Published

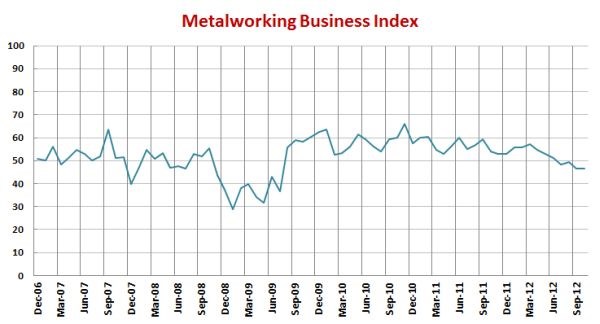

Metalworking Industry Contraction Flattens

While October’s MBI reading showed that the industry contracted for the fourth month in a row, it appears that there was a slight change in the trend: Growth wasn't contracting as fast as contraction was accelerating.

Share

.jpg;maxWidth=600)

With a reading of 46.5, the October Metalworking Business Index showed that the metalworking industry contracted for the fourth month in a row. However, while the rate of contraction remained unchanged from September, it appears there was a slight change in the trend in the industry, based on the graphs of the overall index and the subindices.

Growth had been decelerating at a consistent rate for most of 2012, but the rate of contraction has not been accelerating as fast as that rate of growth was decelerating. This is a subtle shift, but could indicate the beginning of a bottom to this low point of the cycle. I’m writing this on Election Day, so the election results haven’t been factored into the results of the survey yet. I think we will see improvement in the index, regardless of who won.

New orders contracted for the fourth month in a row, but at a slower rate than in September. Production contracted for the third time in the last four months and the rate was faster than in September. Employment contracted for this first time since April 2011. Backlogs continue to contract at a significant rate as new orders have been contracting more than production. Supplier deliveries are still lengthening, but the index is the lowest it has been since August 2011. This indicates that the slowdown is fairly widespread throughout manufacturing. While material prices are still increasing, albeit more slowly, prices received by shops contracted for the second month in a row.

Perhaps the brightest part of the survey was that the future business expectations index improved in October. While this subindex is still near its low since mid-2009, it does appear to be bottoming out. During the last two upturns in metalworking, the future business expectations rebounded before most other subindices.

.JPG;width=70;height=70;mode=crop)