Metalworking Activity Starts 2022 With Modest Boost

GBI: Metalworking reflected greater levels of activity in new orders, production and backlogs with a modest increase for January 2022.

Share

Takumi USA

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

Autodesk, Inc.

Featured Content

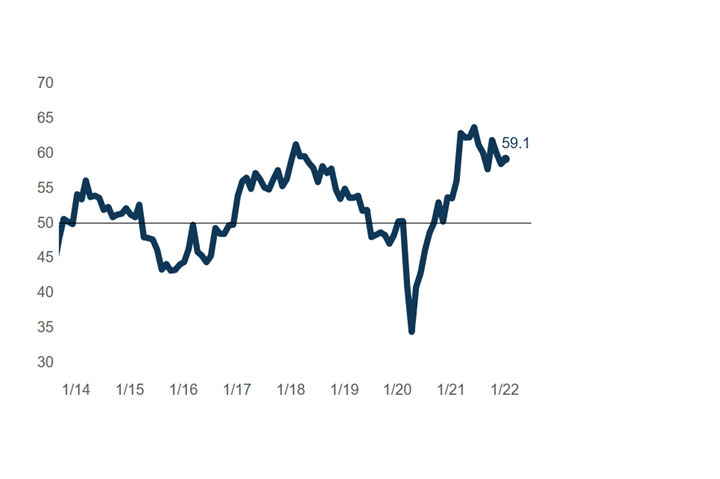

View MoreJanuary’s total business activity according to the Gardner Business Index (GBI): Metalworking increased nearly one point to close at 59.1.

GBI: Metalworking Index

The Metalworking Index started 2022 modestly stronger thanks to an accelerating expansion in new orders, production and backlog activity. Images: Gardner Intelligence

Greater levels of activity in new orders, production and backlogs all contributed to the month’s overall gain. January’s supplier deliveries reading also increased; however, in the present environment, rising readings indicate weakening supply chain performance. Those business activity readings which posted lower readings than last month’s include employment and export orders. January’s export reading fell below 50, indicating contracting activity. Separately, the decline in employment activity indicated only slowing expansion.

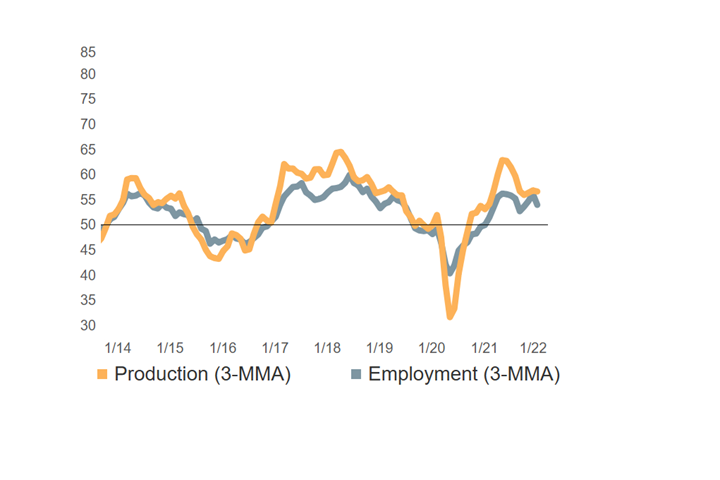

Production and Employment Activity: Doing More With Less

Production activity has remained robust over the last six months despite a relatively weak employment market and struggling supply chains. Graph is based on three-month moving averages.

Over the last six months, metalworking job shops have learned to do more with less. Since August, production readings have remained in a tight range with an average reading near 56. Historically, such strong performance has only been reported during expansionary phases of the business cycle and recalls the expansionary periods of 2014-2015 and 2017-2018. This time, however, the business cycle is different as manufacturers contend with a very tight labor market and weak supply chains. Finding ways to raise production to meet heightened demand with fewer workers and crippled supply chains is and will remain a challenge for the foreseeable future.

Related Content

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)