Reshoring Initiative 1H 2023 Report Announces Upward Trends

Geopolitical risk and industrial policy drove the first half of this year’s announcements, indicating exceptional progress in U.S. reshoring.

Share

Takumi USA

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

Photo Credit: Reshoring Initiative

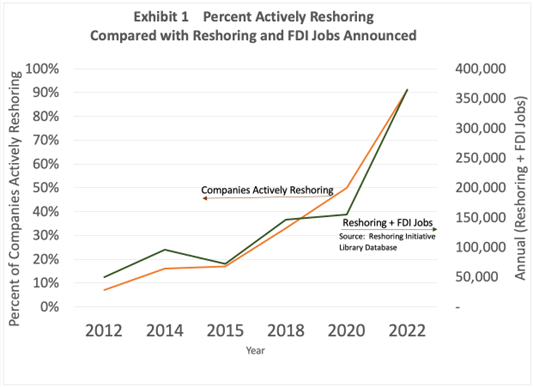

According to the Reshoring Initiative’s latest 1H 2023 report, announcements made regarding the first half of 2023 and foreign direct investment (FDI) were in line with 2022’s record reshoring rates — upwards of 300,000 jobs are expected to be announced by year-end. EV battery and chip investments along with other essential product industries formed the bulk of the announcements.

Several factors have come to light that substantiate the strength of U.S. reshoring and FDI trends. In the first quarter of this year, average spending on U.S. factory construction was more than double the average from the past 17 years. Reshoring Initiative data parallels the magnitude and focus of the construction investments. Independently conducted surveys on reshoring actions by U.S. companies also correlate very closely with Reshoring Initiative data on jobs announced over the past 12 years (see graph above), adding validity to both data sets.

Reshoring and FDI job numbers demonstrate exceptional progress for U.S. manufacturing after decades of offshoring. If this progress can be combined with an industrial policy that supports greater cost competitiveness, the U.S. will continue the rapid strengthening of its supply chains.

The Reshoring Initiative’s 1H 2023 Report contains data on U.S. reshoring and FDI by companies that have shifted production or sourcing from offshore to the U.S. Read more at Reshoring Initiative 1H2023 Report.

“We publish this data to show companies that their peers are successfully reshoring and that they should reevaluate their sourcing and siting decisions,” Harry Moser, founder and president of the Reshoring Initiative, says. “With 5 million manufacturing jobs still offshore, as measured by our $1.2 trillion/year goods trade deficit, there is potential for much more growth. We also call on the administration and Congress to enact policy changes to make the United States competitive again.”