The Global Machine Tool Boom Continues, Except in China

The latest World Machine Tool Survey finds major machine tool countries moving in separate directions.

Share

On the surface, the findings of Gardner Intelligence’s latest World Machine Tool Survey portray a seemingly ordinary year for the machine tool industry. But scratch the surface, and we find something remarkable happening: Major geographic regions for machine tools are moving in very different directions.

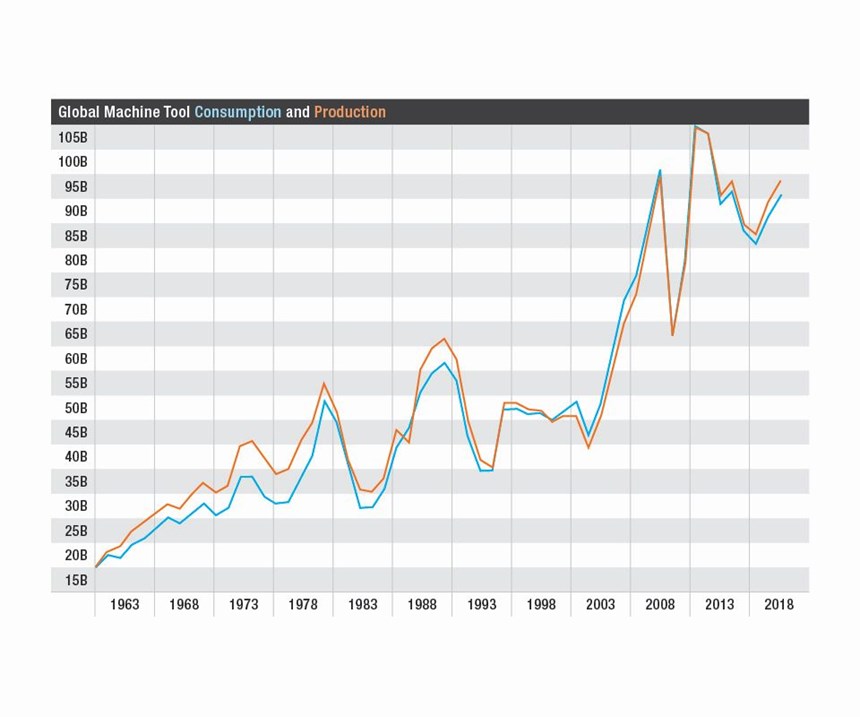

According to the latest survey, the results of which have recently been published, global machine tool consumption increased $4.1 billion, or 4.8 percent, to $91.9 billion in 2018. This made 2018 an apparently ordinary year, as the median annual increase in global machine tool consumption since 1961 is 4.2 percent. Plus, 2018’s consumption growth rate was slightly slower than 2017’s, which was 6.9 percent.

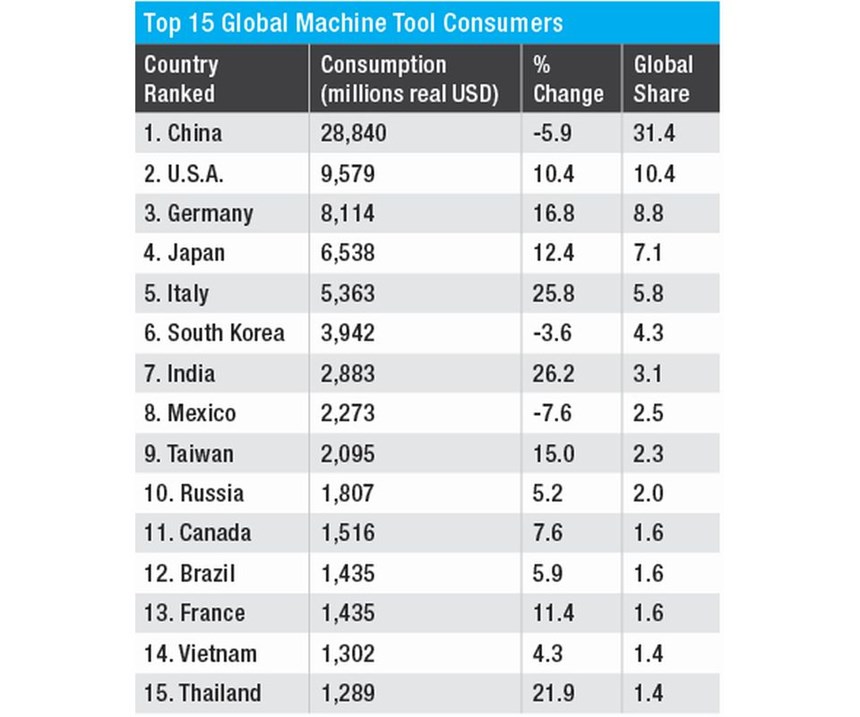

However, 2018 machine tool consumption was the fifth highest in real dollars. Further, 12 of the top 15 machine-tool-purchasing countries, which account for slightly more than 85 percent of global machine tool consumption, increased their consumption in 2018. That is just the seventh time since 1980 in which at least 12 of the top 15 countries increased their consumption in a given year. This happened in 2017, too.

Yet what makes 2018’s growth in machine tool consumption even more remarkable is what has happened in China. Since 2002, China has been the world’s leading machine tool consumer, and the country has consumed at least 33.7 percent of the world total since 2009. This was the case until 2018, when China’s consumption dropped 5.9 percent from $30.7 billion to $28.8 billion, and its share of global machine tool consumption fell to 31.4 percent.

