A Characterization of Blockchain Technology

If you are not an information technology person or an accountant, you may be struggling to figure out what blockchain technology is all about. Here’s a simple way to understand it.

Share

Lately, you may be encountering the term blockchain in many discussions related to information technology, the Internet of Things, data security and other contexts. Blockchain technology often comes up in news about Bitcoin and other cryptocurrencies. If you are a not an information technology person or an accountant, you may be struggling to figure out what blockchain technology is all about. I believe I have come up with a way to understand it, at least on a superficial, non-technical level. This explanation isn’t meant to reveal how blockchain works, but rather characterize what it does.

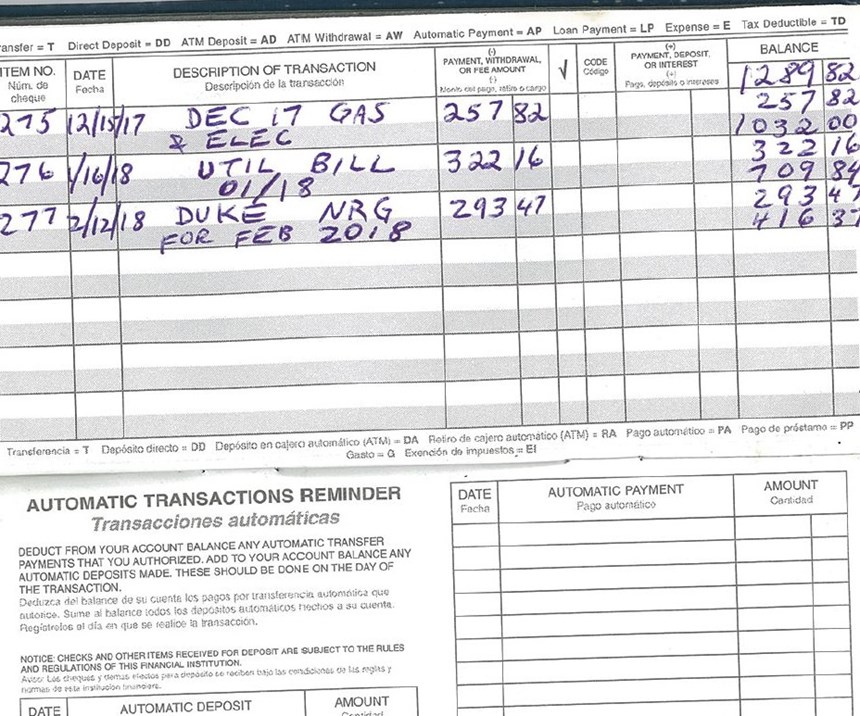

Blockchain technology is described as a distributed-transaction-ledger database of economic exchanges that can be programmed to record and share information about these transactions. It also can be used for almost any kind of data exchange. To relate blockchain concepts to everyday life, there are similarities to managing any checking account with a traditional paper checkbook and register, which I still use for paying some bills. Whenever I write and sign a check, I record it in the register, where I jot down the check number, the date, the party to whom I’m making a payment and the reason for the check. On the right side, I fill in the check amount and subtract it from the current balance. I record deposits in the same way. A mock-up of my check register is shown in the second image above.

This check register is a kind of ledger. You can think of each check and the corresponding register entry as a “block” of information about the transaction. Similar blocks of information are captured for online transactions in blockchain. They are date-stamped and the math is done automatically in software. Now imagine that every time I write and sign a traditional paper check, I also make a photocopy of the just-then updated pages of my check register and attach it to the check. The photocopy shows the person accepting my check that I’ve been keeping an accurate record of my checking activity. Now suppose that when this recipient deposits my check, they also update their check register, photocopy it and attach it to mine to pass along the next time they write a check. And we all keep doing this: adding photocopies of everyone’s updated check registers to the stack that accompanies each new check being written or accepted. Nothing is hidden. It’s all open and transparent.

This ever-growing stack of paper photocopies being passed around and shared is like the “chain” of blocks in blockchain concepts, as I understand them. Of course, with blockchain technology, the equivalent of the stack of photocopied check register is digital, so attaching the most up-to-date version to every online transaction to be distributed across the network is very practical, given the almost unlimited capacity for handling extremely large records in the Cloud.

