Business Activity Higher for Shops Using Advanced Manufacturing Equipment

The Metalworking Business Index has registered consistent expansion in recent months, with shops that use advanced equipment like five-axis reporting accelerating expansion.

Share

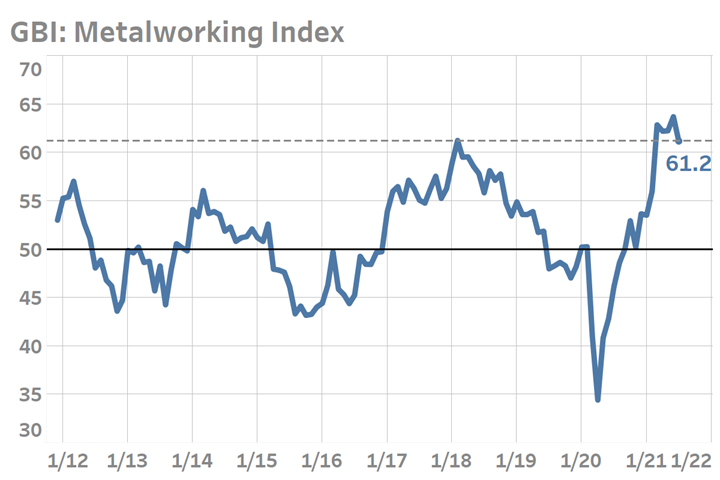

In recent months, the Gardner Intelligence Business Index: Metalworking, commonly known as the “Metalworking Index,” has reported consistent readings in the low 60s. Starting in 4Q2020, the Index crossed above the ‘50’ line, which delineates between contracting and expanding business activity. It then quickly surged to an all-time high of 63.7 in June. Between March and July of 2021, the Index has remained in a narrow range, generally indicating consistent month-to-month expansionary growth. Impressively, the pace of growth over the last five months has exceeded the peak expansion pace set during the best month of the prior business cycle back in 2018.

In a testament to the strength of the metalworking industry, between March and July of 2021, the Metalworking Index expanded more quickly than during the peak month of its prior business cycle.

The Metalworking Index represents a very broad measure of manufacturing business activity, covering all types from metalworking less precision machining. The Index is agnostic to company size, geography and end-markets served. Importantly, it also is agnostic to the metalworking manufacturing techniques utilized, responses from manufacturers using old and or simple equipment are coupled with those using the latest in high-tech metalworking manufacturing operations.

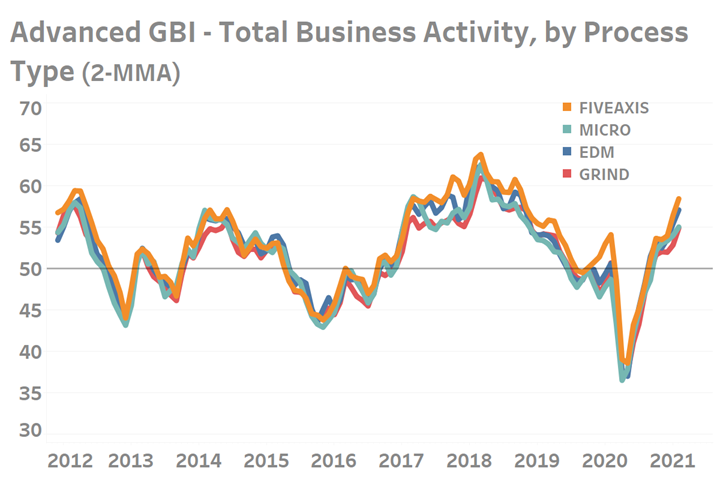

In order to assess the impact of technology on business activity, Gardner therefore provides an “advanced” version of the GBI which monitors business activity by manufacturing technology deployed. It is here that we see a significant difference between Gardner’s Metalworking Index, which measures overall activity in the metalworking space, and those employing specialized metalworking manufacturing operations.

Shops employing advanced metalworking manufacturing operations are reporting a greater acceleration in business conditions as compared to all types of metalworking shops.

In the year-to-July period — July marks the latest available data as of this publication — shops deploying advanced manufacturing techniques, and in particular five-axis and EDM operations, have reported an increasing acceleration of their business activity, besting the broader Metalworking Index’s performance. The latest trends may signal that we will see a repeat in business cycle behavior from 2018. During that time, business activity expanded faster for shops deploying five-axis and micro-machining with readings in the mid-60s while overall metalworking activity scored in the low 60s. This difference in scores during 2018 indicated that a greater proportion of shops utilizing these operations experienced more upward momentum in new orders, production, hiring and/or backlog activity.

Looking for more economic insights? Gardner Intelligence, the economic arm of Modern Machine Shop’s parent company, provides industry insights as well as custom reports. Check out Gardner Intelligence’s resources.

.jpg;width=70;height=70;mode=crop)