Share

Takumi USA

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

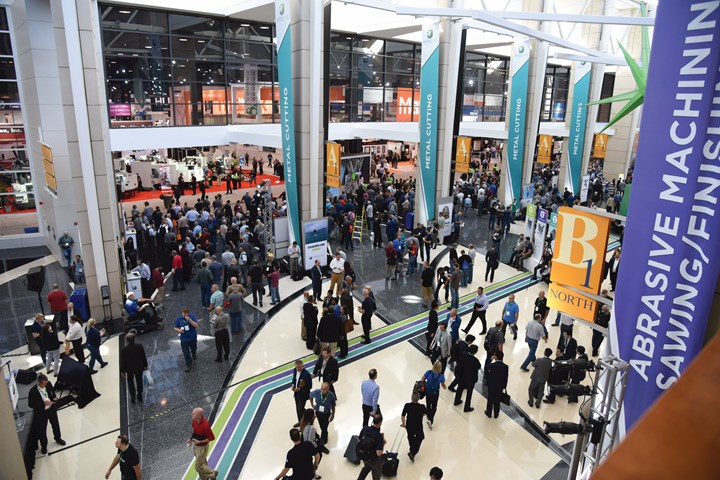

The Grand Concourse at McCormick Place during the last in-person IMTS in 2018.

Photo Credit: IMTS photos provided by AMT - The Association For Manufacturing Technology

Having experienced broken supply chains and the scarcity of goods that shocked the United States during the COVID-19 pandemic, have we learned, finally, that the status quo is crazy? That our thinly stretched manufacturing supply chains are untenable? That the hidden costs of offloading production to low-cost countries are unsustainable?

If we don’t want to relive these experiences when the next global disruption hits our shores, the answer better be yes.

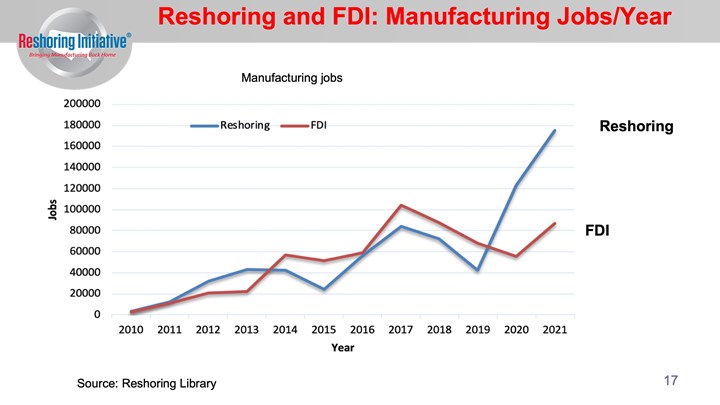

Thankfully, there is good news on this front. The pace of reshored manufacturing capacity and foreign direct investment (FDI) in U.S. manufacturing has accelerated significantly over the past two years. According to the Reshoring Initiative, a nonprofit organization dedicated to assisting companies determine the total cost of offshoring (and thus encourage reshoring), the number of jobs that can be attributed to FDI and reshoring will surpass 400,000 in 2022.

This is one indication that the message is breaking through — globalized supply chains are too fragile and vulnerable to disruption, while locally sourced production is faster, more reliable and creates opportunities for deeper relationships between suppliers and their customers.

If there is one theme to keep in mind at this year’s IMTS, it is exactly this point. The new technologies and processes that will be on display at McCormick Place in Chicago this September include the most advanced robotics, digital manufacturing and machining automation capabilities the world has ever known. The boosts in production capacity and throughput that these technologies offer will not only strengthen American machine shops and the manufacturing sector at large; they will also reinforce U.S. supply chains and allow the country to be more self-sufficient the next time a global disruption hits our shores.

Harry Moser, founder of the Reshoring Initiative, has been working with companies to bring well-paying manufacturing jobs back to the United States by helping them assess the true costs of offshoring production. The goal of the initiative is to shift the mindset of company executives from “offshoring is cheaper” to “local production reduces the total cost of ownership.”

“To shorten supply chains and get the U.S. metalworking industry closer to self-sufficiency will require more machines and machining technology,” Moser says. “If job shops want to convince OEMs to buy from them instead of continuing to import, then IMTS 2022 is the place to go. New machine tool models and new automation features will allow job shops to increase on-time delivery and be more price-competitive than they would have been otherwise. And that is what will help OEMs justify bringing the work back to the U.S.”