What happened with China’s machine tool consumption in 2018 is perhaps partially a result of the trade war between China and the United States. However, it is striking that a year of better-than-average growth in global machine tool consumption occurred at a time when the world’s largest consuming country by far was down noticeably.

Three Countries Surge

These circumstances mean that not only did 12 of the top 15 consuming countries increase their consumption in 2018, but they increased their consumption significantly. Their machine tool consumption increased by an average of 12.7 percent, and three of those countries—India, Italy and Thailand—increased their consumption more than 20 percent.

Meanwhile, other countries joining Italy among the top five machine tool consumers (which account for almost 64 percent of global demand) also significantly increased their consumption. The United States, Germany and Japan each increased their consumption more than 10 percent.

Evidence of Reshoring

Of course, with China down, other leading countries, such as the United States, Germany, Japan and Italy, all increased their share by simple arithmetic. However, the United States is a particularly interesting case. Its global share of machine tool consumption in 2018 was 10.4 percent. That is the country’s highest share since 2001 when it consumed 13 percent of all machine tools (more than China but less than Germany and Japan). Offshoring of U.S. manufacturing began in earnest in 2001 just when the United States’ share of global machine tool consumption started shrinking. Therefore, it is likely no coincidence that the United States’ share began to recover in 2011 at the onset of the reshoring movement. The increased share of the global investment in machine tools should keep U.S. manufacturing competitive for the next five to 10 years.

Same Pattern for Production

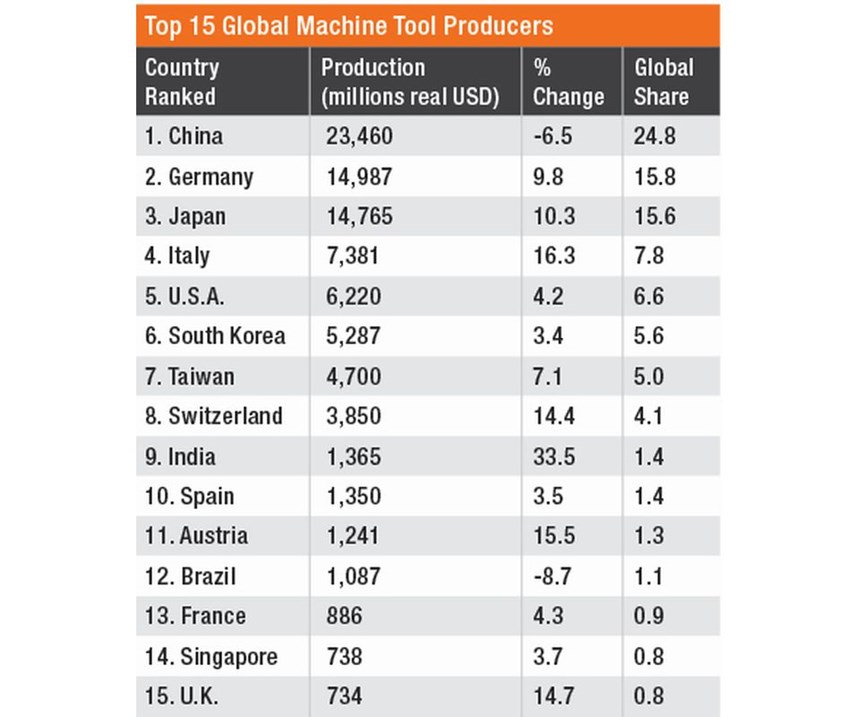

Global machine tool production has followed a pattern similar to consumption. In 2018, global machine tool production was $94.7 billion, which was an increase of $4.2 billion, or 4.7 percent. The increase was more than the median increase since 1961, which is 3.4 percent, but less than the increase in 2017, which was 7.7 percent.

Global production of machine tools in 2018 was also the fourth highest in real dollars, and production of machine tools is even more concentrated than the consumption of machine tools. The top 15 machine-tool-producing countries accounted for 93 percent of all machine tools made in 2018, and 13 out of the top 15 increased their production in 2018.

And, just like with consumption, China had a noticeable decline. In 2018, China produced $23.5 billion of machine tools, making it easily the world’s largest producer. However, 2018 production was down $1.6 billion, or 6.5 percent, compared to 2017. Further, China’s share of global machine tool production fell below 25 percent for the first time since 2008.

China Increases Imports

What makes it even more clear that the global machine tool boom continued in 2018 except for China is China’s imports of machine tools. In 2018, the country imported $9.5 billion of machine tools, which was an increase of 6.7 percent and the highest figure since 2014. The decrease in Chinese consumption and production combined with increased imports of machine tools indicate that the issue was isolated to the domestic machine tool market in China.

An example that the production of machine tools is even more concentrated than their consumption is that the top five producing countries—China, Germany, Japan, Italy and the United States—produce more than 70 percent of all machine tools. For global production to increase when the largest producer by far had a 6.5-percent decline means that the other top-five countries had significant production gains. The other top five countries had an average increase in production of 10.2 percent, but the United States lagged with just a 4.2-percent increase.

More in the Report

The World Machine Tool Survey contains much more information, including not only consumption and production data, but also data related to imports and exports, covering the top 60 machine consuming countries. New this year, the report includes import and export data on high-level machine types. To purchase the report and the data supporting it, visit gardnerintelligence.com.

Read Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)