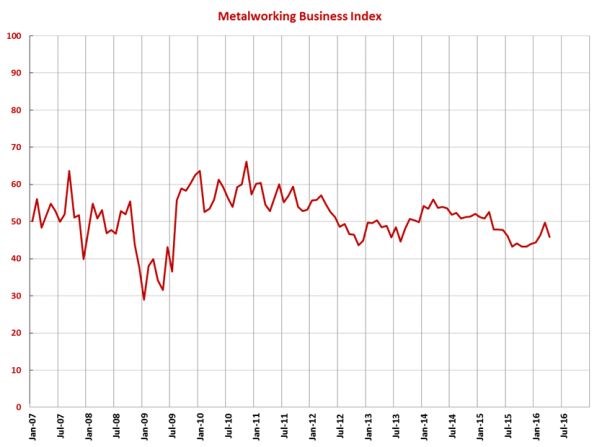

GBI: Metalworking April 2016 – 45.9

This month’s numbers indicate future capital spending could be on the rise.

Share

Takumi USA

Featured Content

View More

With a reading of 45.9, the Gardner Business Index showed that the metalworking industry contracted in April at a faster rate than the previous two months, ending a string of four months in which the index showed notable improvement.

New orders and production both fell back into contraction after one month of growth, with production taking the larger hit as it contracted at its fastest rate so far this year. The backlog index contracted at a faster rate than in March after improving sharply since November, and employment contracted at its fastest rate since August. The export index had been contracting at a slower rate since August, but that trend appeared to end in April. Supplier deliveries lengthened at a faster rate for the second month in a row.

Material prices increased at an accelerating rate for the second month in a row, although this rate of increase was still the slowest in nearly six years. Prices received have decreased since June, but their rate of decrease was the slowest since September. Future business expectations dropped, but were still among the highest since August.

The Southeast region continued to be quite strong, having grown three of the first four months of this year, and it was the strongest region in each of those months. March and April were the two best months for this region since the survey began in December 2011. Every other region contracted in April, however. The Northeast contracted after two months of growth, the North Central-West and North Central-East have contracted most of the last year, and the West has contracted eight of the last nine months. The South Central recorded its lowest index, as the oil and gas industry continued to struggle.

While they are still well below the historical average, future capital spending plans were higher than $700,000 per plant for the first time since February 2015. These spending plans increased 29.4 percent in April, the first increase over one year earlier since September 2014. This could be the beginning of increased in capital spending in the metalworking industry.

Related Content

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity Trends Downward in May

Accelerated contraction and declines in business optimism span manufacturing segments. Odds are that broad-reaching economic factors are at play.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)