Why Is U.S. Automotive Manufacturing Strong Right Now?

That’s a big question, but some facts and figures reveal a few of the facets of this industry’s current vitality.

Share

Automotive OEMs and their suppliers are investing in retooling and improving facilities to increase productivity and improve efficiency. Notable OEM spending programs include $1.4 billion for a transmission plant in Livonia, Michigan; $200 million for an assembly plant in Avon Lake, Ohio; $75 million for an engine plant in Trenton, Michigan; $1 billion to retool factories in Ohio and Michigan; and $700 million for an assembly plant in Flat Rock, Michigan, to name a few.

According to the 2017 Metalworking Capital Spending Survey by Gardner Business Intelligence (the research division of Gardner Business Media, publisher of Modern Machine Shop), facilities that serve the automotive industry have said they will spend $804 million on machine tools this year (not counting job shops that do work for this industry). In fact, the automotive industry represents the largest end market for all machine tool purchases this year.

Overall spending by strictly automotive facilities is expected to total $370 million on machining centers, $48 million on turning centers and $103 million on grinding equipment. The survey indicates that automotive industry spending will be about 60 percent higher than spending by the aerospace industry and four times more than the medical industry. The Top End Markets table (see slideshow at the top of the article) shows the expected spending figures. Looking at some of the factors behind that strength suggests what it might mean for U.S. manufacturing overall and for the suppliers in the automotive sector.

Strong for How Long?

The automotive industry is strong right now, mainly because automakers are producing a lot of vehicles. Production of cars and trucks is peaking at historic levels, setting a sales record of just under 17.5 million vehicles in 2015 and about 17.55 million in 2016. Predictions call for production of vehicles in North America to top 18 million in 2017, 2018 and 2019.

A number of factors seem to be boosting consumer purchases of cars, light trucks and SUVs/crossovers. Unemployment is low, the stock market is high, gas prices and interest rates are cheap. Dealer incentive programs are also enticing buyers with big discounts. However, none of these factors is locked in.

Since the Great Recession of 2008, job growth has been slow and wage gains have been meager. Gas prices today reflect global production levels, which can be manipulated by major overseas producers. Interest rates are likely to creep up. The incentive programs may keep cars moving off dealer lots to make room for more output from the auto factories, but the impact on profit margins may curtail them. Nevertheless, in the short term, it appears that the pro-business stance of the current government administration contributes to a positive outlook for the automotive industry. Still, there are no guarantees.

Historically, the automakers have rarely been nimble enough to respond to the whims of buyers without some substantial disruption to the supply chain. These disruptions may appear to be ripples to economists looking at the total economy, but they can be tsunamis to suppliers that lose big contracts.

Another issue influencing the automotive sector is profound change in automotive design and production. Electric vehicles, lightweight construction and driverless operation seem destined to change how and what we drive. Another technology likely to have an impact, perhaps a sweeping impact, on the style of vehicles and the style of manufacturing processes is additive manufacturing. Fuel-efficiency mandates are likely to be rolled back, but this action may give automakers more breathing room to pursue long-term shifts in design and production, while revenues from the current vehicle lineup can be sustained longer. Speculation and predictions abound, but what lies ahead is, to use a figure of speech, clearly unclear. Whatever direction the industry takes, significant investment in capital equipment will be required

Years ago, job shops and contract manufacturers learned to keep their customer bases diversified to avoid over-reliance on one industrial sector. This advice was especially applicable to the automotive sector. Many shops enforced strict rules about keeping no more than 25 percent of their businesses to one industry or customer. While opportunities to participate in the strong automotive market shouldn’t be ignored, a moderate approach still seems wise.

Additive for Automotive

Several developments in additive manufacturing processes are worth noting here, because they are of special interest to automotive manufacturing. One is the ability to make parts as large, or larger, than a complete engine block. Although this capability is of primary value in R&D for prototyping, evaluating lightweight design options and so on, practical production applications include a more affordable, more efficient way to create parts for low-volume vehicles and personalized car parts such as a custom spoiler, for example. Speeding the production of tooling and fixturing items is also valuable in automotive production environments.

The ability to make parts more quickly and make them in large volumes will be the turning point in additive manufacturing for automotive companies. Jet engine manufacturers share the same interest—various additively manufactured components now go into the latest generation of jet engines. Developers of additive manufacturing equipment recognize the opportunity here. We are a few years away from this breakthrough, but it bears close watching.

