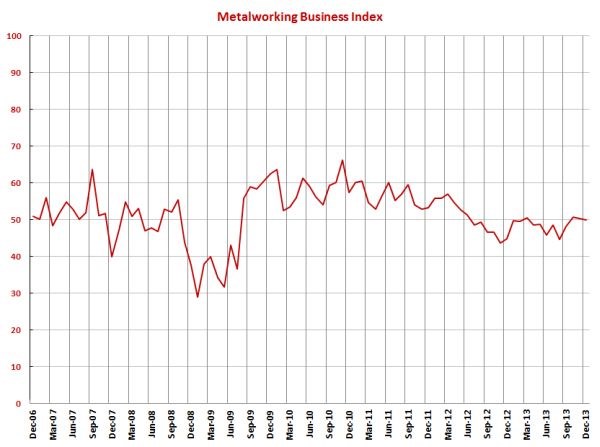

December MBI at 49.9 – Industry Conditions Unchanged

With a reading of 49.9, Gardner’s metalworking business index (MBI) showed that conditions in the metalworking industry were unchanged from November. This comes after two months of modest growth.

Share

With a reading of 49.9, Gardner’s metalworking business index (MBI) showed that conditions in the metalworking industry were unchanged from November. This comes after two months of modest growth. While the index was essentially flat in December 2013, it was 11.4 percent higher compared to December 2012. This was the fourth month in a row that the index was higher than it was one year ago, and it was the second consecutive month that the rate of growth was more than 10 percent. So, even though the index is not indicating strong growth, it is indicating that the industry has improved significantly compared to a year ago.

The most significant reason for the slight decline in the index was the slower growth in production. The production subindex recorded the largest change of the six subindices that are used to calculate the overall index. The most likely reason for the slower growth in production was the Christmas and New Year’s holidays fell during the middle of the week, which likely led plants to close for longer than normal. Otherwise, it would have been unlikely for production to slow with new orders continuing to grow faster. Backlogs continued to contract at a similar rate. However, the trend in backlogs indicates that capacity utilization should increase significantly in 2014. Employment growth slowed in December. Exports contracted at their slowest rate since April 2012. Supplier deliveries continued to lengthen at a decent pace, which indicates relatively good conditions throughout the supply chain.

Material prices have increased at a relatively constant rate since April 2013. Prices received were largely unchanged throughout 2013, but in December they increased at their fastest rate since February 2013. Future business expectations improved notably since August 2013, reaching their highest level since April 2012.

Plants with more than 50 employees grew for at least three months, depending on how large the facility is. Plants with fewer than 50 employees continued to contract. However, the rate of contraction at smaller facilities continued to slow down.

The West South Central region grew at the fastest rate in December. It grew faster the previous two months. New England grew at the next fastest rate, and it grew three of the previous four months. The South Atlantic region grew for three straight months while the Mountain region grew five of the last six months. The East North Central, West North Central, and Pacific contracted in December after growing in November. The Middle Atlantic and East South Central remained stuck in a prolonged contraction.

Future capital spending plans grew month-over-month for the fourth consecutive month. The annual rate of change grew faster the last two months, which is a very positive for capital equipment spending in 2014.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)