February Metalworking Index and the Impact of the Coronavirus

As efforts to counter COVID-19 affect the global supply chain, Gardner Intelligence is carefully tracking their potential impact on the industry.

Share

Autodesk, Inc.

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

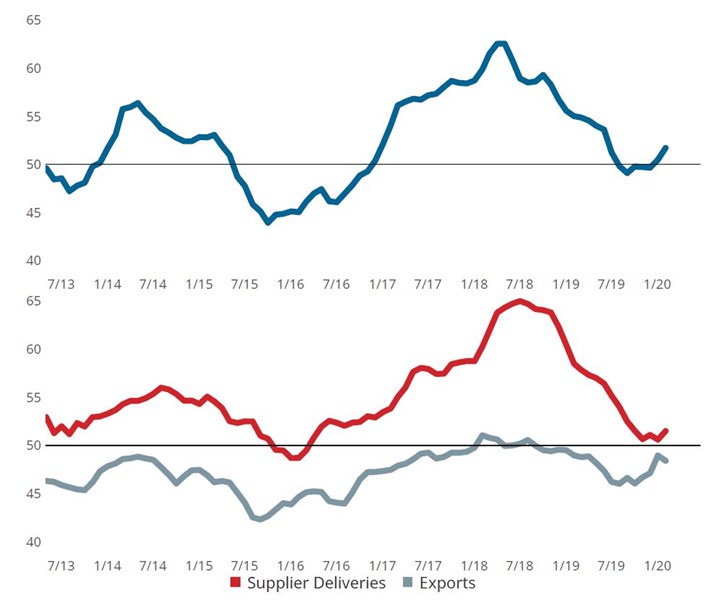

The Gardner Business Index (GBI): Metalworking held onto January’s expansionary gain with a repeat 50.2 reading in February. Gardner Intelligence reviewed the six components that make up the Index and found that the reading of 50.2 was supported by a quickening expansion in production, supplier deliveries, new orders and employment. The index was hindered from making further advances by contracting activity in exports and backlogs.

Gardner Intelligence is also carefully tracking the potential adverse effects that COVID-19, widely known as the coronavirus, is expected to have on the GBI in the coming months. The efforts of Asian governments in January and February — and a widening number of countries since then — to combat the spread of the coronavirus are having a detrimental impact on the world’s supply chain as quarantine measures affect workers, companies and cities. In the short term, these necessary measures will nevertheless restrict the normal flow of upstream and sub-component goods, which are needed for the proper functioning of the manufacturing sector.

The Metalworking Index (as seen in the top blue line) reported a second month of expansionary activity in February. The latest reading was supported by expanding production, supplier delivery and new orders activity. Gardner Intelligence expects that most (if not all) of its indicators will be subjected to shocks from the ripple effects of the coronavirus. The fact that the virus originated in Asia suggests that American manufacturers in the immediate future should pay particular attention to their supply chains and volatility in export orders (as marked by the red and gray lines in the bottom graph).

The Metalworking Index is unique in its ability to measure just the metalworking manufacturing industry on a monthly basis. This means that the Index will help us to quantify both the negative impact from the virus at present along with the timing and strength of manufacturing’s eventual recovery from it.

At this time, it is particularly important for our readers to complete the GBI Metalworking survey sent to them each month. Your participation will enable the best and most accurate reporting of the true magnitude and duration of COVID-19’s impact. That reporting will enable you and your peers to make informed, data-driven decisions at a time when there may be a strong temptation to make impulsive gut decisions that could make a difficult situation worse.

Related Content

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

-

Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

-

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=150)

.png;maxWidth=300;quality=90)