing decision can be made with substantial confidence.

Spindle utilization comparisons between machines of older and newer design are central factors that drive equipment sales. Given the rapid improvement of machine tool technology in recent years, the efficiency gain is often enough, by itself, to justify the purchase. In a typical situation where a customer considers moving up to a more sophisticated and efficient machine, the question “Should I buy?” often becomes “Can I afford not to buy?”

Purchasing Pitfalls

After more than 30 years in the machine tool business, Mr. Grove is familiar with some of the blind alleys that equipment buyers may encounter. He explains that a few machine brands still should be avoided, particularly if the builders are no longer in business and parts or service availability is suspect. Regarding the well-established machine tool builders, however, Mr. Grove says, “Today, quality is a given.”

Under any circumstances in manufacturing, idle machinery is undesirable. But this is particularly true during the break-in period immediately after equipment is installed. Thus, equipment buyers must be particularly careful to ensure that the time gap between purchasing a machine and beginning to run parts is as narrow as possible. Reaching this goal requires prompt, professional installation and adequate initial training. Tipton Machinery’s policy is to ensure that all customers are entirely comfortable with their equipment from the outset, but not every dealer or builder can provide this kind of assistance.

In some cases, the seller may only install and test the new machinery—providing no training or other guidance during the break-in period. Thus, it’s crucial for buyers to determine whether a particular dealer or builder possesses the capabilities to be an effective catalyst during this process. Additionally, the seller’s service capabilities are key considerations to avoid costly downtime during the machine’s life span. “What really minimizes the buyer’s risk is the local support and service that he receives from the dealer,” says Mr. Tipton.

If a buyer wants to trade in an older machine for a new one, it’s important to have an accurate idea of the machine’s market value. For buyers who want to trade, Mr. Grove says, “If a customer wants to know what his equipment is worth, he should pick up several publications from used equipment dealers and find out how much they’re asking for machines of similar age and with comparable features.” Buyers should also understand that, regardless of the amount they’re quoted as a trade-in allowance, the equipment dealer can’t afford to offer a machine’s full market value and still make a profit when the machine is resold.

Realistically, buyers should expect the actual trade-in allowance on a given machine to be somewhat less than half of the average price that used equipment dealers are currently charging for similar machinery. In some cases, the trade-in allowance may be even lower, because some older machines are particularly difficult for dealers to sell. According to Mr. Grove, this is especially true if parts are difficult or extremely costly to obtain.

An important aspect of any purchasing decision is the cost to maintain or upgrade existing equipment. For example, the cost to retrofit an older machine with a new CNC unit may represent a substantial percentage of the machine’s total value. It’s also difficult and costly to obtain electronic components for older CNC units. Furthermore, it may not be advisable to repair an older control that provides substantially less capability than a more recent generation available with a new machine. As a rule, if a shop is spending too high a percentage of a particular machine’s residual value on repairs or upgrades, investing in new equipment will enhance productivity immediately and save money in the long run.

Leasing

Some important and fundamental differences exist between purchasing and leasing equipment. From the viewpoint of simple economics, leasing is considerably more costly than purchasing. But leasing may offer more flexibility for new shops or established shops that may have short-term needs for specialized equipment. In certain cases, leasing is also attractive from a financial perspective. For example, a new machine shop business might lease its start-up equipment to conserve cash for covering initial operating expenses.

The manager of a new shop without an established customer base might also prefer the option of changing or upgrading equipment more frequently during the shop’s formative stage of growth. While loans to purchase equipment may require substantial down payments with financing based on the remaining amount of the equipment’s full value, a lease typically requires no down payment and monthly payments are based on the portion of the equipment’s full value that will be depleted during the lease period. At the end of this term, the lessee normally has the option to purchase the equipment for its residual value as specified in advance by the lessor.

Mr. Grove advises a prospective lessee to carefully review the terms of a lease. “Some leases have substantial buyout amounts at the end,” he says. “You need to know how much that is, because some buyouts can be 30 percent of the equipment’s value or greater.”

