A Banner Month for Machine Tool Sales

According to the USMTO, machine tool sales in September were 3,452 units and $638,010,000 in real dollars. These numbers are absolutely astounding. Unit sales were the highest in the history of the USMTO program, which dates back to 1996. Further, unit sales were the highest since June 1986, which made September the single best month of unit sales in nearly 30 years.

Share

According to U.S. Manufacturing Technology Orders (USMTO), machine tool sales in September were 3,452 units and $638,010,000 in real dollars. These numbers are absolutely astounding. Unit sales were the highest in the history of the USMTO program, which dates back to 1996. Further, unit sales were the highest since June 1986, which made September the single best month of unit sales in nearly 30 years. In those nearly 360 months, there have only been seven months when sales topped 3,000 units. Unit sales in September were 55.3 percent more than they were last September. That sent the annual rate of change, which had been floating around 0 percent for 2014, to 7.6 percent. Based on my forecast for the remainder of the year, unit sales should end 2014 up 5.7 percent compared to 2013.

In September my unit forecast was too low by 20.3 percent, which was by far my worst performance of any month in 2014. Year to date my forecast is too low by 3.0 percent. Based on my forecast and actual data, I think some sales were held from July and August and pushed into September because of IMTS.

Real dollar sales also were the second highest in the history of the USMTO program (March 1998 had $758 million of machine tool sales). Only three times in the history of the program have real dollar sales topped $600 million in a single month. Compared to last September, real dollar sales were up 60.1 percent. Sales in September moved the annual rate of change into positive territory for the first time since November 2012. Based on my forecast, real dollar sales will end the year up 7.0 percent.

With dollar sales increasing more than unit sales in September, the average price of a machine increased 3.1 percent compared to one year ago. That is the month-over-month increase in the average price of machine since January 2014. Annually, the average price of a machine has been contracting at a slower rate since May. This is historically a sign of an improving machine tool market in unit and dollar terms. One other interesting tidbit was the disparity in the average price of machines sold in September by region. In the Southeast, Northeast and North Central - West, the average price increased by at least 16.5 percent. However, in the West, South Central and North Central - West, the average declined by at least 5.3 percent and as much as 10.6 percent.

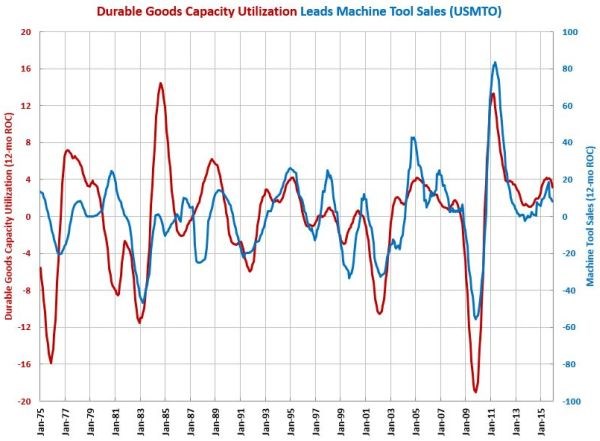

My four primary leading indicators for machine tool sales (money supply, durable goods capacity utilization, Gardner Business Index and durable goods production) are pointing to be a very strong year for the machine tool industry in 2015.

You can find more on machine tool sales and the leading indicators on our metalworking and monetary pages.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=970;quality=90)