Now, go back to my checking account analogy. Obviously, the stack of check register photocopies continually being added to and exchanged would get very thick very quickly, so this system wouldn’t be workable. However, if we could do this somehow, it would be darned hard to change any of the entries to make it look like I had more money than I really do. For one thing, I’d have to go back to a check written a while ago to hide my fraud, and that would mean changing all the entries for checks written after that one. To get away with this, everyone with photocopies of the original, correct register would have to agree to change all their photocopies to hide the deceit. This is very unlikely to happen, even in this fairytale of mine.

Blockchain technology, it seems, provides similar (but much stronger) safeguards. Like the stack of unchangeable register photocopies being passed around and added to in my story, the distributed ledger provided by blockchain is virtually impossible to tamper with. In some systems, programmers who are interested can earn a bonus for running programs to check all the entries and calculations in the blockchain ledger. If mistakes or oddities are found, that version of the ledger is knocked off the chain and other correct ones get circulated instead. Therefore, blockchain transactions can be considered incorruptible and trustworthy without having a central, third-party mediator or arbitrator to verify and guarantee the entries.

Likewise, blockchain users must have a unique digital key to make transactions. This digital key, which is long and complex, functions like the signature on the check written from my checkbook. Only I can sign a check to use the money in my checking account. The digital key used for transactions with blockchain provides the same security, only this digital key is much harder to forge than a signature.

In addition, with blockchain technology, the digital record of transactions is encrypted, adding another layer of security. In a way, my old-fashioned check register is also encrypted, although my approach is not particularly systematic. I make it up as I go along. The mockup of my check register pictured above shows my record of three times I sent a check to pay my monthly utility bill. For each entry, I casually used abbreviations and acronyms that are perfectly clear to me, but may be mysterious to others. Of course, blockchain technology follows much stricter rules and procedures for encryption. A digital code reader, based on a complex decoding algorithm, must be used to interpret transactions in the blockchain.

Now back to my checkbook analogy again. The stack of photocopied registers that is being passed around might convince you that the soundness, or even the existence, of the bank holding my checking account doesn’t matter. There’s no reason to refuse my check as payment or wait for it to clear, even if you are in a different part of the country or outside it. Blockchain transactions are giving users similar freedoms and fluidity (and lower transaction fees).

Blockchain technology is also one of the enablers behind the concept of smart contracts. Adding to my story line again, say I text a local wine merchant that I want first dibs on a crate of cabernet sauvignon being shipped from a vineyard in California, but only if it is available before a dinner party I’m planning. We agree that he will text me if the shipment comes in on time and, if I have enough money in my checking account, I will immediately drop off the check (along with the photocopied registers) and pick up the bottled wine at the door. We both know that the deal is off if the conditions don’t fly.

Smart contracts can be set up to work the same way under blockchain technology on an online platform. The contracts are executed automatically (digitally signed, sealed and delivered) when all agreed-upon conditions are met, as verified by online applications created for this purpose. In fact, smart contracts can be anonymous and still be trusted. Imagine that my only contact with the abovementioned wine merchant was the exchange of text messages, yet we could do business reliably. If everything worked out in that scenario, the wine merchant made the sale and I drove off with my wine for the party.

We also can discuss cryptocurrencies in this context. Cryptocurrencies are based on digital units representing something with perceived value and, once purchased with “real money,” are thereafter usable for exchange with all the advantages and security that blockchain technology provides. It’s a little bit like this (as I roughly imagine it): My checking account is based on dollar money in the bank. But say I have a wine cellar full of rare vintages in carefully laiddown bottles. Suppose, instead of using checks, I decide to start swapping signed IOUs (with attached copies of my cellar inventory records) for those bottles in some sort of barter arrangement with kindred wine connoisseurs. Others may like using my IOUs as well, because as my wine ages to perfection or becomes increasingly rare, its value may rise, which seems to be happening with some cryptocurrencies. The main point is, blockchain technology makes the cryptocurrency equivalent of my IOUs well protected and trustworthy.

So, there you have it—my grossly oversimplified explanation of blockchain technology. Despite its gaps or defects, it helps me understand this development as I learn more about it. This is a start. We must get a grasp on blockchain technology, because it promises to have a huge impact on how we do business in the near future.

Read Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More

.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)