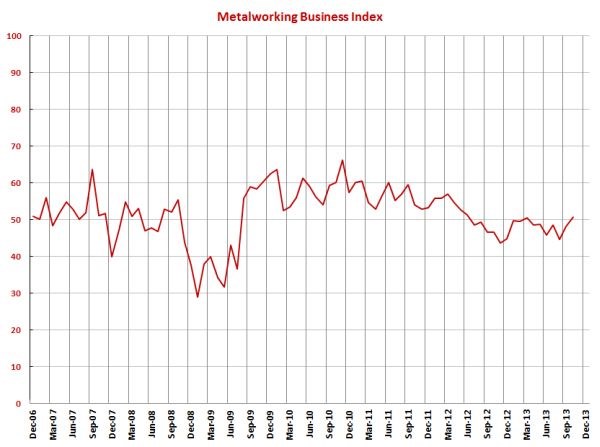

October MBI at 50.7 – First Growth in Six Months

With a reading of 50.7, Gardner’s metalworking business index showed that the metalworking industry expanded for the first time since March 2013.

Share

With a reading of 50.7, Gardner’s metalworking business index showed that the metalworking industry expanded for the first time since March 2013. The index was 9.0 percent higher than it was in October 2012 and it was the second straight month of month-over-month growth. And, it was the fastest rate of growth since June 2012.

New orders grew for the first time since March 2013 and at their fastest rate since May 2012. Similarly, production grew for the first time since May 2013 and at their fastest rate since May 2012. Backlogs continued to contract, but they did so at their slowest rate since February 2013. After two months of contraction, employment grew in October Exports continued to contract as the dollar remains relatively strong. Supplier deliveries continue to lengthen at similar rate to the last 12 months.

Material prices increased at a similar rate to most of 2013. Prices received barely increased in October, which is similar to the rest of 2013. Future business expectations shot up in October, reaching their highest level since May 2012.

Shops with more than 50 employees have been expanding throughout most of 2013 and that trend continued in October. Shops with fewer than 50 employees have contracted throughout 2013. However, the rate of contraction has moderated the last couple of months. Shops with fewer than 19 employees had an index of 49.2 in October compared to 40.2 in August.

While nine regions had contracted for three months, in October four regions expanded. The Mountain region had an index of 60.2. New England grew for the second month in a row. The South Atlantic and West North Central region moved to expansion from contraction. The East North Central, Middle Atlantic, and Pacific regions were just under 50. The East South Central continued to contract the fastest but it did see a significantly slower rate of contraction compared to August.

Future capital spending plans were up 6.3 percent compared to last October. This was the second month in a row that the month-over-month rate of change grew.

Related Content

-

Optimism Grows as Metalworking Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

-

Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)