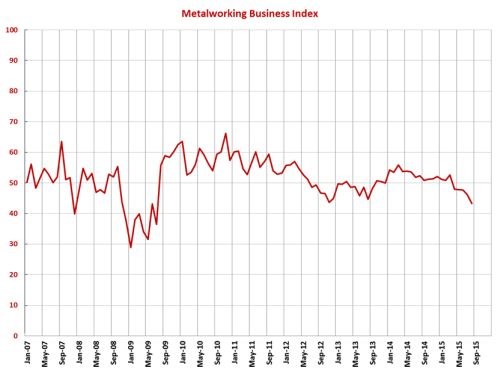

August MBI Index at 43.3 – Lowest Index since July 2009

With a reading of 43.3, Gardner’s Metalworking Business Index showed that the industry contracted in August for the fifth month in a row to its lowest level since July 2009, when the index was 36.5.

Share

With a reading of 43.3, Gardner’s Metalworking Business Index showed that the industry contracted in August for the fifth month in a row to its lowest level since July 2009, when the index was 36.5. The rate of contraction accelerated significantly in July and August. Compared with one year earlier, the index has contracted for eight consecutive months, and August’s rate of contraction was the fastest of those eight months.

New orders also contracted for the fifth month in a row, and, like the total index, their rate of contraction accelerated in July and August, taking this subindex to its lowest level since July 2009. Production contracted for the second month in a row and the third time in four months, although the rate of contraction was significantly slower than that of new orders. The backlog index, therefore, continued to contract at an accelerating rate, falling in August to its lowest level in two years. The decline in this subindex has been fairly steady since March 2014, indicating that capacity utilization will fall heading into 2016. Employment fell for the first time since August 2013, and its drop from July was quite significant. Because of the rapid appreciation of the dollar over the last year, exports also contracted at their fastest rate since July 2009. Meanwhile, supplier deliveries continued to lengthen at a moderate rate similar to the previous three months.

Material prices increased at a notably slower rate in August, and, in fact, their index fell to its lowest level since November 2009 when it was 50.0. Prices received by metalworking facilities contracted for the fourth time in five months, however, this index has been just below 50.0 in each of these months. Future business expectations weakened slightly compare with the previous three months and have been below average for five straight months. They are at their lowest level since September 2013.

The one bright spot is that future capital spending plans reached their highest level since this past March, although they were still about 33 percent below their average since December 2006.

For more economic news, visit Gardner Business Media's Economic News Blog.

Related Content

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

.JPG;width=70;height=70;mode=crop)