Indexable Tools Bring Solid Job Shop Returns

An event in the heart of Europe sheds light on how the company behind Precision Twist Drill and other venerable solid-round-tool brands aims to break into the North American indexable-insert market.

Share

“When people think about indexables, the same eight or nine brands always come to mind,” Brian Norris said as the tour bus wound its way through the mists toward the mountaintop lake. As the recently appointed president of cutting tool supplier Dormer Pramet’s North American division, Mr. Norris seemed eager to put big plans into action. “There’s plenty of room for another brand,” he continued. “Small- and medium-sized job shops, general machining applications, MRO—we see opportunity there.”

The 11-person group on the bus was dwarfed by some of the other international contingents headed toward the summit that day. And yet, these select American, Mexican and Canadian distributors are the vanguard of Dormer Pramet’s advance into a market that, along with China, is considered the best opportunity for expanding the Pramet line of indexables beyond Europe. These particular North Americans had been invited to travel across the Atlantic because the company considers them the best able (and most likely) to cultivate the kinds of on-the-ground relationships that will be critical to expanding the line in their home countries. “Salespeople aren’t enough,” says Dan Murrell, national sales manager, Canada, about expanding the company’s North American offering beyond its longstanding solid round-tool lines. “We need technical people, people who can stand there at the spindle and talk shop. If they don’t believe in Pramet, the customers certainly won’t.”

The occasion was Cutting Days 2017, hosted at Pramet’s home facility in the Czech Republic, and we’d taken the opportunity to visit a tourist attraction that’s quite different from the art and architecture we’d see later in the ancient capital of Prague. Nestled in the Jeseniky mountains about 150 miles east of that city, the massive Dlouhé Stráně hydroelectric power plant seemed strangely at home amid the trees and trails of the surrounding nature preserve. We’d just emerged from deep underground, where twin 325-W turbines—reportedly the most powerful in all of Europe—pull water from a man-made reservoir situated high enough to see neighboring Poland with the naked eye.

Conceived during the communist era but not completed until after the entirely peaceful Velvet Revolution of 1989, the plant is a testament to engineering prowess and industrial culture. For the North American group and other Cutting Days visitors, however, the excursion was intended to convey a different underlying message: the extent of the capability of the Pramet-brand indexable cutting tools used to machine those turbines, not to mention the reputation and reach of that brand in its home markets.