Three common types of leases are operating leases, finance leases and sale-leasebacks. Operating leases typically have terms that are substantially shorter than the equipment’s anticipated life span. Thus, payments for operating leases are also higher than those required for a finance lease. An operating lease may be used to obtain extremely high-tech equipment that is likely to become obsolete after a relatively short time period. This is the simplest type of lease for accounting purposes, because the lease payments may be expensed in the same manner as rental payments. For tax purposes, the lessee is not required to show the equipment as an asset on a balance sheet.

A finance lease typically has a longer term that corresponds generally with the equipment’s useful life span. Payments are usually lower for this type of lease, and it’s common for the lessee to ultimately purchase the equipment by paying the buyout amount at the end of the lease. For example, Tipton Machinery’s standard 60-month lease requires no down payment and provides a $1.00 purchase option at the end of the term. As a rule, the higher the value of equipment leased, the more flexibility customers can expect in the lease’s structure and terms.

In a sale-leaseback arrangement, equipment is initially purchased and used for a period of time, after which it is sold to a lessor with an agreement that allows its former owner to continue using the equipment on a lease basis. This arrangement can provide a substantial cash infusion when the equipment is sold, and it also helps to improve a company’s balance sheet. A sale-leaseback can also allow a company to liberate equity for other uses that was formerly tied up in equipment.

Collateral Concerns

Because the period between purchasing and profitably operating a machine is an anxious time for buyers, dealers offer fixed-rate financing plans that delay the initial payment for 90 days. During the summer of this year, for example, Tipton Machinery offered this type of plan to finance certain types of equipment for a 60-month term at 5.9-percent interest. Under this plan, a shop that purchased a machine for $100,000 would make fixed payments of $1,947 per month. Mr. Grove points out, however, that buyers are sometimes able to find better financing arrangements through their own banks or other lenders. Additional financing plans are also available, including floating-rate loans and 7-year terms with lower monthly payments.

Small Business Administration (SBA) loans are also an excellent source of money to finance equipment purchases. Unfortunately, some misconceptions about SBA loans may deter people from investigating this option. Contrary to popular belief, SBA loans do not require several months to be approved and funded. In fact, a period of 30-60 days is more typical. Because SBA loans are funded through the federal government, many borrowers fear that they will face excessive red tape and delays. In reality, however, applying for an SBA loan does not involve any more documentation than a standard commercial or real estate loan.

Perhaps because the SBA formerly made loans to assist minority businesses, people may have the impression that these loans are approved primarily on the basis of race or national origin. But the SBA’s minority program was terminated many years ago. Under the current Guaranteed Loan Program, SBA guarantees 75-80 percent of the amount that a private lender extends to any applicant who qualifies under its guidelines.

Interest rates on SBA loans are usually variable rates that are tied to the New York Prime Rate. The rate is adjusted quarterly, but the SBA does not allow the margin to be greater than 2.75 percent above the prime rate. Furthermore, lenders are prohibited from charging points to originate or service SBA-guaranteed loans. The SBA charges a one-time loan guarantee fee (2 to 3.875 percent) that is based only on the portion of the loan that it guarantees.

Although regulations have been tightened somewhat since the 1980s, lenders that provide funds for capital equipment today are likely to base their decisions primarily on the applicants’ recent performance and current assets. Presenting evidence of a long business history, while helpful, is certainly not a requirement to obtain financing today. This high level of confidence is possible because the modern history of metalworking presents a strong argument that the current slowdown is nothing more than a speed bump on the highway.

Related Content

How to Calibrate Gages and Certify Calibration Programs

Tips for establishing and maintaining a regular gage calibration program.

Read MoreRethink Quality Control to Increase Productivity, Decrease Scrap

Verifying parts is essential to documenting quality, and there are a few best practices that can make the quality control process more efficient.

Read More6 Variations That Kill Productivity

The act of qualifying CNC programs is largely related to eliminating variations, which can be a daunting task when you consider how many things can change from one time a job is run to the next.

Read More4 Commonly Misapplied CNC Features

Misapplication of these important CNC features will result in wasted time, wasted or duplicated effort and/or wasted material.

Read MoreRead Next

Setting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

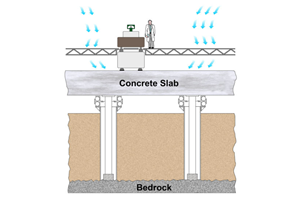

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.jpg;maxWidth=300;quality=90)