The rising number of jobs that can be attributed to FDI and reshoring indicate growing awareness of supply chains and signal an effort to reinforce domestic production capacity.

Ryan Kelly agrees. Kelly is the general manager of AMT - The Association For Manufacturing Technology’s San Francisco Tech Lab and head of the Onshoring Project, a consortium of organizations (including Gardner Business Media, the publisher of Modern Machine Shop) that share common objectives for helping North American companies achieve agile supply chains.

“During the pandemic, ‘supply chain’ became a buzzword,” Kelly says. “The average American — maybe for the first time in their lives — was dealing with scarcity, whether it was toilet paper or not being able to buy a car. But it’s not like the supply chain changed during the pandemic. We just revealed the level of fragility in the globalized supply chain that grew over the last several decades. We used this moment to come together, pool our resources and communicate a message to the world about what’s wrong with the supply chain and help to describe what a better system would look like.”

Hardinge employees from Taiwan traveled to the company’s facility in Elmira, New York, to train workers to produce machine tools from two product lines in the U.S.

I was able to see first-hand what reshoring looks like when I visited Hardinge’s manufacturing plant in Elmira, New York, earlier this year. The company is now producing its Bridgeport XR Series of vertical machining centers and Talent Series of turning products in its Elmira facility after decades of these product lines being manufactured in Taiwan. What I saw were team members from Hardinge’s Taiwan facility training the company’s Elmira employees to once again produce these machines in the United States. It was fascinating to witness.

Of course, reshoring and strengthening the domestic manufacturing base involves more than increased automation and advanced machining technologies. At IMTS 2022, in addition to more than 2,000 booths in nine pavilions, visitors will be able to engage with programming that addresses supply chains and related topics such as workforce development, sourcing, investment in manufacturing and more. Mark your calendars now and register at IMTS.com/register. — BRENT DONALDSON

Automation At Every Step

If you feel like automation is everywhere at IMTS 2022, that’s because it is.

Tim Shinbara, chief technology officer at AMT, puts it this way: “The total solution has become the norm. You simply can’t put all of automation into one pavilion because it’s really about the interoperability of the whole manufacturing system.”

By “total solution,” Shinbara is referring to fully automated CNC machining systems capable of producing parts in a single setup. This requires more than just material handling systems like robots and pallet changers. Without other supporting systems, single-setup automation won’t be on the table.

For example, automating milling is not merely a matter of buying a machine-tending robot, but a collection of decisions. If the application calls for running multiple parts in small batches, then perhaps a pallet changer is better suited to the task. And how large should that pallet changer be? A job shop cutting

larger, one-off parts might be fine with five stations, but a shop working in larger batches might need 12 or more. Beyond material handling, does the shop want to run this milling machine lights-out? In that case, it needs an automated tool changer with a large enough tool magazine to keep enough replacement cutting tools to fill the whole night shift. The shop also might need high-end tool holders to prevent runout, not to mention in-process verification to ensure quality parts.

Automation at IMTS

A holistic approach to automation requires careful consideration of goals, competing products and even competing views about how automation can be most effective. “This is one of the major selling points for IMTS,” Shinbara says. “You come here and learn about the new technologies and put together plans for how to incorporate them into your facility in a way that best suits your work.” But what advances in automation should IMTS visitors be keeping an eye on?

- IN-HOUSE AUTOMATION: OEMs are developing automation systems designed to work with specific machine tools. Take the Okuma (BOOTH 215219/338500) Armroid , a robotic arm designed to work with two of the company’s turning machines, with specific attachments designed to overcome specific turning challenges. Or look at the Palletech system by Mazak (BOOTH 215218/338300), a palletized automation system designed to integrate seamlessly with the company’s milling machines.

- COBOTS: “Cobots have improved dramatically in two areas: safety standards and vision systems,” Shinbara says. By vision systems, Shinbara is referring to cameras that enable cobots to accurately identify parts by shape. Zeiss (BOOTH 135502/433231) and Hexagon (BOOTH 135202) are two companies that have recently released advanced vision components for cobots, but they are not the only ones. “These peripheral technologies are really integral for robotics and automation,” says Andra Keay, managing director of Silicon Valley Robotics and vice president of AMT – The Association For Manufacturing Technology.

