Chinese Competition In Die/Mold

For several years, the buzz among American moldmakers has included the persistent complaint that competition from China and other Asian nations is eroding business conditions.

Share

For several years, the buzz among American moldmakers has included the persistent complaint that competition from China and other Asian nations is eroding business conditions. While a number of U.S. shops have closed their doors during the past decade, the survivors rely increasingly on technologically driven process improvements to maintain profitability. Because competition forces successful American die/mold shops to employ the best available machinery and techniques, the assumption persists that a technological advantage will continue to counteract the effect of a substantial U.S.-Asia wage gap. Reinforcing this impression, many metalworking professionals in the United States believe that Chinese machine shops are primitive operations. This encourages the view that Chinese competitors lack the wherewithal to compete in high-end markets for complex, precision tooling.

Assuming the role of a latter-day Paul Revere, Tom Siwek, CEO and co-chairman of ProTech Plastics (West Chicago, Illinois), is puncturing these illusions with some intriguing presentations delivered to metalworking audiences. Mr. Siwek recently visited die/mold shops in southern China (including Hong Kong), Singapore and Taiwan to analyze the state of Asian moldmaking. His findings build a chilling case that—barring any substantial changes in current American policies or practices—survival of the nation's die/mold industry may be in serious jeopardy.

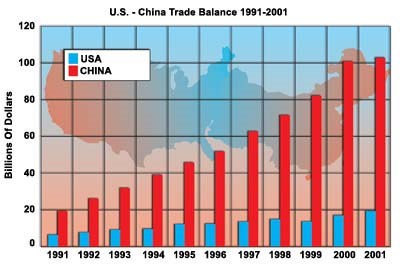

During the 1990s, China emerged as the chief competitor to American die/mold shops, as well as to other U.S. manufacturers. According to U.S. Census Bureau figures, the U.S. trade deficit with China has increased eightfold since 1990. In 2001, the United States accrued an overall trade deficit with China of more than $83 billion—even larger than the $69 billion U.S. trade deficit with Japan. The current value of Chinese imports flowing into the U.S. represents five to six times the value of American goods and services exported to China.

While the scarcity of trained metalworkers is frequently cited as a principal cause for America's competitive disadvantage, these statistics indicate that a disproportionate cash flow between the two countries represents another key factor. In this vein, U.S. die/mold shops seem to be swimming against political currents both at home and abroad. On one hand, the Chinese government has liberalized regulations on foreign-owned companies, thus making it more attractive for large manufacturers of consumer products to locate plants in the country. On the other hand, both political parties in Washington continue to aggressively promote expansion of U.S. trade and investment in China, thus extending a spiraling trade deficit.

As long as Chinese suppliers were unable to meet international quality standards or to satisfy delivery schedules for U.S.-based customers, American die/mold shops enjoyed a substantial measure of protection. But in addition to discovering that Chinese die/mold shops are better equipped than most Americans believe, Mr. Siwek found that these shops now possess the capabilities to meet or exceed the performance of many shops in the United States.

Mr. Siwek made this comparison by soliciting competitive quotes from an American and a Chinese moldmaker to provide tooling for his firm's injection molding operations. He found that the Chinese supplier provided better quality and customer service at a substantially lower cost than the U.S. shop. While the U.S. shop was 1 week late in making delivery, for example, the Chinese supplier met ProTech's requested delivery date. Furthermore, the Chinese supplier had no problem meeting Mr. Siwek's material specifications for tooling used in high-volume, continuous production.

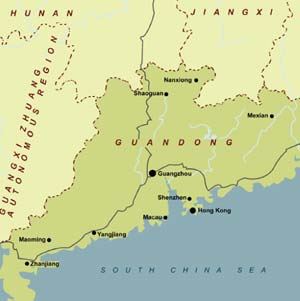

This experience corresponds to the conditions Mr. Siwek witnessed when he visited machine shops in Southern China. A substantial portion of China's export metalworking industry is based in the Pearl River delta area north of Hong Kong. Much of this activity is located in the fast-growing city of Shenzhen.

"All of the shops we visited had been built recently and used up-to-date equipment," says Mr. Siwek. "The average shop employs 100 to 350 machinists. The larger shops may have as many as 1,000 employees and produce 200 to 500 molds per year. The quality we saw is second to none, and the Chinese are familiar with all of the modern mold components and systems."

The Chinese have been able to attain this level of performance primarily because of some fundamental changes in the communist government's economic policies. These changes began in 1978, when former Premier Deng Xiaoping committed the country to a new economic course designed to open up China to foreign trade and investment. This reflected the government's desire to move China's economy from a sluggish, Soviet-style model to a more market-oriented system.

To pursue this goal, local government officials and managers of industrial plants were granted previously unknown autonomy to develop a variety of free enterprise ventures. Despite some liberalization of economic rules, however, the Communist Party of China (CPC) has preserved many state-run enterprises—and the CPC retains strict control of the country's overall development. Therefore, China's limited brand of capitalism has not been accompanied by any corresponding gains in individual liberty or human rights.

