Manufacturers Begin Making Significant Adjustments to Production

As automotive OEMs closed facilities and states closed non-essential businesses to help combat the coronavirus, significantly more manufacturers made adjustments to production/capacity in last week’s survey.

Share

During the week of March 23rd, Gardner Intelligence conducted its fourth short survey to gage the effects of COVID-19 on discrete parts manufacturers across all the industries that Modern Machine Shop publisher Gardner Business Media covers. The survey asked two basic questions:

- What changes has your business experienced as a result of COVID-19?

- What adjustments has your business made as a result of COVID-19?

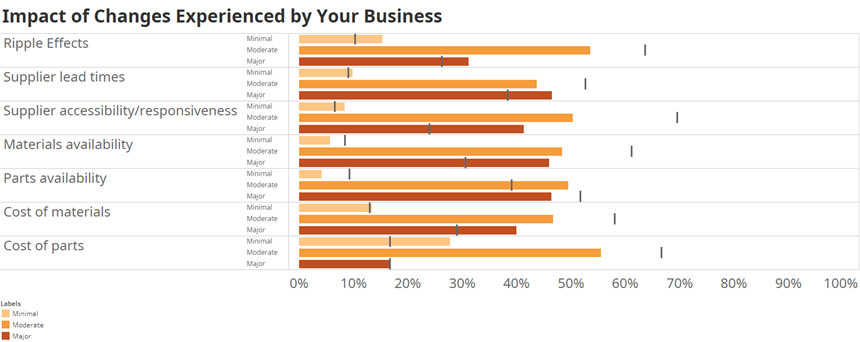

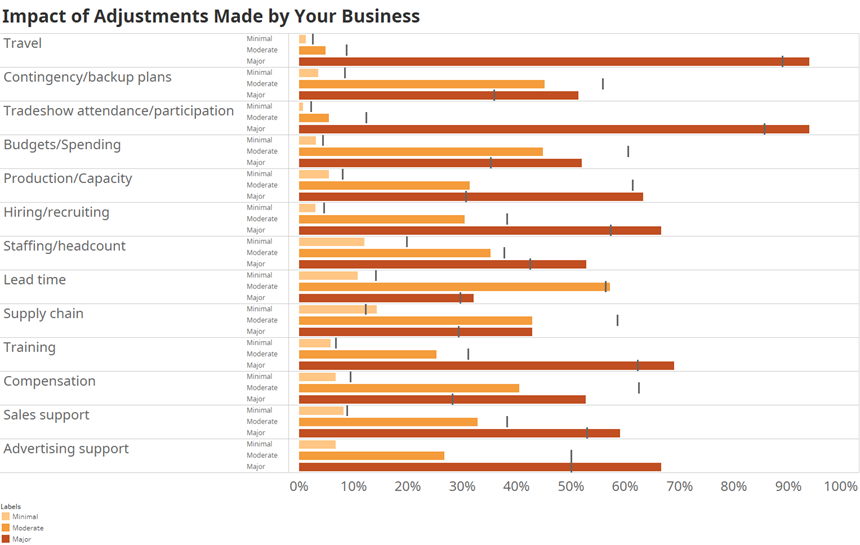

For each of those questions, respondents were asked to compare the current state of their business to the norm prior to COVID-19 and rank the severity of the change or adjustment from minimal to moderate to major.

Additional questions were added on facility hours, staffing and interest in medical manufacturing in the fourth week.

