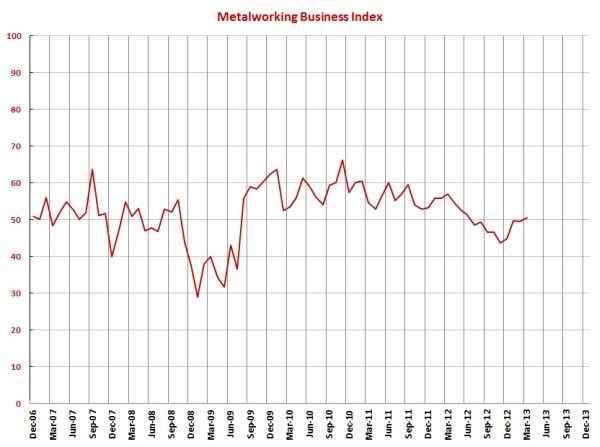

Metalworking Returns to Growth

With a reading of 50.5, Gardner’s metalworking business index showed that business activity in the metalworking industry increased for the first time since June 2012.

Share

.jpg;maxWidth=600)

With a reading of 50.5, Gardner’s metalworking business index showed that business activity in the metalworking industry increased for the first time since June 2012. Basically, the contraction lasted just six months and was most likely due to the election and fiscal cliff. Now that those issues are finished or on the back burner, the metalworking industry is recovering.

New orders have grown consistently for three months. At the same time, production has grown faster each month. With new orders falling from a slightly higher level to a slightly lower level than production, it seems that there is still adequate capacity at metalworking facilities. This is the likely reason for backlogs continuing to contract, although the rate of contraction has slowed. The relatively weaker recovery in backlogs is the most significant reason why the overall index does not show even stronger growth. In addition to the drag from backlogs, exports are holding the industry back from faster growth. While exports have been contracting more slowly, the recent problems in Europe and the increased quantitative easing in Japan will likely keep the dollar relatively strong. This means exports will remain a drag on the metalworking industry. Supplier deliveries have been slowly lengthening, indicating that the durable goods supply chain is improving. Also, employment has started growing faster again.

Materials prices slowed their rate of growth in March, but there is still a strong upward trend in the rate of growth in prices since July 2012. At the same time, prices received have been contracting or growing slowly. The combination of these two trends and the accelerating growth in employment is putting pressure on profits at metalworking facilities. Future business expectations continue to improve rapidly and are now just above the historical average.

Shops with 50 or more employees have been growing for three months. In March, shops with 20-49 employees started growing as well. But, shops with 19 or fewer employees are still contracting. The rate of contraction in these shops has been fairly constant the last three months. Regions with the strongest growth (in order) are the West North Central, Pacific, New England, South Atlantic, and West South Central. The other four regions contracted mildly in March. End markets showing strong growth in March were aerospace; electronics; industrial motors, hydraulics, and mechanical components; and pumps, valves, and plumbing products.

.JPG;width=70;height=70;mode=crop)