Automotive as a Top Industry

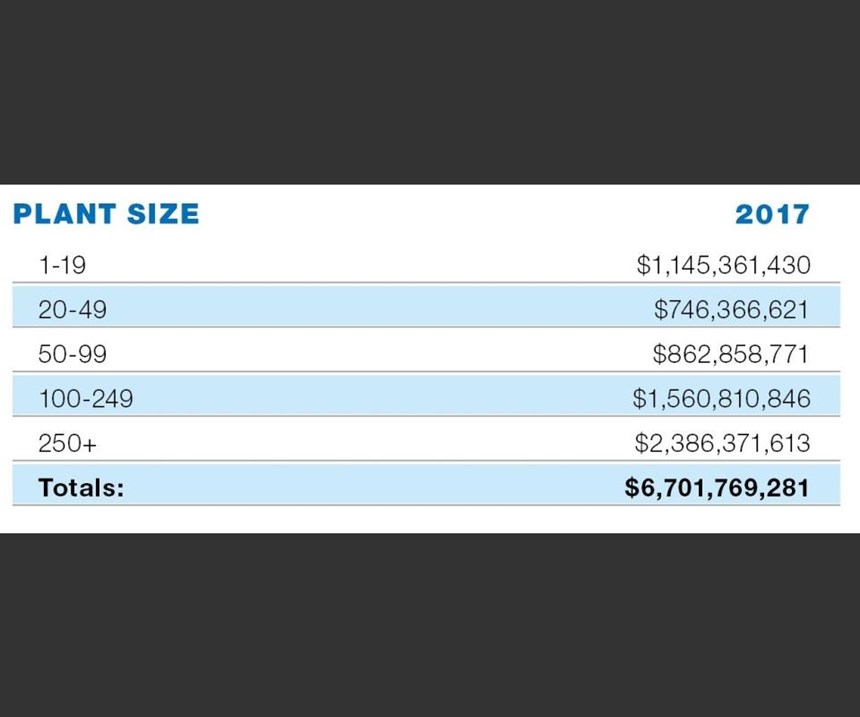

To be clear, the automotive industry represents plants of all sizes, and plants with fewer than 100 employees are spending heavily on machine tools, too. The Plant Size table in the slideshow at the top of the page shows machine tool spending (for automotive and all other industries) by companies of different sizes. Numbers from this table show that shops on the low end of the size range will spend roughly three-fourths as much as companies with 100 or more employees.

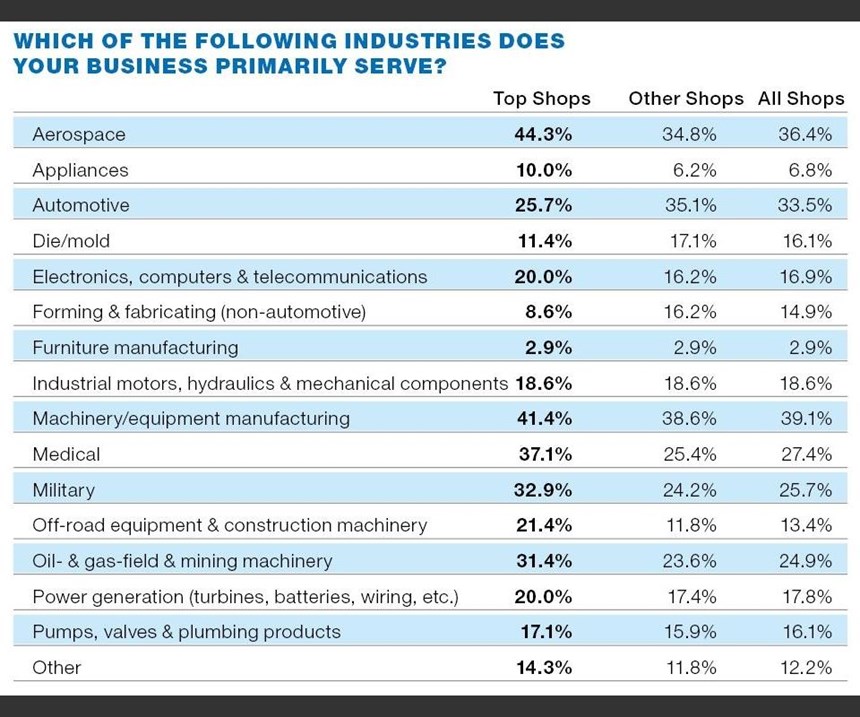

Some interesting findings about service to the automotive industry arise from our latest Top Shops benchmarking survey, which seeks to identify the specific practices or strategies that leading shops share. About 94 percent of the participants in this annual survey are contract manufacturers or job shops. A look at a table in the slideshow at the top of the page (“Which of the Following Industries Does Your Business Primarily Serve?”) from the profile information of these participants (nearly 350 shop principles) shows that one-third of them are involved in some service to the automotive industry. The point here is that a lot of work is being done for the automotive industry by small- to medium-size companies.

Perhaps more significant is that companies identified as Top Shops tend to be less involved in automotive than other shops surveyed. In 2016, about 26 percent of the Top Shop group identified automotive as a “business primarily served,” whereas the figure for other shops is close to 35 percent. Top Shops also tend to be more involved in aerospace (44 percent) than the other shops (slightly more than 35 percent). This suggests that aerospace attracts and/or demands a commitment to a high level of technological capability and the keen management skills that go with it. That said, there is no implication that automotive work is any less worthy of technological or management prowess, or that it faces challenges any less demanding. The fact is that the automotive industry does have a large appetite for high volumes of simpler parts that fit well in the production portfolio of many job shops.

Every industry is seeking suppliers that strive for top performance by adopting best practices, investing boldly in technology and nurturing an able workforce. Having the technology capability of top shops engaged more fully in automotive manufacturing has a “rightness” that should be fulfilled.

Related Content

Rethink Quality Control to Increase Productivity, Decrease Scrap

Verifying parts is essential to documenting quality, and there are a few best practices that can make the quality control process more efficient.

Read MoreSelecting a Thread Mill That Matches Your Needs

Threading tools with the flexibility to thread a broad variety of holes provide the agility many shops need to stay competitive. They may be the only solution for many difficult materials.

Read More4 Commonly Misapplied CNC Features

Misapplication of these important CNC features will result in wasted time, wasted or duplicated effort and/or wasted material.

Read More6 Machine Shop Essentials to Stay Competitive

If you want to streamline production and be competitive in the industry, you will need far more than a standard three-axis CNC mill or two-axis CNC lathe and a few measuring tools.

Read MoreRead Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read More