Published

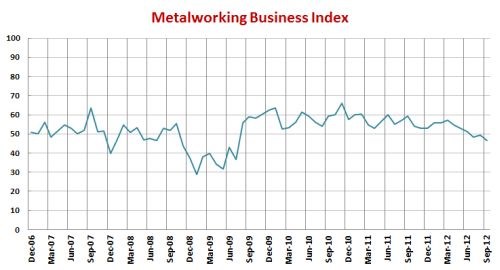

September MBI at 46.6 – Industry Moves off Peak Levels

With a reading of 46.6, September’s Metalworking Business Index showed that the metalworking industry has contracted for the third month in a row.

Share

.jpg;maxWidth=600)

With a reading of 46.6, September’s Metalworking Business Index showed that the metalworking industry has contracted for the third month in a row. The August MBI provided an indication that the industry would break out of its slowing trend, which began in March 2012. However, the results of the September MBI indicate that the slowing trend continues. With some key leading indicators for metalworking still strong, the question is: How far and for how long will the industry contract? Is this a temporary slowdown while the industry waits to see what happens in the election, or is it linked to a world economy that is already slowing at a more significant rate?

Five of the six subindices used to compute the MBI had a negative impact on the reading in September. The new orders index showed faster contraction in September, reaching its lowest level since July 2009. After moving from contraction to expansion in August, the production index moved back into contraction in September. New orders have been contracting faster than production and this has put pressure on backlogs. The backlog index has contracted for six consecutive months and is at its lowest level since July 2009. Employment continues to expand as it has for 17 straight months. Reports from IMTS indicate that virtually every company affiliated with the metalworking industry is still looking to hire more people. Supplier deliveries was the only subindex to make a positive contribution to the September MBI. Delivery times lengthened more during the month.

Future business expectations continue to move lower, reaching their lowest level since July 2009. Also, future business expectations have been below average for the last three months.

.JPG;width=70;height=70;mode=crop)