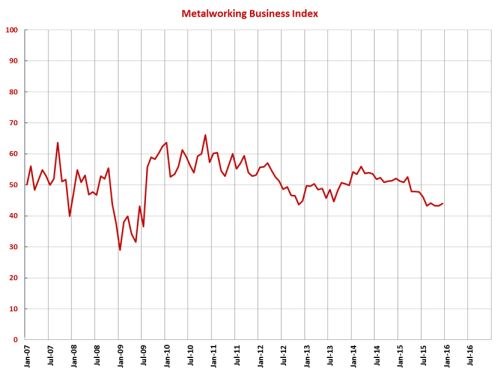

GBI: Metalworking for December 2015 – 44.0

Industry closes out the year at its highest level since July, a further indication that it may have reached a bottom.

Share

With a reading of 44.0, the Gardner Business Index showed that the metalworking industry in December reached virtually its highest level since July 2015. This index has been contracting at a stable rate since August, indicating that the industry may have reached a bottom in this cycle.

New orders contracted for the ninth month in a row, but they have trended up somewhat the previous five months. Production contracted for the sixth month in a row, although in November that contraction was at a slower rate. The production index has not improved as much as the new orders index during the last five months, bringing the two into better balance. The backlog index, however, contracted once again in December. Although this index improved noticeably from November, it still indicates falling capacity utilization in the months ahead. Employment contracted for the fifth straight month, although this index has improved since August. The export index contracted for the 21st month in a row, however, its rate of contraction has slowed significantly since August as the strengthening of the dollar has moderated. Supplier deliveries shortened for the third time in four months. Shorter delivery times indicate that suppliers aren’t as busy and, therefore, can more easily meet the demands of customers.

The material prices index was unchanged in December, staying at its lowest level since May 2009. Prices received have decreased since June, although they decreased at a much slower rate in December. Material prices were falling faster than prices received. Future business expectations have been steady, but somewhat low, the last four months of 2015.

Future capital spending plans have remained relatively stable for five months, and in December they were about 33 percent below the historical average. While planned spending was still contracting compared with one year earlier, the rate of contraction has decelerated since June 2015.

Related Content

-

Optimism Grows as Metalworking Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Metalworking Activity Trends Downward in May

Accelerated contraction and declines in business optimism span manufacturing segments. Odds are that broad-reaching economic factors are at play.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)