2015 Machine Tool Consumption Forecast – Up 37 Percent

Since two significantly down years after the financial collapse in the fall of 2008, machine tool consumption has been quite strong, performing at or above the historical average market. But 2015 looks to be the best post-recession year yet. According to the Gardner Research Capital Spending Survey and Forecast, metalcutting machine tool consumption will increase 37% next year.

Share

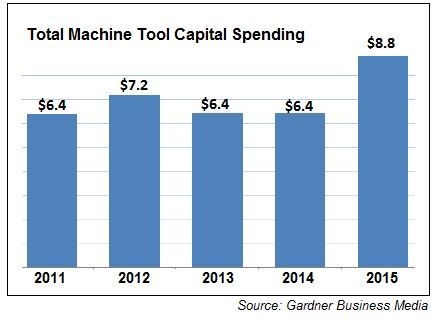

Since two significantly down years after the financial collapse in the fall of 2008, machine tool consumption has been quite strong, performing at or above the historical average market. But 2015 looks to be the best post-recession year yet. According to the Gardner Research Capital Spending Survey and Forecast, metalcutting machine tool consumption will increase 37% next year. This dramatic jump in consumption comes after what is estimated to be a slightly down 2013 (-10%) and flat 2014.

Consumption of metalcutting equipment is expected to reach $8.8 billion in 2015. If the forecast proves true, then 2015 would be the strongest year for machine tool consumption since 1998, which had sales of $9.6 billion in real dollars. Moreover, next year could see the U.S. become the number one consumer of CNC machine tools for the first time since 2000.

While the general economy remains mired in slow growth, the four primary leading indicators for machine tool consumption are indicating significant growth for 2015. These leading indicators are:

- Money Supply – Typically, changes in the money supply lead machine tool consumption by about two years. The money supply grew at an accelerating rate from February 2013 to June 2014. And, the rate of growth reached its second highest peak in history. This indicates a rapidly growing machine tool market throughout 2015.

- Capacity Utilization – Perhaps the most important leading indicator, it usually leads machine tool consumption by 10 months. Durable goods capacity utilization was at 78.6% in July 2014. Based on the correlation with backlogs from the Gardner Business Index, capacity utilization should reach 80% in the next couple of months and remain there throughout 2015. This would be the first time durable goods capacity utilization was higher than 80% since June 2000.

- Gardner Business Index – According to this diffusion index from Gardner Research, business conditions at metalworking facilities have improved every month but one since October 2013. Annually, the index has grown at an accelerating each of the last six months. While the index has only been around since 2006, it has shown a high correlation with machine tool consumption. The index leads the machine tool industry by about 10 months.

- Durable Goods Production – Production is at an all-time high in the U.S. For 20 consecutive months, durable goods production has set a record high for that month. Production should grow at an accelerating rate through at least the end of the year. Production leads machine tool consumption by about 15 months.

For the last two years, metalworking facilities spent relatively more money on horizontal and/or larger machines. However, projections indicate that trend will reverse itself in 2015. The machine types with the largest increases in spending will likely be either vertical machines or smaller machines of all types. Horizontal machining centers will still be the most preferred machine type, but the level of spending will be fairly flat compared to 2014. Machine types forecast to grow significantly in 2015 include vertical machining centers, vertical lathes, small horizontal turning centers, small horizontal lathes, and certain types of grinding machines. Also, the survey appears to indicate a much greater interest in machines for additive manufacturing in 2015.

The top five industries buying machine tools in 2015 are projected to be job shops, machinery/equipment manufacturers, automotive, pumps/valves/plumbing products, and forming/fabricating (non-auto).

Roughly one-third of the spending will be at facilities with more than 250 employees. According to the Gardner Business Index, these larger metalworking facilities are growing at their fastest rate in nearly two years.

Unlike other capital spending projections, Gardner’s forecast is based on surveying end users about their specific spending intentions by machine type. The projection is then derived from statistical analysis of the end-user sample. The survey has historically been among the most accurate predictors of spending.

Stop by Gardner's booth (W-10) to learn more. Also, be sure to use the digital IMTS directory to help plan your booth visits.

Read Next

Building Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)