Another Reason Machine Shop Ownership is Changing: Cheap Money

Once largely overlooked by investors, manufacturing businesses now present potentially attractive destinations for dollars seeking returns — and dollars are more available than ever before.

Share

In an earlier post, Peter Zelinski cited five factors contributing to the increased activity we have seen in mergers, acquisitions and other ownership changes for machines shops. His list includes demographics; the greater discipline and systemization of shops; and changing attitudes about manufacturing. I wholeheartedly agree with each of these factors. However, I believe there is another factor that overarches all the factors Peter writes about in his post. That overarching factor is cheap money.

Since we use money to buy goods and services, we typically don’t think of money as being cheap or expensive. Yet, money is a good too. And like other goods, the “price” of money is affected by the laws of supply and demand.

All other things being equal, an increase in the supply of money leads to a decrease in the price of money. So, what has happened to the supply of money? It has gone up — a lot!

The chart above shows base money, essentially the physical money we carry around in our wallet, of the United States. Note that the scale in is in millions of dollars, which means the actual figures represent trillions of dollars. The money supply that we actually use to buy goods and services is even larger since that amount includes all the money in checking and savings accounts among other financial instruments, but the graph above illustrates the extent of recent change.

Prior to the start of the financial crisis in 2008, base money in the United States was just under $1 trillion. You can see that the amount of base money had steadily increased year after year up to that point, as it had since the early 20th century.

During the financial crisis, base money increased by $0.8 trillion in a couple of months. Form there, the amount of base money expanded much further, increasing more than fourfold by the summer of 2014.

But what seemed like a staggering increase in base money in November 2008 looks relatively small in comparison to the increase in base money that we would go on to see in 2020. From the end of February to the end of December 2020, the base money increased $1.8 trillion dollars. That is equivalent to all the base money that existed in the history of the U.S. as of September 2009.

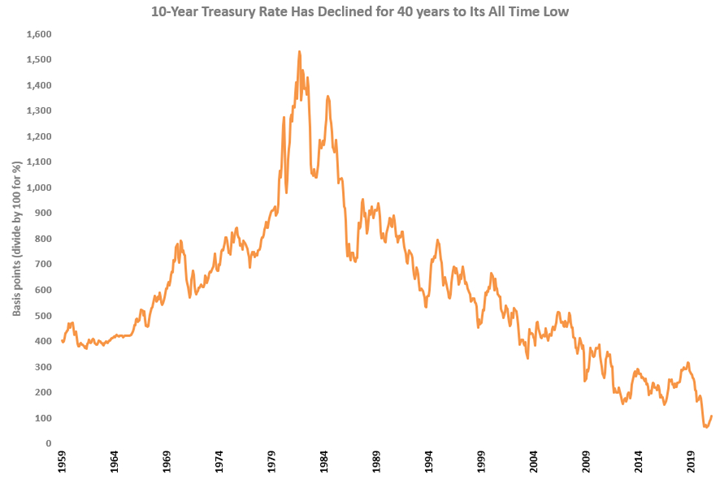

Where did this money go? It has gone into various assets and raised their prices. But particularly significant to this argument, it went into the bond market, driving up the prices of bonds, which led to a fall interest rates. Currently, the 10-year Treasury rate is about 1.5%, which is easily an all-time low. This means money is cheap, historically so.

Now, I believe the expansion in money is to some extent hitting manufacturing.

For most of the last two decades, manufacturing has generally been ignored by Wall Street and investors. Manufacturers across many sectors were shifting to offshore manufacturing capabilities rather than investing in more productive capacity at home. The pendulum is swinging the other way now, with supply chains shifting and being disrupted. The importance of this has become a focus of not just OEMs, but also investors. Currently, manufacturing is one of the stronger sectors of the economy, maybe the strongest. Consumer durable goods spending in the U.S. is at its highest percent of total consumer spending ever.

Because manufacturing has generally been ignored and is doing relatively well, there is profit opportunity for investors, including at small and medium size machine shops. There are more than 20,000 machine shops in the U.S., and many of them have worked to transform themselves into more modern and effective manufacturing service providers, in part by leaning into some of the factors Peter Zelinski mentions at the link above.

Related Content

6 Variations That Kill Productivity

The act of qualifying CNC programs is largely related to eliminating variations, which can be a daunting task when you consider how many things can change from one time a job is run to the next.

Read MoreTips for Designing CNC Programs That Help Operators

The way a G-code program is formatted directly affects the productivity of the CNC people who use them. Design CNC programs that make CNC setup people and operators’ jobs easier.

Read More4 Steps to a Cobot Culture: How Thyssenkrupp Bilstein Has Answered Staffing Shortages With Economical Automation

Safe, economical automation using collaborative robots can transform a manufacturing facility and overcome staffing shortfalls, but it takes additional investment and a systemized approach to automation in order to realize this change.

Read More4 Commonly Misapplied CNC Features

Misapplication of these important CNC features will result in wasted time, wasted or duplicated effort and/or wasted material.

Read MoreRead Next

5 Reasons Why Machine Shop Ownership Is Changing

Mergers, acquisitions and other ownership changes are an effect of Boomer-age shop owners retiring, but only in part. Also important: The way we think about machining has changed.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)