Five Traits Define Top Performers in Five-Axis Machining

Benchmarking data reveal how elite manufacturers make the most of more axes of motion.

Share

Hwacheon Machinery America, Inc.

Featured Content

View More

Takumi USA

Featured Content

View More

Autodesk, Inc.

Featured Content

View MoreGenerally, five-axis machining is not worth doing unless it is done well.

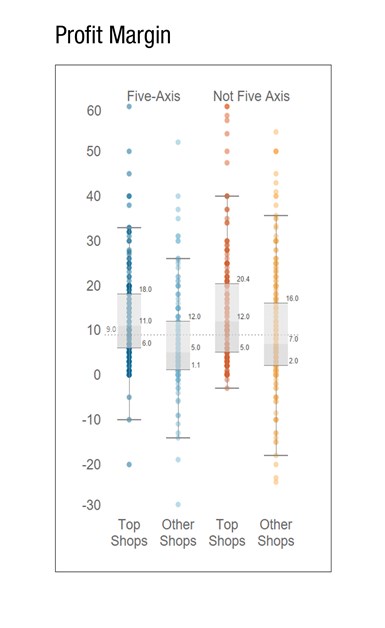

This is according to analysis of data from Modern Machine Shop’s Top Shops benchmarking program, which uses answers to detailed survey questions to rate and rank the performance of CNC machining businesses throughout North America. The highest performers — the Top Shops — score in the top 20 percent. As one might expect, these shops tend to be the most profitable, reporting roughly double the profit margin of non-Top Shops. Less intuitive is the fact that among the other 80 percent of survey-takers, shops with five-axis machines have lower profit margins than those without them.

In short, five-axis machining capability does not make a shop a Top Shop. Rather, it takes a Top Shop to make the most of five-axis machining, to the extent that lower-performing shops might be better off without it.

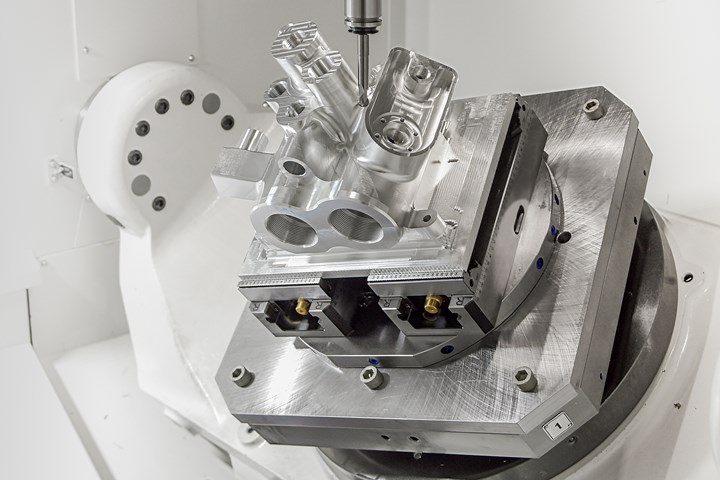

A 6061 aluminum pump housing undergoes five-axis machining operations on a Variaxis i800 Neo from Mazak. The company’s Mazatrol programming system reportedly allowed easy offsetting to control tight tolerances on the ports, holes and threads, and the machine’s two-pallet changer is just one of a variety of automation options.

The reason why is simple: Five-axis machining is expensive. The benchmarking data show that overall, five-axis shops (both Top Shops and other shops) spend roughly double the amount of non-five-axis shops on tooling, materials, people and capital equipment. Those that can generate enough revenue to make up for the additional costs have much in common. Based on our analysis of the data, here are the leading five traits of shops that do five-axis well:

Shops that use five-axis machining but do not qualify as Top Shops tend to be less profitable than others. The gray box represents the middle 50 percent of values (profit margin percentages). Values outside the gray (excluding the outliers outside the horizontal marks) are in the upper and lower quartiles, respectively. The median value divides light and dark gray.

1. They machine more parts. As a whole, the best five-axis shops machine more total parts — more pieces per year across more total SKUs. As a result, five-axis Top Shops report profit margins that are generally in-line with those reported by non-five-axis Top Shops and greater than those reported by the rest of the pack (particularly five-axis shops that are not Top Shops).

More surprisingly, five-axis Top Shops produce more without reporting greater machining capacity or higher spindle utilization than other shops. Scrap, rework, and delivery rates are not much different, either. Five-axis shops also tend to have longer lead times than non-five-axis shops. Given these realities, how are five-axis Top Shops able to machine more parts than their peers?

