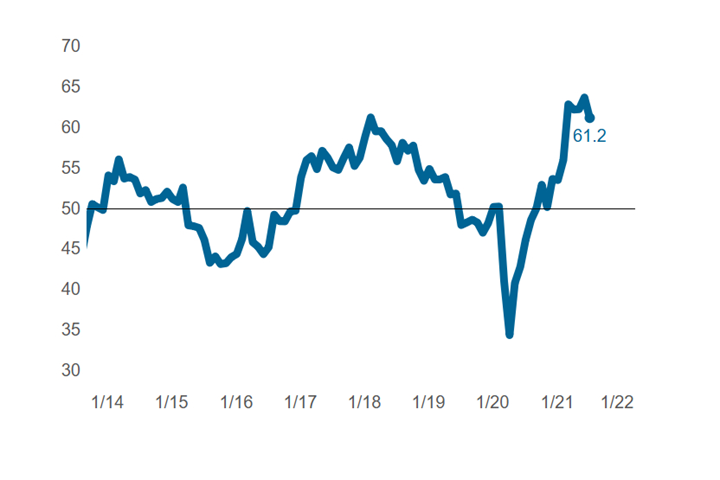

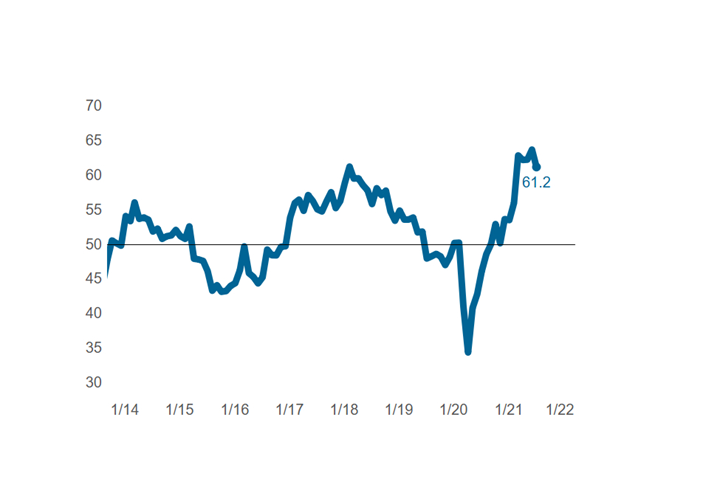

Metalworking Index Eases After Setting All-Time High

The Gardner Business Index: Metalworking had a July reading of 61.2, indicating a slowing expansion, while supplier backlogs and new orders remain largely unchanged.

Share

The Gardner Business Index: Metalworking registered slowing expansion during July with a reading of 61.2.

The Gardner Business Index: Metalworking fell by slightly more than 1 point during July; however, the Index remains near record levels.

The decline was triggered by a third sequential month of slowing new orders activity in combination with a modest deceleration in production activity. The asymmetrical movement of these factors contributed to a five-point decline in the reading for backlog activity, marking the largest one-month downward change in backlog activity since the start of the pandemic.

The reading for supplier deliveries, which reflects changes in order-to-fulfillment time, remained largely unchanged, spending a third month above a level of 80 and indicating that supply chains remain heavily disrupted. Similarly, employment activity remained elevated for a fifth consecutive month. Recent readings are comparable to the elevated employment activity readings from the 2017-2018 business cycle expansion.

July marked the fourth month of a slowing expansion in new orders activity, but the first time that month-to-month slowing was more than seemingly incidental.

Recent months of slowing new orders and production and backlog activity, coupled with peak readings for supplier deliveries and employment, are reminiscent of 1H2018 readings. During that time, a slowing expansion in new orders was quickly followed by declining readings for production and backlogs while supplier deliveries and employment activity were still setting peak readings. While the reasons for present market conditions are vastly different from those of 2018, there is nonetheless good reason to be cautious about the potential for a turn in the business cycle.

Related Content

-

Optimism Grows as Metalworking Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

-

Metalworking Activity Trends Downward in May

Accelerated contraction and declines in business optimism span manufacturing segments. Odds are that broad-reaching economic factors are at play.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

.jpg;width=70;height=70;mode=crop)