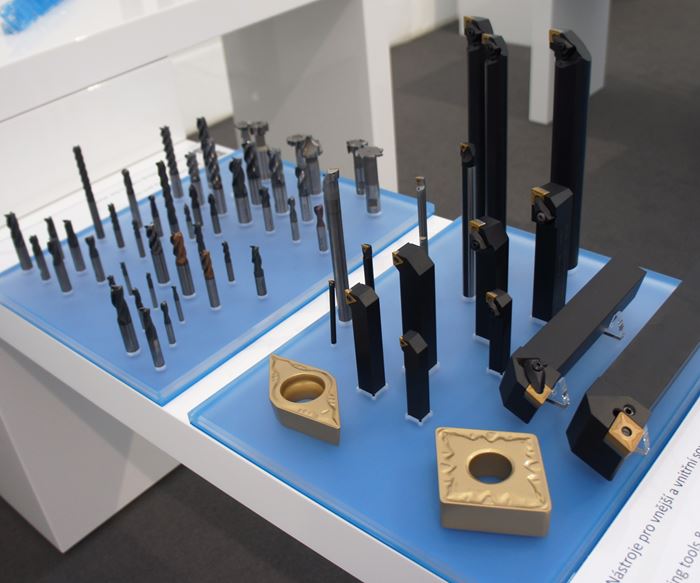

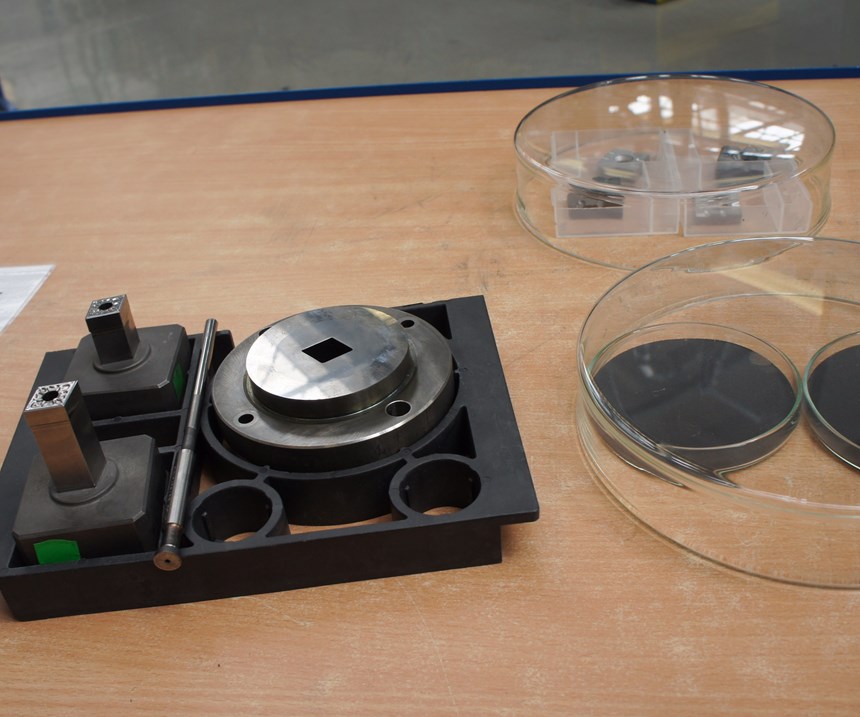

From there it was back to the indexable manufacturing plant, located in the nearby town of Sumperk, for a close-up look at how these tools are manufactured. Last but certainly not least was a view of various cutters proving their capabilities in action at the adjoining XP Center, a new research and training facility whose opening was among the primary reasons for hosting Cutting Days 2017. In roughly two weeks’ time (one for the main exhibition, plus a week dedicated to students), an estimated 2,000 people filed past these demonstrations as well as tabletop displays where Dormer-brand solid tools were arrayed right alongside Pramet indexables (the companies merged in 2014, an occasion that sparked the last “Cutting Days” event). Here are a few notable takeaways:

- Capacity is no burden to expanding Pramet into North America (or elsewhere). Illustrated in the picture gallery above, the plant currently produces about 450,000 inserts per week, but the process has capacity for far more. In fact, representatives reported that the primary barrier to producing as many as 850,000 inserts per week isn’t equipment, but personnel.

- The niche will be narrow for Pramet tooling in North America, at least until the brand is established. Narrow, that is, compared to Pramet’s broad reach in Europe. Founded in 1950 and acquired by Sandvik in 1999, the line targets industries and processes ranging from heavy machining to railway manufacturing and repair to material-preparation processes like scarfing and bar-peeling. However, the North American group’s focus is mostly on offerings like the new TNGX 10 inserts, visible in the picture gallery above. That is, cutting technology that is flexible enough to apply in multiple applications; incorporates design features that minimize cost per edge; can be introduced at competitive price points; or can otherwise help small- and medium-sized manufacturers to justify the cost of the indexable tooling they need to compete in an era when high-speed steel (HSS) and other options often aren’t enough.

- The sales and support structure is already in place. Despite the dominance of solid carbide round tools, ‘90s-era predictions about the “death” of HSS haven’t really played out. There’s still a “huge” market for this tooling, Mr. Norris says, a market “that will likely be there forever.” What’s more, the company’s roots in the solid and HSS markets are deep. As the sole suppliers of Dormer tooling as well as venerable brands Precision Twist Drill and Union Butterfield, Dormer Pramet distributors can offer a range of options and are well-positioned to know when a move to indexable carbide is warranted, he points out. Meanwhile, new prospects for the Pramet line will benefit from the company’s existing sales and support structure, which is headed by Mr. Norris as of May of this year. As for the company’s solid-tool offerings, Mr. Norris says continued additions to the product portfolio and investment in personnel will help ensure stability and build partners’ confidence moving forward.

Related Content

Custom PCD Tools Extend Shop’s Tool Life Upward of Ten Times

Adopting PCD tooling has extended FT Precision’s tool life from days to months — and the test drill is still going strong.

Read MoreTungaloy Drills, Milling Inserts Provide Enhanced Stability

Tungaloy has expanded its DrillForceMeister and TecMill lines with new drill bodies and milling inserts.

Read MoreKennametal's Expanded Tooling Portfolio Improves Performance

The company has launch eight new products that expand on and support existing platforms across multiple applications.

Read MoreDarex Adds End Mill Attachment to Drill Sharpener

This LEX600 end mill attachment enables users to sharpen the primary and secondary grind on the tips of two-, three- or four-fluted end mills up to 5/8".

Read MoreRead Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.jpg;maxWidth=300;quality=90)