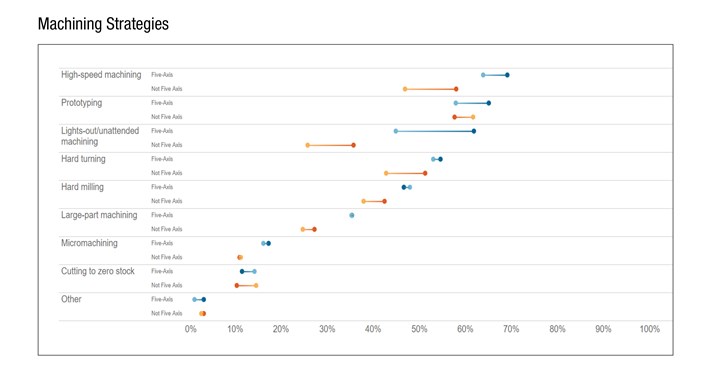

2. They make machines count. Five-axis Top Shops tend to run machines for 25 percent more hours compared to others, and more of those hours are lights-out. As a result, it is no surprise that this elite group reports 50-percent lower setup times than non-top-shop five-axis shops. Notably, setup times are roughly equal to those of non-five-axis Top Shops, despite the fact that five-axis work generally requires more complex setups. Speedy setups boost revenue per machine by facilitating the long, lights-out machining runs that characterize top five-axis performers.

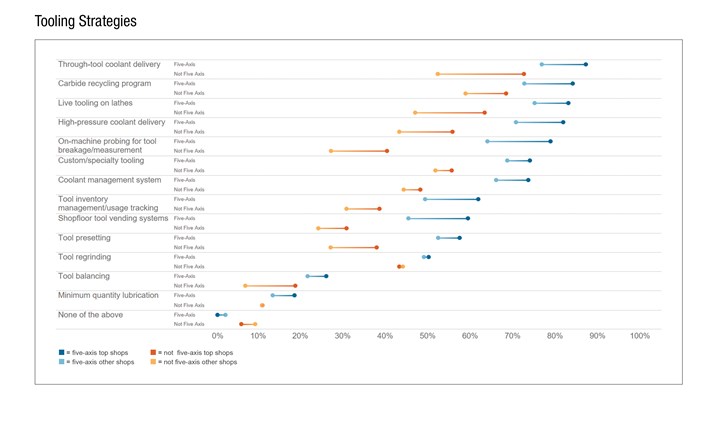

The data also show willingness to invest beyond the essentials in the name of a more efficient process and higher gross sales per machine. For example, on-machine probing is the biggest difference in the benchmarking data between five-axis Top Shops and all other survey-takers. Members of this elite group are also more likely to use all or most of the workholding strategies asked about in the survey, including multiple-workpiece and quick-change fixtures; pallet changers and tombstones; and magnetic, hydraulic and pnuematic clamping. Five-axis Top Shops are far more likely to use tool inventory management systems, particularly shop-floor vending units.

3. They make people count. Gross sales per machine is not the only driver of five-axis Top Shops’ higher return on assets (ROA). This group also reports higher gross sales per employee. In particular, they pay wages commensurate with the skills of the shopfloor personnel that put tooling and workholding into action. For instance, five-axis Top Shops wages for setup personnel are higher than all other shops relative to programmer/operator wages. Essentially, they spend more on setup personnel relative to the other categories.

Higher gross sales per machine and higher gross sales per employee boost ROA to levels above that of other five-axis shops as well as other (non-five-axis) Top Shops. Income and profit margins climb higher, and five-axis machining becomes more affordable. On the other end of the spectrum, five-axis shops that are not Top Shops tend to report the lowest gross sales per machine and gross sales per employee of the four groups. These shops tend to be the least profitable of all survey-takers because they are not doing five-axis machining well enough to make up for the added cost.

