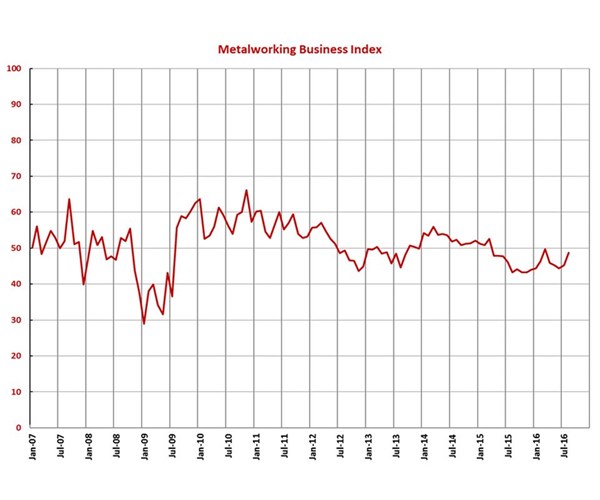

Gardner Business Index: Metalworking August 2016 – 48.7

Contraction continues to slow as index reaches its second highest level in almost a year and a half.

Share

With a reading of 48.7, the Gardner Business Index showed that the metalworking industry contracted in August at a significantly slower rate than in July and reached its second highest level since March 2015, which was the last time the index showed growth for the industry.

The new orders subindex jumped substantially for the month, growing for just the second time since March 2015. The production index also increased sharply, growing for just the third time since April 2015 but reaching its highest level since March of that year. While backlogs continued to contract, as they have since March 2014, this subindex has improved considerably since November 2015. Employment contracted for the 13th month in a row, but the rate of contraction was slower in August. Exports have contracted since March 2014. Supplier deliveries have lengthened since March of this year, but the rate of lengthening slowed noticeably in August.

Material prices have increased since March, and the rate of increase in each of the months since has been faster than at any time since late 2014. Prices received decreased at a minimal rate in August, having done so at a slower and slower rate since November 2015. Future business expectations improved in August for the second month in a row. Other than a spike in March, this subindex reached its highest level since August 2015.

Custom processors and plastic/rubber product manufacturers both posted an index above 63.0 in August. Presumably, if these facilities are cutting metal, it’s to make dies and molds. Off-road/construction machinery and industrial motors/hydraulics/mechanical components both grew in August, ending at least five months of contraction. Aerospace was also strong, growing for the fifth time in the previous six months.

While they are still below the historical average, future capital spending plans reached their highest level since November 2014. Compared with one year earlier, future spending plans increased for the fifth month in a row, and in three of those five months they increased more than 23 percent. This is a positive sign for capital spending in 2017.

Related Content

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

.JPG;width=70;height=70;mode=crop)