All Metalworking Metrics Continue Trend of Slowing Decline

The metalworking industry index signals decelerating contraction for a second consecutive month.

Share

Autodesk, Inc.

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View More

Takumi USA

Featured Content

View More

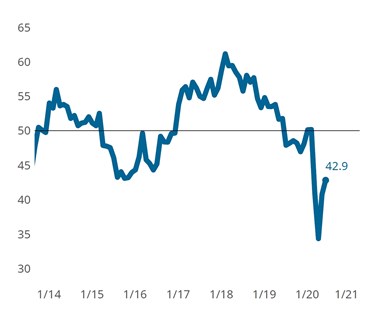

Metalworking Business Index: The Metalworking Index moved higher again in June as all components moved toward more normal readings. The index has gained nearly nine points since its all-time low in April.

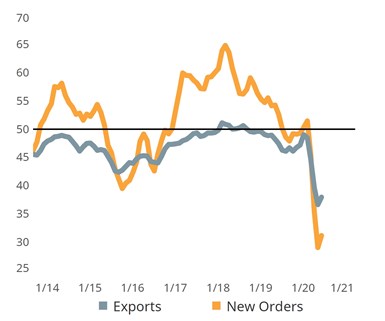

The Gardner Business Index (GBI): Metalworking moved higher in June to 42.9, marking a second month of improved readings. Adding further encouragement to the June reading was that all components of the index reported improving numbers. In particular, forward-looking index components such as new orders and exports had more survey respondents indicating flat or increasing activity in June compared to May. As metalworking shops continue to regain their footing and reestablish their supply chains, business owners have also regained much of the business outlook confidence they reported before the coronavirus pandemic began. This could mean the industry is reaching its bottom.

Leading Indicators of Business Activity Continue To Make Gains: For a second month, the proportion of survey respondents reporting that new orders and exports activity were either flat or expanding increased. The implication is that the sector may be nearing its bottom.

The June reading for supplier deliveries contracted for a second consecutive month, placing the latest reading below 60 and well within the historical range of readings experienced in prior years. (Falling readings signal that more metalworking shops are receiving supplier deliveries in a timely manner.) This reading may come from a combination of reduction in total upstream orders and upstream manufacturers successfully finding ways to operate in business environment disrupted by COVID-19. Despite upstream supplies becoming more available, June marks the fourth month in which survey participants have indicated a broadening expansion in material prices while simultaneously experiencing contracting prices on their own products.

Related Content

-

Metalworking Activity Contracts With the Components in June

Components that contracted include new orders, backlog and production, landing on low values last seen at the start of 2023.

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

-

Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)