Share

Takumi USA

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View More

Autodesk, Inc.

Featured Content

View MoreAs the world continued to dig out from lingering Covid and supply chain

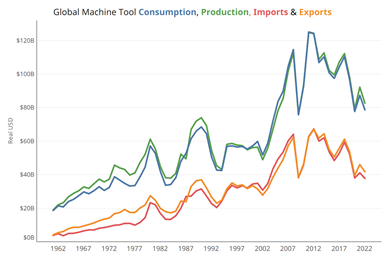

issues last year, machine tool production fell some 10% and consumption some 9% across the top 50 industrialized countries in 2022. Specifically, overall machine tool consumption decreased from $87.3 billion in 2021 to $79.5 billion in 2022 while production decreased from $92.1 billion in 2021 to $82.6 billion in 2022. Though the drop was significant, 2022 nonetheless was a solid year for the machine tool industry. According to AMT – The Association for Manufacturing Technology, 2022 was the third-best year on record for new orders for machine tools in the U.S.

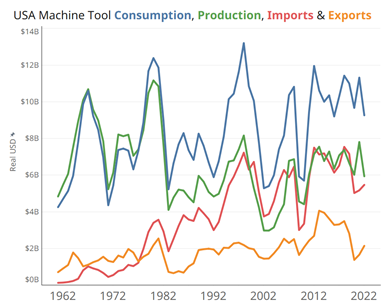

Of the top 10 machine-tool-producing countries, only India and Brazil posted year-over-year gains at relatively modest increases in real dollars (adjusted for currency exchange rates and inflation) over their 2021 levels. Expanding to the top 20 machine-tool-producing countries, Russia also reported modest gains. Of the top 10 machine tool producing countries, the U.S. saw the largest drop at about 24%.

As expected, world machine tool consumption followed a very similar pattern. There were bright spots, however, with three of the top 10 consumers posting gains: Italy grew its machine tool consumption by 11.7%, India by 30.3%, and Mexico by 11.5%.

The World Machine Tool Survey

These data come from the annual World Machine Tool Survey conducted by Gardner Business Media (publisher of Modern Machine Shop). Each year the Survey ranks the world’s top countries in machine tool production, consumption, imports and exports. For the ranking, the Gardner Business Intelligence team takes reported or estimated machine tool economic data and adjusts for exchange rates and inflation which enables year-to-year comparisons in real dollars.

There was little change in the order of the world’s top 10 machine tool producers and consumers from 2021. Leading the list of producers was China at $27.1 billion. According to a report issued by ISO in 2021, a little over three-quarters of Chinese production then was in CNC machines. Second place in 2022 machine tool production was a near tie between Japan ($10.5 B) and Germany ($10.3 B). They were followed by Italy ($6.9 B), the United States ($5.9 B), South Korea ($4.5 B), Taiwan ($3.9 B), Switzerland ($2.6 B), India ($1.4B) and Brazil (1.0 B). The world’s top exporters, in order, were Germany, Japan, China, Italy and Taiwan.

China was also the world's number one consumer of machine tools at $27.4 billion. The United States came in second by a very large margin at $10.1 billion. They were followed by Italy ($5.7 B), Germany ($5.5 B), Japan ($4.0 B)South Korea (3.1 B), India ($2.8 B), Russia ($2.1 B), Mexico (2.0 B) and Taiwan ($1.8 B). China also remained the world’s top machine tool importer, followed by the US, Germany, Mexico and Italy.

| 2022 |

Consumption USD |

Consumption Rank |

Production USD |

Production Rank |

Imports USD |

Imports Rank |

Exports USD |

Exports Rank |

| China | 27.4 B | 1 | 27.1 B | 1 | 6.6 B | 1 | 6.3 B | 3 |

| USA | 9.3 B | 2 | 5.9 B | 5 | 5.5 B | 2 | 2.1 B | 8 |

| Italy | 5.7 B | 3 | 6.9 B | 4 | 2.8 B | 5 | 3.2 B | 4 |

| Germany | 5.5 B | 4 | 10.2 B | 3 | 2.6 B | 3 | 7.3 B | 1 |

| Japan | 4.1 B | 5 | 10.5 B | 2 | .08 B | 15 | 7.2 B | 2 |

| South Korea | 3.1 B | 6 | 4.5 B | 6 | 1.0 B | 9 | 2.4 B | 6 |

| India | 2.8 B | 7 | 1.4 B | 9 | 1.6 B | 6 | 0.2 B | 21 |

World Shares Manufacturing Challenges

One of the more striking observations about the 2022 World Machine Tool Survey is how consistent the production and consumption numbers were globally. Typically, there are more changes among the rankings due to varying conditions in regional manufacturing economies around the world. However, last year virtually all industrialized nations faced very similar challenges. There were the lingering effects of the Covid-19 pandemic which continued to impact supply chains everywhere. While supplier deliveries did improve over the course of the year, key shortages continued to hamper production, particularly in electronic components.

Inflation was another factor affecting the world manufacturing industry. According to the IMF, the global inflation rate was 8.8% in 2022, the highest level since 1982. This, in combination with the war in Ukraine, drove energy prices to the highest levels in years. Oil prices rose to $139 per barrel in March, the highest in more than a decade, and natural gas prices in Europe rose to a record high in December. All of these factors contributed to increasing delivery times and prices for machine tools, regardless of country.

The lack of skilled labor is also a broad-based issue and, as readers of Modern Machine Shop know all too well, particularly acute in the United States. That is creating demand for more sophisticated machine tools and automation to reduce the labor required to manufacture goods. While this class of equipment does represent a growing portion of the mix of manufacturing technologies, it is more expensive and takes more time to build. Though many of world’s major machine tool builders did see a modest downturn in 2022, average backlogs remain relatively high.

Read Next

Building Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.jpg;maxWidth=300;quality=90)