The Shift to Horizontal Machining Centers Gathers Steam

Metalworking companies, especially job shops, continue to invest more heavily in HMCs. This trend points to the inherent capability and flexibility of these machines for producing complex, high-value workpieces.

Share

Most metalworking facilities are high-mix, low-volume businesses. Batches tend to be small, while the variety of parts produced is quite high. New processes for incoming jobs need to be developed on a regular basis. Therefore, metalworking facilities must be careful when they consider the capabilities of the capital equipment they purchase and the skillsets of the people they employ. The wrong mix of equipment and people can leave either asset underutilized. Productivity will suffer. However, the right mix of equipment and people can help increase productivity and enhance flexibility, thus significantly improving a shop’s profitability.

The 2018 Capital Spending Survey by Gardner Intelligence shows that in recent years shops have increasingly turned to horizontal machining centers (HMCs) for this increased productivity and process flexibility. The survey provides quantitative evidence supporting the shift to HMCs that this magazine has noted in recent years.

The Numbers

Each year, Gardner Intelligence surveys readers of Modern Machine Shop and three of its sister publications about their plans for spending on metalworking capital equipment, workholding and tooling in the following year. Responses to these surveys are used to forecast spending by industry on specific machine tool, workholding and tooling types. They form the basis of our annual Capital Spending Survey.

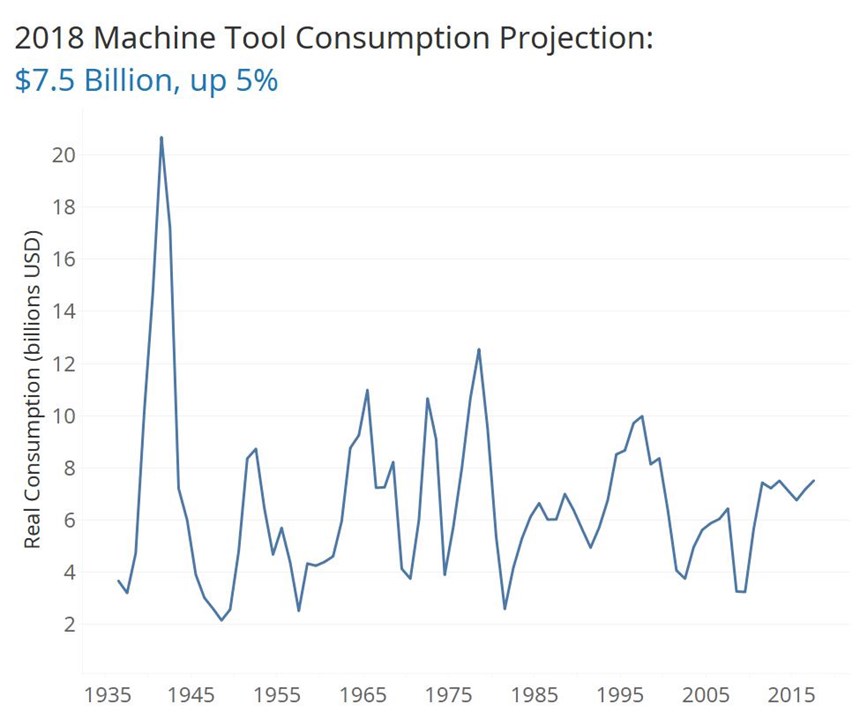

This year’s survey projects spending of $7.5 billion on machine tools in 2018. This projection represents an increase of 5 percent over our latest estimate of $7.1 billion for 2017. If this increase occurs, then machine tool consumption would reach its highest level since 2000, which was the last time consumption topped $8 billion. Further, this projection would make 2018 the seventh year in a row that consumption was above the average annual consumption of $6.6 billion.

