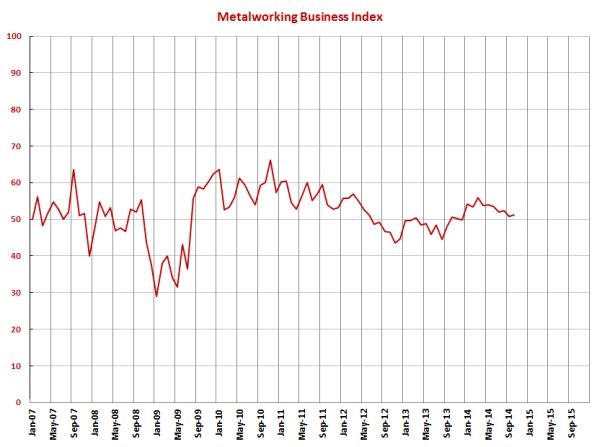

October 2014 MBI Shows Rate of Expansion Picking Up

With a reading of 51.2, the Gardner Business Index showed that the metalworking industry grew for the 10th consecutive month and the 12th time in 13 months. October’s rate of expansion was slightly faster than last month.

Share

With a reading of 51.2, the Gardner Business Index showed that the metalworking industry grew for the 10th consecutive month and the 12th time in 13 months. October’s rate of expansion was slightly faster than last month. The month-over-month rate of growth was just 1.0 percent, which was the slowest rate of growth since August 2013. The annual rate of growth decelerated for the first time since it began growing in March.

Both new orders and production increased for the 13th month in a row. In both cases, the rate of expansion was significantly faster than the previous month. The accelerating contraction in backlogs took a pause in October as backlogs contracted at a slightly slower rate than they did in September. Compared to the same month one year ago, backlogs contracted for the first time since August 2013. While it was still growing quickly, the annual rate of growth has decelerated for two months in a row. This indicates that capacity utilization will likely see its peak rate of growth in the second quarter of 2015. Given the trend in backlogs, it is still likely that capacity utilization will average more than 80 percent in 2015. Employment continued to expand but the rate of hiring has slowed compared to the first half of the year. The rate of contraction in exports continued to accelerate as the dollar continues to appreciate against other world currencies. Supplier deliveries continued to lengthen but the rate of increase has slowed the last two months.

Material prices have increased at a slower rate since June. Material prices were increasing at a rate similar to the first four months of the year. Prices received have increased the last six months. This is the strongest period of sustained price increases by metalworking facilities since the summer of 2012. Future business expectations took their biggest hit since December 2012 and were at their lowest level since October 2013.

Plants with more than 100 employees continued to grow but they did so at their slowest rate of 2014. Facilities with 20-99 employees saw significantly better business conditions in October. Once again they were growing at a rate similar to that of the largest facilities. Shops with fewer than 20 employees contracted for the fifth month in a row and the eighth time in 2014.

For the fourth month in a row, the South Central region was the fastest growing region by a fairly wide margin. Its index has been above 60.0 two of the last three months. The North Central - East and Northeast regions also expanded. The North Central – West, West, and Southeast regions contracted after growing for a number of months.

Future capital spending plans contracted 13.5 percent compared to last October. This was the fastest month-over-month contraction since February 2014. The annual rate of growth decelerated to 4.2 percent, which was the first time it decelerated since it began growing in April.

For more manufacturing economic news, visit Gardner's Economics News Blog.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)

.png;maxWidth=970;quality=90)