So Your Qualified Plan Is A Tax Trap - Here’s How To Escape

Do you have a significant amount of money ($400,000 or more) in one or more qualified plans—an IRA, profit-sharing plan, 401(k) or others? This is a bittersweet subject. It is bitter if you don’t know how to legally avoid the tax-robbing laws that enrich the IRS, and it’s sweet if you implement one or more of the

Share

Autodesk, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View MoreDo you have a significant amount of money ($400,000 or more) in one or more qualified plans—an IRA, profit-sharing plan, 401(k) or others?

This is a bittersweet subject. It is bitter if you don’t know how to legally avoid the tax-robbing laws that enrich the IRS, and it’s sweet if you implement one or more of the strategies that follow, turning the tables on the IRS and creating millions of dollars of tax-free wealth.

To personalize this article, write down how much you have in your qualified plans ($_____).

Now comes the bitter part—extremely bitter if you happen to be rich. When your plan funds are distributed to you—using a $10,000 distribution as an example—you’re socked with 40 percent in income tax. Horrified, you watch your $10,000 shrink to $6,000 after the first $4,000 tax bite. When you go to heaven, the IRS feasts again on the remaining $6,000; this time, it’s the 55-percent estate tax. That’s another $3,300 swallowed by the tax collector. So, your family winds up with a paltry 27 percent, only $2,700. The IRS gets 73 percent, or $7,300. Now, multiply 73 percent by the amount you wrote in the blank above. Sorry, but that’s the potential tax damage to your plan funds.

In an evil sort of way, the IRS gives you a second chance. If you die before distributing all of your plan funds, your heirs still get hammered for the same 73 percent double income tax and estate tax. Stop! Take a moment to apply these awful same-if-you’re-dead-or-alive rules to your plan numbers. Most of my clients cringe when they realize the sad tax consequences: A stratospheric $730,000 per $1 million of your plan funds are lost to tax collectors.

Now, we are ready for the sweet part, the part that enriches you and your family. The following are real-life examples of strategies other readers of this column have used. When an example or strategy fits your facts and circumstances, get more information so you, too can join the tax-saving and/or wealth-creation fun. All numbers are rounded for ease of reading.

Strategy 1: Use all or a portion of your plan funds to buy a single, premium, immediate life annuity (a tax-free transaction). Then, use the annuity amount, which continues for as long as you live, to buy life insurance in an irrevocable life insurance trust (ILIT). For example, a single 61-year-old reader turned $135,000 of after-tax plan funds into $1.2 million in his ILIT, all tax-free. We call this strategy the “Junk Money Plan” (JMP).

Strategy 2: This strategy is called the “Retirement Plan Rescue” (RPR). It is similar to a JMP. The only difference is that the necessary amount to pay the insurance premium is distributed from the plan each year. A 71-year-old widower got $2 million into his ILIT using only $176,000 in after-tax plan funds.

Strategy 3: A subtrust does the same trick as an RPR, keeping the life insurance proceeds out of your estate, but without the need for an ILIT. The insurance death benefits—with the same premium cost as a RPR—are about 20 percent higher. Generally, a subtrust is used only for plan participants who are married.

Strategy 4: Boost the annual average rate of return of your plan funds to more than 15 percent without market risk by investing in Life Settlements (LS). A public company makes LS available to the little guy. Minimum investment is $50,000 for qualified investors.

Strategy 5: If you would like to make a significant contribution to charity, either during your life or upon death, there are ways to use your plan funds to enrich your favorite charity without reducing the amount that will go to your heirs.

You’ll love what Ken, a reader from Kansas, did with his 401(k): Ken’s 401(k) has a balance of $510,000, and Ken plans to contribute an additional $12,000 per year for the next 15 years. He used an RPR (Strategy 2) to buy $3.8 million worth of second-to-die life insurance in an ILIT. His 401(k) invested a portion of its funds in LS (Strategy 4) to boost its income. When Ken and his wife both get hit by the final bus, the $3.8 million in the ILIT will be divided between his heirs ($1 million) and charity ($2.8 million). Any balance in the plan will take advantage of Strategy 6.

Strategy 6: Make sure your professional advisor sets your plan up to take advantage of the new Stretch IRA rules when you go to heaven. These rules allow you to leave your IRA to younger family members so that distributions are made over their (longer) life expectancy rather than your (shorter) life expectancy. This is a great wealth-creating device for your kids and grandkids.

Related Content

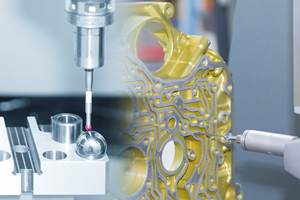

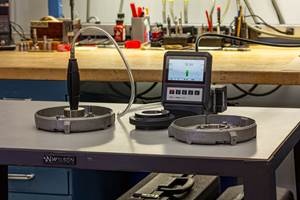

Rethink Quality Control to Increase Productivity, Decrease Scrap

Verifying parts is essential to documenting quality, and there are a few best practices that can make the quality control process more efficient.

Read MoreHow to Choose the Correct Measuring Tool for Any Application

There are many options to choose from when deciding on a dimensional measurement tool. Consider these application-based factors when selecting a measurement solution.

Read MoreHow to Determine the Currently Active Work Offset Number

Determining the currently active work offset number is practical when the program zero point is changing between workpieces in a production run.

Read More4 Rules for Running a Successful Machine Shop

Take time to optimize your shop’s structure to effectively meet demand while causing the least amount of stress in the shop.

Read MoreRead Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More

.jpg;maxWidth=300;quality=90)