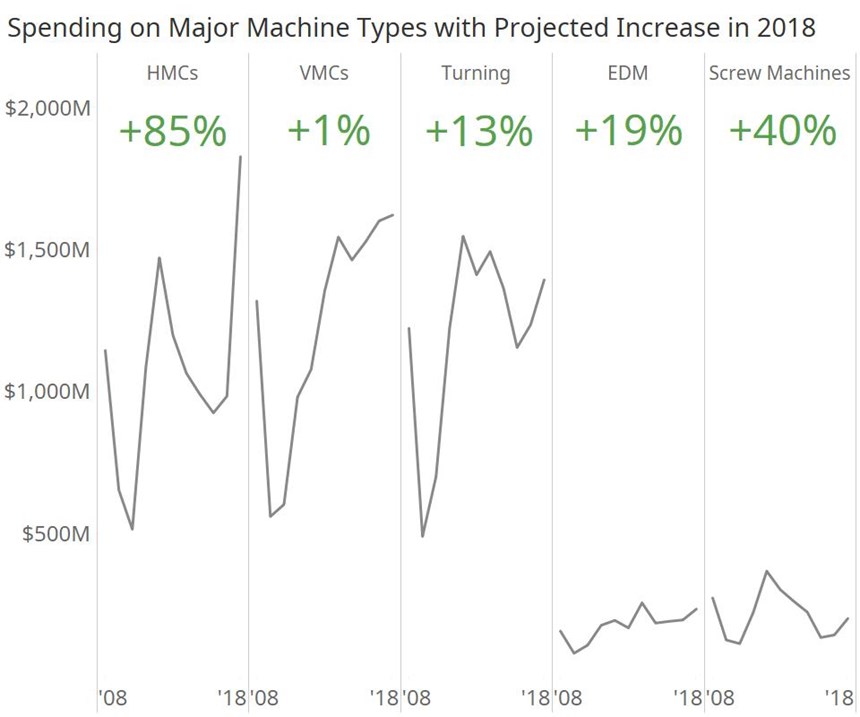

Of the $7.5 billion of projected spending on machine tools in 2018, $1.8 billion (almost 25 percent of all spending) will be on HMCs, compared to $1.6 billion on vertical machining centers (VMCs). Moreover, 2018 would be the fourth year in 10 during which HMC spending exceeded VMC spending.

The 2018 projection for HMCs is 85 percent higher than the estimate for 2017. It is also almost $400 million higher than the next best year for HMCs since 2008. However, the projection for VMCs is up only 1 percent compared to 2017 figures, and while it would be the highest since 2008, it is only marginally higher than VMC spending since 2014.

These comparisons are significant because VMCs are used much more frequently than HMCs; they are arguably the most used type of machine tool in metalworking facilities. Modern Machine Shop’s most recent Top Shops survey shows that nearly 82 percent of shops use a VMC, whereas just less than 50 percent use an HMC.

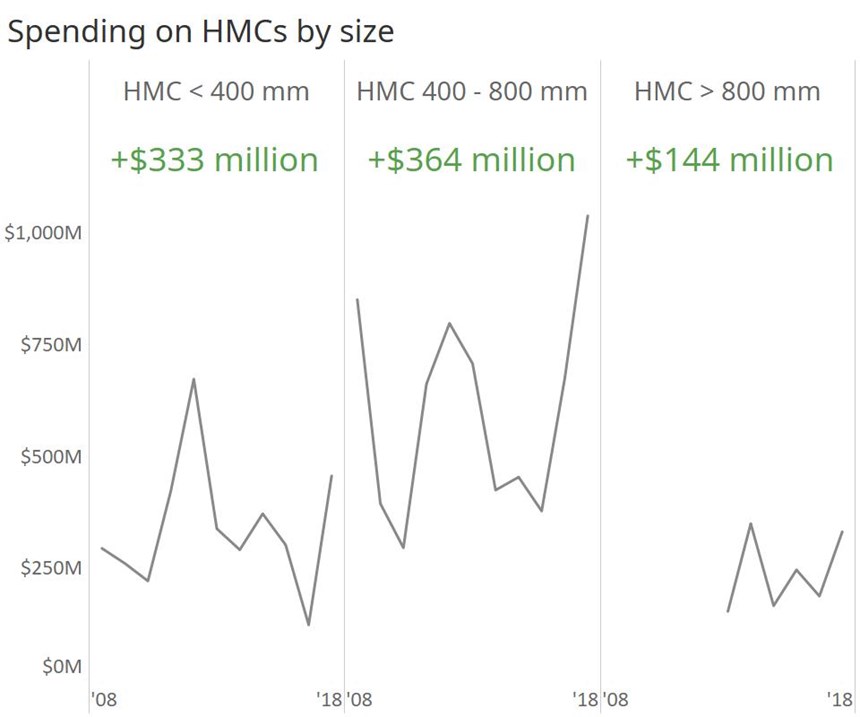

Within the family of HMCs, the greatest increase in spending will be on the class of machines with a 400-800-mm pallet. The survey projects more than $1 billion (55 percent of all HMC spending) spent will be on these mid-sized machines. Of the remaining spending, the portion devoted to smaller HMCs will slightly exceed the portion devoted to larger HMCs.

Job Shop Spending

In this year’s survey, job shops say they plan to spend almost $800 million on HMCs in 2018. This amount is more than four times the spending on HMCs planned by manufacturing industries such as automotive or aerospace. Job shops are precisely the type of metalworking facility that has the most to gain by using an HMC.