- HYBRID MACHINES: Combination milling and 3D-printing machines are slowly becoming more viable as the technology matures. These machines enable the user to add material to the workpiece — or even build a workpiece from powdered material — before machining the rough edges into tolerance. This technology could enable shops to complete parts in a single setup when it might otherwise be impossible to do so.

- DIGITAL CONNECTIVITY: One of the most important aspects of an automation system is how the working parts connect to each other digitally. “What is frequently overlooked is how fundamentally important connectivity is, both in terms of communications networks, and in terms of standards, drivers, libraries and operating systems,” Keay says. While these systems may not have an obvious impact, they smooth the production process in numerous small ways that add up over time. “Whatever stage of the automation journey you’re on, you need to invest in going digital and then in connecting to the cloud,” Keay says. — ELI PLASKETT

Manufacturing Money Matters

Money for American manufacturing is plentiful — so long as shops look in the right places. Although Dayton Horvath, director of emerging technology and investments at AMT, says that while investment is often concentrated in technology-driven start-ups, job shops can still benefit from other types of funding. Public-private partnerships help fund the training and adoption of advanced manufacturing technology, while OEMs reshoring their products are likely to be on the lookout for domestic component manufacturers.

The Investment Community

The venture capitalists attending the IMTS Investor Forum on Tuesday, September 13 and Wednesday, September 14 will focus on advanced technology providers over job shops. Shop owners looking to recapitalize should look to family offices and private equity firms with long investment horizons. To attract these types of buyers typically requires marquee customers and strong financial performance, Horvath notes.

As automation decreases the cost of labor in producing a part, companies determining production locations must give more weight to metrics like shipping costs and supply chain stability. The domestic adoption of automation, rising shipping costs and global unrest may accelerate the growth of American manufacturing.

While these characteristics spark initial interest from buyers or other shop owners looking for merger opportunities, achieving the best valuation requires a different set of characteristics. As described at the recent Machine Shop Ownership Change Conference, a virtual event produced by Modern Machine Shop and ERP software provider ProShop, industry-specific certifications imply higher skill levels, while the active use of ERP software enables concrete measurement of shop metrics. Consistent EBITDA (earnings before interest, taxes, depreciation and amortization) is also more important than a single year’s revenue, and diverse income streams are preferable to overemphasis on a big-name customer.

Public/Private Funding

Public-private partnerships and government programs can provide funds

The U.S. Government has taken a bipartisan interest in domestic manufacturing. In early May 2022, President Joe Biden delivered a speech at United Precision Metals in Hamilton, Ohio, in support of the Bipartisan Innovation Act. This pending legislation directly funds semiconductor manufacturing to the tune of $52 billion, and is also slated to authorize another $300 billion for manufacturing, supply chain resilience and technology innovation. Photo Credit: John Wilczynski

that enable manufacturers to benefit from technological innovations without breaking the bank.

Government-funded programs include initiatives such as the Department of Agriculture’s Business and Industry Program, which will support rural manufacturers in purchasing additive manufacturing equipment, and the Export-Import Bank’s domestic lending program, which will defray job shops’ costs as they upgrade their production equipment. America Makes and the Department of Labor will also assist manufacturers in developing additive manufacturing apprenticeship programs.

Smaller programs also exist on the state level, says Harry Moser, founder and president of the Reshoring Initiative. For example, STS Group AG recently invested $39 million to set up its first manufacturing operation in Virginia. The company plans to fill 120 jobs in partnership with the Virginia Talent Accelerator Program, an initiative that provides recruitment and training services customized to qualified companies’ needs at no cost. The Florida Job Growth Grant Fund is also awarding $3.7 million to develop a manufacturing pipeline in central Florida, helping Valencia College develop a program to train students in utilizing robotics technology for semiconductor manufacturing.

OEM Opportunities

OEMs like DMG MORI and Hardinge are securing their supply chains by moving to domestic production for significant product lines. For production facilities serving these companies, this means an influx of potentially lucrative work producing components.