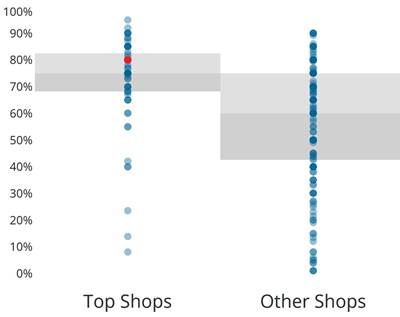

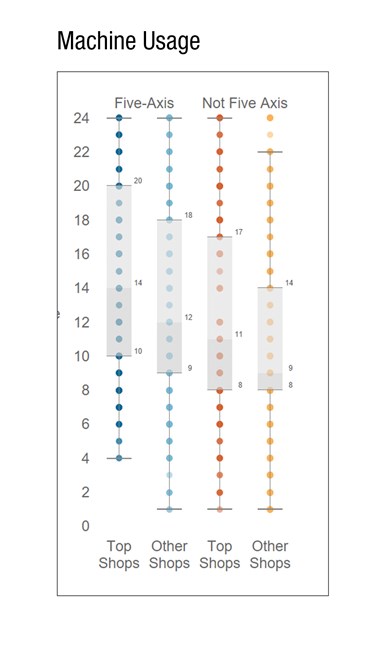

Top five-axis shops run more hours and prioritize lights-out machining. Here, the gray box represents the middle 50 percent of values (hours of machine runtime). Values outside the gray (excluding the outliers outside the horizontal marks) are in the upper and lower quartiles, respectively. The median value divides light and dark gray.

4. They think beyond machining. Five-axis Top Shops have a greater tendency to employ enterprise resource planning (ERP) or other software that helps to manage the use of more complicated five-axis processes and to put those processes in context. Capability matters little without work to feed the machines, so five-axis Top Shops are also more likely to use job-estimating software to increase the number and accuracy of quotes.

However, the data also show that more accurate quoting is not enough to account for generally lower quote-to-book ratios and generally higher numbers of customers among five-axis Top Shops. Although all five-axis shops (Top Shops and other shops) are more likely to highly value sales and marketing, this trend is more pronounced among the Top Shops. Specifically, they cite skilled salespeople; outreach and messaging ranging from print advertising to social media to customer tours; and membership in trade associations and other business groups.

Successful five-axis shops are also likely to employ higher-level strategies to maintain a niche in the supply chain and ingratiate themselves with more customers. Three are particularly popular: gaining access to customer forecasts, sharing forecasts with suppliers, and offering design for manufacturability (DFM) services. Forecasts help top five-axis shops ensure all materials for a job are on-hand when needed, while DFM can make parts easier to cost-effectively machine.

5. They are never satisfied. Five-axis Top Shops’ overall greater willingness to put time and money into formalized improvement methodologies indicates that they are never satisfied with the status quo. As a whole, this elite group is more likely to adopt lean manufacturing practices such as 5S and Kaizen, as well as Six Sigma, theory of constraints and various other methodologies. “And” is the key word, because five-axis Top Shops are particularly likely to check almost every box in the survey question about specific improvement strategies. These strategies likely account for much of the reason why Top Shops can leverage shopfloor technology and skills to achieve longer lights-out runs that produce more parts and SKUs.

Non-top-shops trying to make five-axis work need not despair. Benchmarking is, by nature, an exercise in evaluating one’s own process in the interest of getting better, and it is no stretch to call the Top Shops survey a tool for continuous improvement. In a sense, they have already adopted the right mindset by taking the survey, and contributing to the critical mass of data that is required to yield insights like the ones covered in this article.

Related Content

Investing in Automation, Five-Axis to Increase Production Capacity

To meet an increase in demand, this shop invested heavily in automation solutions and five-axis machines to ramp up its production capabilities.

Read More6 Machine Shop Essentials to Stay Competitive

If you want to streamline production and be competitive in the industry, you will need far more than a standard three-axis CNC mill or two-axis CNC lathe and a few measuring tools.

Read MoreInside a CNC-Machined Gothic Monastery in Wyoming

An inside look into the Carmelite Monks of Wyoming, who are combining centuries-old Gothic architectural principles with modern CNC machining to build a monastery in the mountains of Wyoming.

Read MoreCNC Machine Shop Honored for Automation, Machine Monitoring

From cobots to machine monitoring, this Top Shop honoree shows that machining technology is about more than the machine tool.

Read MoreRead Next

Benchmarking Becomes a Call to Action

A means of measuring performance evolves into a tool for catalyzing change as Modern Machine Shop’s Top Shops program matures.

Read MoreStandardization Leans the Way to High-Mix Automation

An increasingly digitalized, lean manufacturing process begins with a common selection of cutting tools and five-axis machining fixtures.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.jpg;maxWidth=300;quality=90)