A significant reason for any shop’s preference for making an investment in an HMC is the scarcity of skilled labor.

With fewer skilled people available to set up, run and tend machines, shops must develop automated processes to keep producing parts. HMCs are easier to run unattended, because an increased number of parts can be accessed on an indexing pallet with a multi-sided pedestal-type fixture. Tool magazines on HMCs typically hold a larger number of tools than those on VMCs, which also enables extended unattended operation. For these two reasons, an HMC can produce a greater number of parts and a greater variety of parts without human intervention. So, shops are willing to spend more on an HMC, because it helps offset the cost of training personnel and takes off some of the pressure to find people needed to run a less-automated process.

Because many shops are new to HMCs, they struggle with deciding how large a machine to buy. HMCs generally are more expensive, and there is a temptation to avoid spending as much as might be needed on an adequate tool changer and the ample machining envelope necessary to get the most out of horizontal machining. For example, a shop might have a VMC with a 40-pocket toolchanger. Then it buys an HMC with a toolchanger that has 200 pockets. The increased tool capacity adds so much to the total cost that the shop stops there. However, the wiser shop considers how many different parts will be produced when the machine is running unattended. The part variety may require a toolchanger for 300 tools. Of course, the cost of the even larger toolchanger is substantially more, but the increased productivity and added process flexibility is likely to offset this higher cost. A shop that does not think far enough ahead may pull back from sticker shock and subsequently miss out on the full potential that a new HMC with a larger toolchanger would guarantee.

When switching to HMCs, shops also struggle deciding whether to buy a four-axis or five-axis machine. Moving from a three-axis VMC to a five-axis HMC is a significantly broader jump than to a four-axis HMC. This is attributable to the major increase in engineering and programming capability required to machine in five axes. At this juncture, it becomes critical to make sure that a shop’s workforce has the skills to match the capability of the chosen type of machine. If a shop doesn’t have the engineers and programmers (and those skilled people are hard to find right now), then it might be better to make the lesser jump to four-axis machining.

Other Connections?

By the way, there are some other things going on in the survey that might be connected to this expected increase in spending on HMCs. For example, respondents indicated a decrease in spending on surface grinders. Although it can’t be proven by the data, one explanation for the reduced demand for surface grinders might be related to the precision of HMCs. Reprocessing parts for production on an HMC might naturally include an effort to use this precision to eliminate a grinding step or reduce subsequent grinding operations.

Another shift indicated is in the type of tooling shops are buying. Until 2012, our survey showed that carbide cutting tool inserts represented the highest portion of spending for tooling. From that year on, spending on inserts has fallen, while spending on solid-body cutters and drills has increased. In fact, in this year’s survey, solid-body cutters are expected to overtake inserts as the tooling segment that shops plan to spend the most on.

One reason for this shift also could be related to the precision of HMCs. Manufacturing in the U.S. continues to move to higher value-added parts, which often necessitates smaller tools. It’s possible that the level of precision required at U.S. machine shops has reached a level where the demand for smaller solid tools has outpaced the demand for inserts.

Of course, smaller tools remove less metal in each cut, but the increased speed of today’s machines means that these smaller cuts can remove as much metal in the same amount of time as larger, slower cuts typically done with inserts. In other words, machining with a smaller tool at higher speeds may reduce the number of passes to finish the part. Likewise, cutting forces may be reduced, making workholding and clamping simpler and lighter.

Much More in the Survey Data

The 2018 Capital Spending Survey does seem to corroborate the much-discussed trend to horizontal machining, particularly in job shops. However, the survey also provides data on capital equipment spending projected for many other types of machines by many industries as well. There is a wealth of information contained in the survey. Other trends and patterns can be detected. The discussion presented here is simply one that has the broadest implications for the metalworking community.

Related Content

Weingärtner Maschinenbau HMC Provides Stable Machining

The MPMC features a wide base, optimized guide ratio and configuration of the guideways to provide stability and prevent vibration during operation, even under extreme cutting conditions.

Read MoreDN Solutions America Unveils Impressive Chicago Technical Center at IMTS 2024

New tech center is serving as a cutting-edge showroom and a technological hub for advanced machining applications.

Read MoreShop Replaces Two Verticals With One Horizontal

By trading two VMCs in to help finance the purchase of a new HMC, this shop was able to significantly increase production and move to lights-out machining.

Read MoreFryer’s Horizontal Boring Mill Designed for Ease of Use

The HB Series Boring Mills feature rugged cast iron bodies and high-precision ballscrews and bearings to ensure high-accuracy tolerances.

Read MoreRead Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)