The Power Of Two

A common theme of this column is tax secrets of the wealthy. The secret of wealthy people is a system designed to accomplish two purposes: to show successful business owners (and other persons of means) how to keep all their wealth in the family instead of losing it to the IRS; and to show you how to keep absolute control of your wealth, including your business, for as long as you live.

Share

ECi Software Solutions, Inc.

Featured Content

View More

Takumi USA

Featured Content

View MoreA common theme of this column is tax secrets of the wealthy. The secret of wealthy people is a system designed to accomplish two purposes: to show successful business owners (and other persons of means) how to keep all their wealth in the family instead of losing it to the IRS; and to show you how to keep absolute control of your wealth, including your business, for as long as you live.

The system features 23 core strategies and an infinite number of combinations. Each strategy is capable of saving huge amounts of tax dollars and/or creating large additional amounts of tax-free wealth. When two strategies work in tandem, you have a powerful tax-saving, wealth-building weapon.

This column explores a dynamic duo: a family limited partnership (FLIP) and an intentionally defective trust (IDT).

Example #1: Joe has a mixed portfolio of appreciated investments (some publicly traded stocks and a few bonds, but mostly income-producing real estate that is expected to appreciate rapidly). Joe has six major goals for his investments: 1) freeze the value of the appreciating real estate; 2) transfer the entire portfolio to his kids and grandkids; 3) maintain control of these assets for as long as he lives; 4) protect the assets from third parties (creditors, lawsuits and divorcing in-laws); 5) eliminate any capital gains tax on the transfer; and 6) get the assets out of his estate. The tax basis of the portfolio is $375,000, so there is a potential capital gain of $625,000. Here’s how Joe accomplishes these goals (note: Joe does not need any of the assets or income to maintain his lifestyle).

First, Joe transfers all of the assets to a FLIP—a tax-free transfer. Joe keeps 1 percent, as the general partner, to maintain control. Second, Joe gifts 99 percent (the limited partnership interests) to an IDT. Joe’s kids and grandkids are the beneficiaries.

That’s it. Not only did Joe accomplish all of his goals, but he got two other benefits: 1) the valuation discounts enjoyed by a FLIP (typically in the 35 percent range) allow the gift of the FLIP interests to be valued at only $650,000 for tax purposes. So Joe only used up $650,000, instead of $1 million, of his unified credit (the free amount of assets you can gift without paying any gift tax). 2) Joe can use the income produced by the FLIP assets (and the principal, if necessary) to provide for the education of his grandchildren.

Example #2 has the same facts and goals as #1, except the asset is the stock of Success Co. It is worth $5 million, appreciating rapidly and owned 100 percent by Joe. The company is being run by Sam, Joe’s 30-year old son; Joe wants to transfer it to Sam. Joe needs a flow of cash to maintain his lifestyle.

A two-step process will accomplish all of Joe’s goals. Step 1: Have Success Co. professionally valued after first recapitalizing (issuing voting stock—1 percent, and nonvoting stock—99 percent). The appraiser takes a 40 percent discount for the nonvoting stock (actually three discounts: general lack of marketability, minority discount and nonvoting stock worth less than voting stock). So, for tax purposes, Success Co. is worth only $3 million. Joe keeps the voting stock to maintain control of Success Co.

Step 2: Joe sells the nonvoting stock to an IDT, which pays him with a note. The IDT will get the funds to pay Joe’s note as it collects its share of the income from Success Co., an S corporation. When the note is paid, the IDT will transfer the stock to Sam, the beneficiary of the IDT. Joe avoids the capital gains tax, and Sam gets the stock without paying for it.

A FLIP and/or an IDT are flexible tax planning strategies that can save a tax bundle when transferring almost any kind of asset to your family. This column does not cover every nuance, tax-saving possibility, rule or tax trap with a FLIP and IDT. Work with a qualified and experienced professional.

Related Content

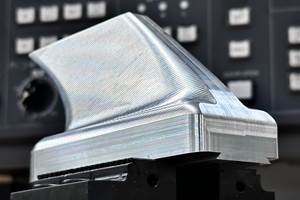

Custom Workholding Principles to Live By

Workholding solutions can take on infinite forms and all would be correct to some degree. Follow these tips to help optimize custom workholding solutions.

Read More4 Rules for Running a Successful Machine Shop

Take time to optimize your shop’s structure to effectively meet demand while causing the least amount of stress in the shop.

Read MoreTips for Designing CNC Programs That Help Operators

The way a G-code program is formatted directly affects the productivity of the CNC people who use them. Design CNC programs that make CNC setup people and operators’ jobs easier.

Read MoreHow to Determine the Currently Active Work Offset Number

Determining the currently active work offset number is practical when the program zero point is changing between workpieces in a production run.

Read MoreRead Next

Building Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.png;maxWidth=150)