Metalworking Activity Remained Contractionary in December

Metalworking activity remained contractionary at the same rate as in November. Stable contraction is relatively good in the current environment.

Share

ECi Software Solutions, Inc.

Featured Content

View More

Autodesk, Inc.

Featured Content

View More.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

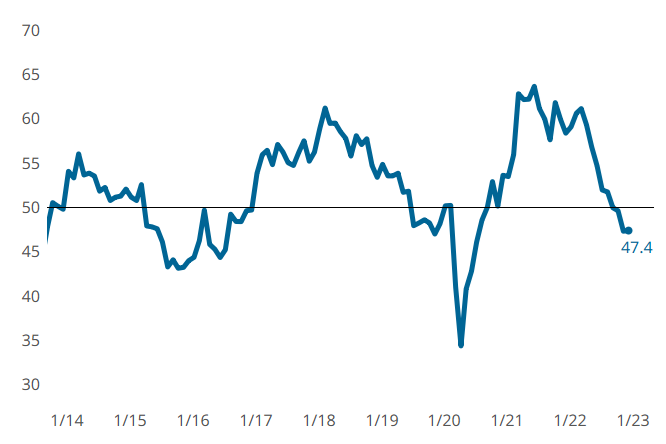

The Metalworking GBI contracted, about the same in December as November. Photo Credit: Gardner Intelligence

The December index closed at 47.4, essentially the same as November. Most components saw a bit faster contraction in December than November. New orders ended 2022 contracting, which has been the case since July. Backlog did the same, having started to contract in September. Production activity contracted to a lesser degree than backlog, new orders and exports, but may fall in line with the demand-based components here soon. Employment activity remained above the line, still expanding, but continually slowing, landing dangerously close to ‘flat’ in December. Supplier deliveries continued to lengthen at slower rates, with no reason to expect the pace to pick up again any time soon given the way most components are consistently tracking.

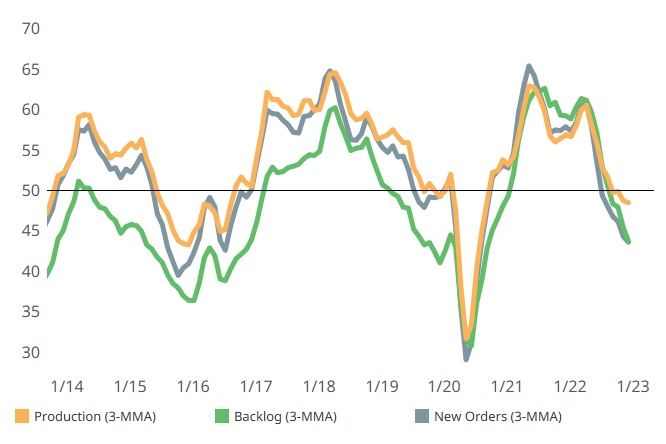

New orders and backlog activity contracted similarly in December. Production activity did not contract as much in December, but it may just be a matter of time. (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.