Machine Tool Orders Boom in December 2020

Machine tool orders reached their highest level since September 2018 (the last in-person IMTS) and their highest level outside of an IMTS month in three years.

Share

December machine tool orders were 2,775 units and $448,983,000.

December unit orders were the highest since September 2018 (an IMTS month) and the second-highest since December 2017, making December 2020 a breakout month. Unit orders in December increased 22.4% compared with one year ago, marking the fourth consecutive month of growth. As a result, the annual rate of contraction decelerated for the fifth straight month to its slowest rate of contraction since December 2019.

In December, dollar orders increased at a slightly slower rate of 16.3%. Therefore, the average dollar price of machine tools decreased by 5.0% compared with one year ago. The annual rate of contraction in dollar orders decelerated for the fifth month in a row.

Month-over-month rates of change differed wildly among the six regions.

Region Units Dollars

West 20.9% 69.3%

South Central 44.3% 12.2%

North-Central West 28.4% 2.1%

North-Central East 19.2% 10.9%

Southeast 45.5% 7.8%

Northeast -1.2% 10.2%

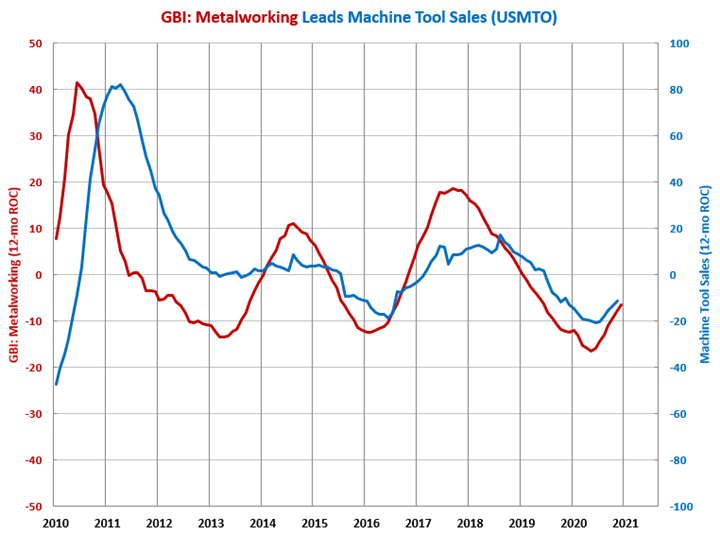

Compared with one year ago, the GBI: Metalworking grew 6.6%, which was the sixth consecutive month of growth. The annual rate of contraction in the GBI decelerated for the seventh consecutive month and tends to bottom out 7-10 months prior to machine tool orders bottoming out. However, it is clear that the annual rate of change in machine tool orders has already bottomed ahead of schedule.

.JPG;width=70;height=70;mode=crop)