Published

November MBI’s Growth is Still Solid

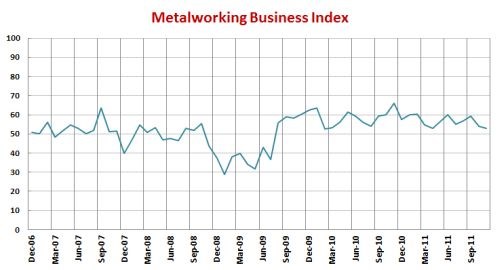

With a reading of 52.9, the November MBI showed that the metalworking industry has grown for 28 consecutive months.

Share

ECi Software Solutions, Inc.

Featured Content

View More

Autodesk, Inc.

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

With a reading of 52.9, the November MBI showed that the metalworking industry has grown for 28 consecutive months. However, the rate of growth has slowed each of the last two months, and November’s growth rate is the third slowest of the last 28 months.

The slowing rate of growth could be more than just a blip. Most of the subindices are showing slower growth or or faster contraction for several months in a row.

November’s rate of growth for new orders was mostly unchanged, but it did see its slowest rate of growth since August 2010. Production, which has been growing faster than new orders for a couple of months, saw slower growth. Because production has been growing faster than new orders, backlogs have contracted each of the last two months. The backlog subindex is at its second lowest level since August 2009.

Shops continue to hire new employees. The rate of hiring is slower than a few months ago, but it is about the average rate of this period of growth in metalworking.

Exports have seen a slight contraction for three months, which could be a result of stronger consumer spending in the United States and an emphasis on reshoring keeping more parts and finished product here in the United States.

The one subindex that signaled accelerating growth was supplier deliveries, which has shown lengthening delivery times for three months.

The rate of growth in material prices has been slowing since early 2011, although this could change as central banks around the world seem to be kicking off another round of money printing.

Future business expectations have remained above average, although they have trended lower since the peak in July 2011.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)