Four Factors Keeping Aerospace in Flight

The Gardner Business Index indicates that the aerospace industry is still early in its growth cycle, justifying market optimism.

Share

In the last two reviews of the aerospace industry in 2018, Gardner Intelligence covered the macroeconomic picture of the aerospace market by reviewing the growth of the passenger and freight markets. This was done by examining the level of air services consumed in recent years and months. As a result, our coverage of the market primarily addressed the demand for aviation services, but the picture of any market is incomplete without also examining the supply side factors.

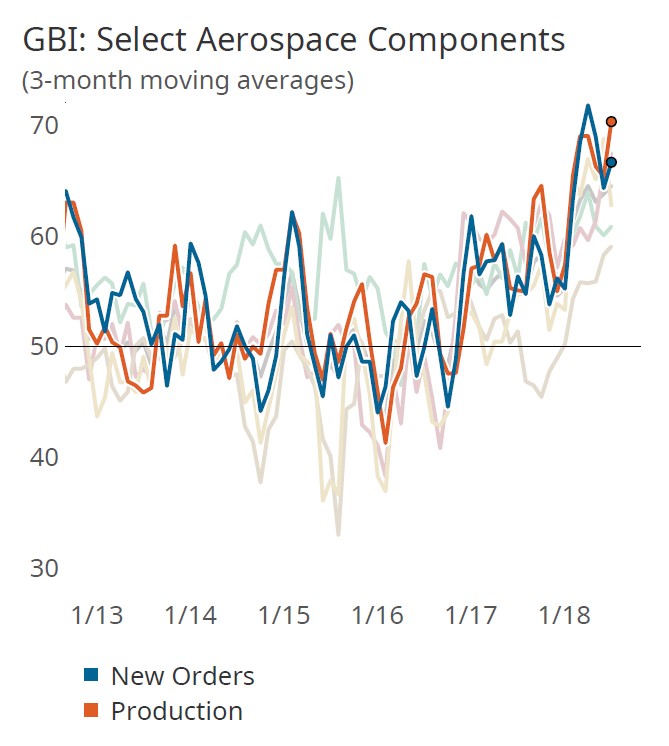

The Gardner Business Index (GBI) data is one of many sources that peers into the dynamics of the supply side of the aerospace market. From this data, we find several insights that may be hard to find elsewhere:

- Exports Are Growing: The GBI: Aerospace data indicate a consistently expanding rate of exported aerospace products through July 2018. Export growth since the second quarter of 2016 generally has been very strong, setting four all-time high readings in the first seven months of 2018.

- Early Indicators Look Promising: Gardner Intelligence considers the new orders and production components of its business index to be early-phase indicators of a growing market, contrasting with indicators like supplier deliveries and employment, which indicate that a burst in market activity is maturing. As of mid-2018, aerospace new orders and production continued to be the dominant drivers of the index, suggesting that the growth phase of the aerospace manufacturing business cycle is still relatively young.

- Business Sentiment Reaches New Heights: For the 12-month period ending July 2018, business sentiment reported by aerospace manufacturers has never been higher. Not only have business sentiment readings broken the one-month record high set in 2012, but it has far and away exceeded the average of any other 12-month period in the index’s history.

- Manufacturers Pass Price Increases: Of the many business factors tracked by Gardner, the ability of aerospace manufacturers to pass price increases along to their customers is one of the strongest indicators of growing market demand. In the first half of 2018, aerospace manufacturers have reported one of the longest and strongest periods for being able to pass higher prices along to their customers.

The current insights provided by Gardner’s data support the optimistic near-term outlook of the industry based on Wall Street’s near-term financial projections of 124 aerospace and aviation-related companies traded on major U.S. exchanges. The aggregated results of their projections suggest strong growth in both earnings and revenues. According to Gardner’s calculations, year-over-year revenue growth during the remaining months of 2018 is expected to average 9 percent.

Related Content

-

Forkardt Hardinge Swiss Workholding Provides Reliable, Consistent Performance

The company’s Swiss collets are designed to securely hold parts without marring surfaces, minimizing vibration to ensure smoother machining, enhanced accuracy and extended tool life.

-

Rego-Fix Appoints New Global Aerospace Specialist

Sherman D’Souza will provide global customers with access to Rego-Fix research, development and technical support teams to create and supply toolholding solutions.

-

Arch Cutting Tools Acquires Custom Carbide Cutter Inc.

The acquisition adds Custom Carbide Cutter’s experience with specialty carbide micro tools and high-performance burrs to Arch Cutting Tool’s portfolio.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)