What’s more, this reshoring could be indicative of a long-term trend as growing supply chain concerns outweigh shrinking labor cost concerns. Labor cost concerns have already been decreasing for over a decade, says Pat McGibbon, AMT’s chief knowledge officer. Whereas labor used to be 30-40% of the cost of a product, McGibbon says this percentage had fallen into the teens by 2007 and has only continued to shrink as automation increases productivity per labor hour.

This has become increasingly important over the last two years, McGibbon says, because economic downturns tend to drive up adoption for automation technology — and the supply chain destabilization arising from COVID-19 has pushed this even further than a normal recession.

Where To Next?

McGibbon doubts the economic tumult of 2022 will stymie domestic manufacturing’s growth. He points to economists Mark Killian, Alan Beaulieu and Scott Hazleton, all of whom predict only a slight dip for manufacturing before it turns and outpaces the consumer sector around the end of 2022 and continues to hold strong for several years. — EVAN DORAN

The Intersection of Worksforce and Shop Culture

Engaging team-oriented, hands-on activities in the Smartforce Student Summit at IMTS mirror real-world industry strategies.

It is no secret that the tight labor market presents a challenge to machine shop owners. In years past, it was common to hear that a shop would hire almost anyone who promised to show up to work on time. Today, many shop owners, even those who are struggling to find employees, are taking steps to ensure that new employees are willing and able to adopt the culture of the shop. Finding the right employee is just as important as finding just any employee. So where can these employees be found, and how do we equip and train the next generation of manufacturing workers?

The answers to these questions are rarely as cut-and-dry as shopping for a machine tool. For smaller shops like Ketchie Inc., a 30-employee company in Concord, North Carolina, every individual can have a significant impact on the business. Courtney Silver, the company’s president, says the business hires for a cultural fit more than anything else. Candidates that demonstrate grit, a focus on customers and the initiative to solve problems are likely to find a long-term place on the shop floor. An emphasis on a multi-generational approach, and mixing new employees into workflows with those who have been with the company for decades, helps ensure new hires stick around long enough to hone their skills.

Of course, helping current job seekers find their place in manufacturing is only half the battle. Getting the next generation of workers interested in manufacturing in the first place is a challenge that Drew Crowe, founder of The New American Manufacturing Renaissance Tour, is tackling head-on. Crowe spent more than 12 years working in job shops, climbing his way up the ladder from machine operator to manager before taking on a job as a CNC machining instructor at a technical college near St. Louis. Now Crowe spends his time touring the country, visiting schools, non-profits and other outreach centers to speak to youth who have no exposure to manufacturing and motivate them to become interested in the field. He leverages his high-energy personality and passion for CNC machining to open young students’ eyes to opportunities in U.S. manufacturing and encourage them to join the workforce.

“I try to make sure that my message to companies and students resonates with where the industry needs to go, but it is up to the companies to make sure they have an employee culture where young people stay engaged and committed,” Crowe says. Visitors to IMTS can hear that message for themselves when Crowe takes the stage at the Job Shops Workshop – Day 1, September 12, in the first session on workforce retention in development. On Tuesday at 2 p.m., September 13, he will be on the IMTS+ Main Stage and later in the week will speak to the next generation at the Smartforce Student Summit.

Smartforce Student Summit at IMTS introduces thousands of students and teachers to manufacturing technology to encourage pursuit of STEM studies and careers.

Inspiring the next-generation manufacturing workforce will be a key theme at IMTS, including at the 2022 Smartforce Student Summit. Greg Jones, AMT’s vice president of Smartforce Development, says this year’s summit will be larger than 2018’s, which hosted more than 24,000 students. Our industry’s vision of the manufacturing technology classroom of the future will be on display, including interactive exhibits, virtual reality experiences and a wide range of advanced manufacturing technologies like robots, collaborative robots, CNC and automation equipment. Students will be able to speak with representatives from several major technology suppliers and machine tool OEMs.

Jones says that outreach to students as young as elementary school age is vitally important, as research has shown that children form opinions about manufacturing and start plotting their career direction as young as fourth and fifth grades. “Smartforce is working alongside manufacturers and schools so that they invest in their programs and put the right equipment, the right robotics and the right industry tools in their classrooms to prepare the kids for what they might experience post-high-school,” Jones says. “And we work alongside training partners like Tooling U-SME and NIMS to equip educators, at all levels, with the training and curriculum that the next generation workforce needs.” — DAVID LYELL

Read Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read More

.png;maxWidth=300;quality=90)