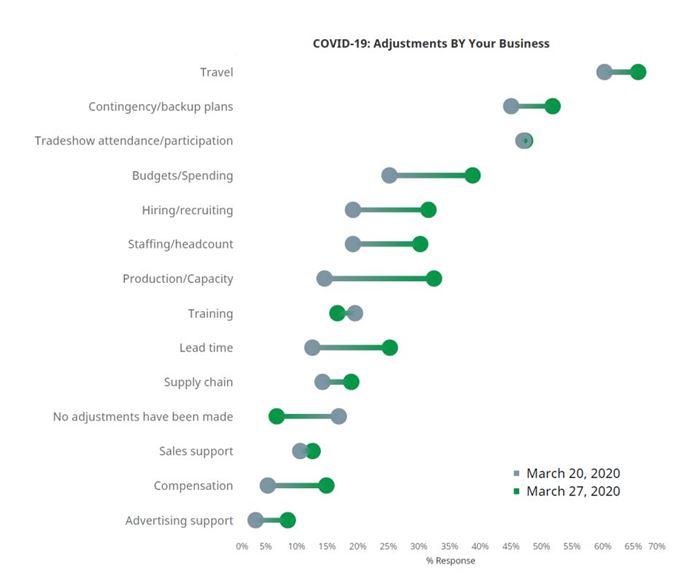

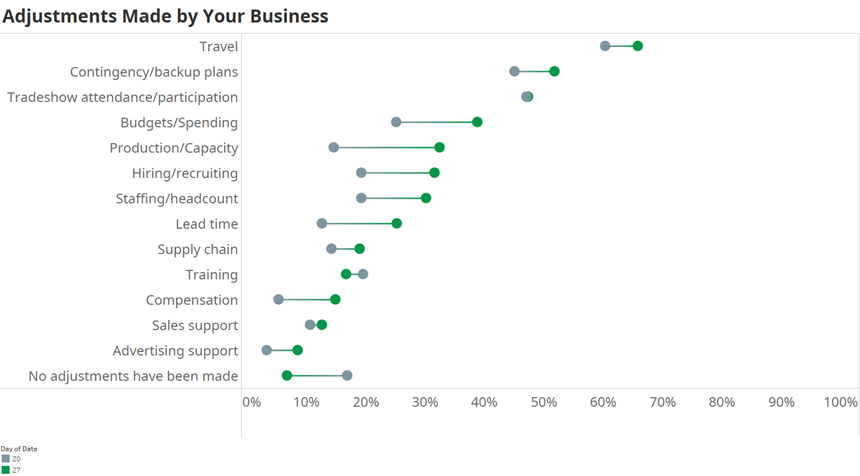

In the charts above, the percent of respondents as of March 27th are green dots and the percent of respondents as of March 20th are gray dots. The orange bars indicated the severity of the impact of March 27th and the gray hashes were the severity of impact as of March 20th.

According to last week’s survey, just 24% of manufacturers experienced no change in their business, which was down from 44% in the previous week. This is very likely a result of a number of states closing non-essential businesses toward the end of the survey period during the previous week.

Ripple effects — those that manufacturers could not tie directly to COVID-19 but believed to be a result of the pandemic — were experienced by 46% of manufacturers. Supplier lead times and supplier accessibility/responsiveness were the changes experienced that increased the most, with roughly 40% of manufacturers experiencing changes to both. Further, materials and parts availability were becoming significant issues for manufacturers.

Ripple effects had a slightly more significant impact as the percent reporting these as major impacts increased to 31% from 26%. The impact on supplier lead times was more severe (major impact increased to 47% from 38%); however, the impact on supplier accessibility/responsiveness was even more severe (major impact increasing to 41% from 24%). The severity of impact of materials availability increased sharply while the severity of impact of parts availability lessened somewhat.

In the fourth week of the survey, fewer than 10% of respondents reported making no adjustments to their business. This was down from 17% the week before. Again, the closing of non-essential businesses in many states was the likely the most significant driver.

Travel continued to be the most significant adjustment made by manufacturers. More manufacturers were implementing contingency/backup plans (52% this week versus 45% the week before). And, it became the second most enacted adjustment ahead of tradeshow attendance/participation, which was virtually unchanged from the prior week. The percent of manufacturers adjusting budgets/spending, hiring/recruiting, and staffing/headcount increased notably as more than 30% of manufacturers made adjustments here. However, production/capacity changed more than any other adjustment from the prior week. Last week, 32% of manufacturers adjusted production/capacity compared with 15% the previous week. Also, more manufacturers adjusted lead time and compensation last week.

In almost every case, the impact of adjustments made by manufacturers was more severe. This week 51% of manufacturers reported that the impact of contingency/backup plans were major versus just 35% the week prior. The change in impact of budgets/spending changes was very similar. The most significant change came in the severity of changes to production/capacity. This week, 63% of manufacturers reported the adjustment as having a major impact compared with 31% the prior week.

During the week of March 23rd, 60% of manufacturers reported normal operating hours while 15% reported reduced hours and 11% were closed. Regarding staffing, 45% were at normal staff levels while roughly 40% were at some level of reduced staffing.

Regarding the medical industry, just 6% of manufacturers had increased their level of service to the medical industry and just 14% were looking to increase or begin their service to the medical industry.

Read Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More

.JPG;width=70;height=70;mode=crop)