The Chinese regime recognized, however, that the country could not compete globally unless it upgraded manufacturing quality and adopted modern marketing practices. To this end, China initiated a nationwide program known as the quality advantage strategy in 1991. This program has now been extended to every sector of Chinese industry. The country has also enlisted the services of mass-marketing consultants from the United States and other nations to develop strong international brand identities for Chinese products. In pursuit of these economic goals, the Chinese have shown an unexpected willingness to bend their communistic ideology.

A major thrust of this new approach involves upgrading Chinese manufacturing practices to conform to international standards. In 1991, the government began to encourage manufacturing plants to pursue ISO 9000 certification. By June 2000, Chinese officials reported that more than 27,000 enterprises had been certified. At the same time that quality has been improved, the Chinese government has cracked down harshly on producers of substandard or defective products.

Yao Sufeng is vice-leader of China's Development Bureau. Regarding the country's recent experience, he says, "Before 1990, serious problems affected the quality of our export commodities. At that time, high-tech and high-value exports accounted for only a small proportion of our total trade. Additionally, quality control was weak. As a result, raising the quality of exports became the key factor determining whether our export trade could continue to expand."

Because China remains essentially a closed society, it's not possible to independently verify statistics provided by the government. But according to China's National Bureau of Statistics, the country currently has more than 8,000 metalworking enterprises. The Bureau also estimates that current annual sales in China's metalworking industry total approximately $23.5 billion.

In addition to Asia's rapid technological development, the competitive challenge faced by American shops is heightened by the region's substantially lower labor costs and well-organized training programs. "Technical schools in Hong Kong and Singapore are currently graduating substantial numbers of fully trained, young metalworkers," says Mr. Siwek. "When we visited the Institute of Technology and Engineering (ITE) in Singapore, we found a modern, 40,000-square-foot training facility equipped with everything from hand-crank mills to optical grinders and a variety of CNC machining centers."

In a rigorous and uninterrupted 3-year program, ITE turns teenage students into competent moldmakers. "When they graduate, these people are ready to cut metal," says Mr. Siwek. "They're capable of designing and building molds, and they can operate all related machine tools." According to Mr. Siwek, ITE has 250 to 300 teenage students. The school's curriculum begins with a foundation of classroom studies that includes a strong emphasis in computer science. Students then begin hands-on training with simple, manually operated machines, working their way up to the most sophisticated CNC equipment.

At the conclusion of a recent presentation in Michigan, Mr. Siwek's report left a large group of American moldmakers in a state of stunned silence. Indeed, a troubling sense of inevitability pervades many remarks made by American metalworking professionals when discussing Asian competition. Although the problems of recruiting and training metalworkers are well-publicized in the United States, perhaps not enough attention has been given to the larger problems facing American machine shops.

First among these is the fact that American metalworkers function within a dramatically different social, political and economic system than the one that prevails in China. China has a massive oversupply of labor that is caused by the migration of a huge number of poor people from rural areas to the country's fast-growing cities. The majority of these migrant workers are women who typically are paid only $40 to $60 per month. In Chinese machine shops, this equates to an unlimited supply of extremely cheap labor for supporting tasks such as polishing, assembly and packaging.

Although China's machine shops are surprisingly well-equipped, employees have very few workplace rights compared to their U.S. counterparts. Regardless of their work ethic, training or availability, therefore, American workers clearly cannot compete on fair terms with China's increasingly skilled and well-equipped workforce.

Furthermore, globalization of manufacturing creates a fundamental conflict between the objectives of multinational manufacturers and the American machine shops that traditionally have served as their suppliers. Supported by America's open trade policies and more favorable business conditions in China, consumer product manufacturers now have strong incentives to locate plants in places such as the Pearl River delta, where many metalworking shops are capable of supplying their needs.

For America's die/mold industry to remain viable in the face of this competition, it seems evident that the United States must pursue a coordinated national strategy. To succeed in this effort, many metalworking professionals now believe that the federal government's active partnership is essential. The complexity of this challenge dictates that America's political and business leaders recognize the crucial role played by manufacturing in national power. For die/mold shops and other domestic manufacturers to survive and prosper, we must address the foreign policy problem of unbalanced trade in addition to issues affecting the development of America's workforce.

Related Content

Grob Systems Inc. to Host Tech Event With Industry Partners

The 5-Axis Live technology event will highlight new machining strategies for optimizing the production of complex medical, aerospace and mold/die parts.

Read MoreLyndex-Nikken Collets Enable Accurate Small-Diameter Cutting

The MMC Mini-Mini collet chuck is well suited for high-speed machining applications where clearance is needed, such as die mold, aerospace and medical parts.

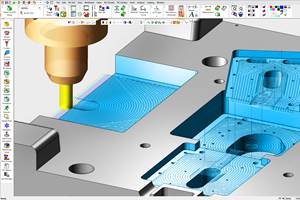

Read MoreCimatron's Updated CAD/CAM Software Streamlines Mold Design

Eastec 2023: Cimatron V16 includes a clean new user interface and increased automation for faster mold design, electrode creation and NC programming.

Read MoreHow to Achieve Unmatched Accuracy in Very Large Workpieces

Dynamic Tool Corp. purchases two bridge-style double-column CNCs to increase the cutting envelope and maintain 5-micron cutting accuracy in the long term.

Read MoreRead Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.jpg;maxWidth=300;quality=90)