MBI Grows for Seventh Month

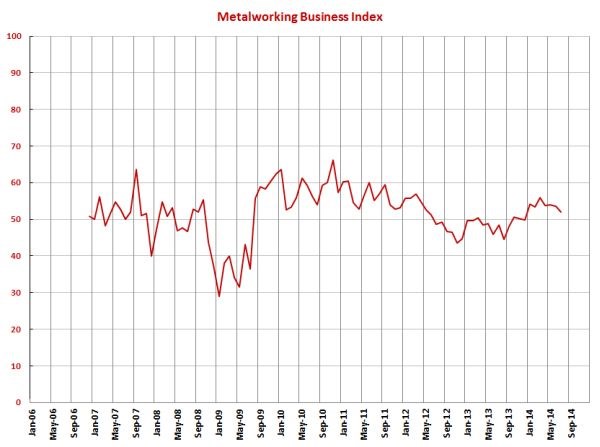

With a reading of 51.9, the July metalworking index showed that the industry grew for the seventh consecutive month and the ninth time in 10 months. While this growth was at its slowest pace of 2014, the index was still 7.0 percent higher than it was one year earlier, the 11th straight month that the month-over-month rate has grown.

Share

With a reading of 51.9, the July metalworking index showed that the industry grew for the seventh consecutive month and the ninth time in 10 months. While this growth was at its slowest pace of 2014, the index was still 7.0 percent higher than it was one year earlier, the 11th straight month that the month-over-month rate has grown. As a result, the annual rate of change has grown at an accelerating rate for five straight months and is growing at its fastest rate since April 2011.

Both new orders and production increased for the 10th month in a row, but their rates of growth have decelerated steadily since March. Backlogs have contracted for four consecutive months, and this rate accelerated in July, taking the backlog index to its lowest level since December 2013. This index is still significantly higher than it was one year ago, however, which is a positive sign for future capacity utilization and capital equipment investment. The rate of hiring had been accelerating since August 2013, but while employment is still growing, the accelerating growth trend was broken in July. Exports continued to contract but at a slower rate than they did in 2013. Supplier deliveries continued to lengthen at a slightly accelerating rate as they have done since June 2013.

Over the last three months, material prices have increased more than at any time since the first quarter of 2013. Over that same period, prices received by metalworkers have also increased at virtually their fastest rate since the summer of 2012. Future business expectations remain above average, but they have been trending down slightly throughout 2014.

Future capital spending plans fell to their lowest level since September 2011. This level was 12.2 percent lower than it was one year ago, which is the first month of contraction since February. The annual rate of change is still growing, but it did decelerate from last month.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)