Second Chances for Surplus Tools

A new website aims to give shops with excess tooling a way to sell that tooling to other shops. Cutting tool suppliers are using the site for their own excess tools.

Share

Hwacheon Machinery America, Inc.

Featured Content

View More

Takumi USA

Featured Content

View MoreIf you held your shop upside down and shook it, how many cutting tools would fall out?

That is, apart from the tools that are in the machines’ toolholders and ready to be used making parts, how much excess or unneeded tooling is sitting untouched in the tool crib or in the drawers of tool chests? Shops routinely are left with cutting tools for which they no longer have a direct need because of jobs that went away, or jobs that didn’t require all of the tooling purchased. In fact, because excess tooling has a way of filling small spaces, shops routinely carry much more of this unneeded inventory than they are aware of having.

And in a way, it makes sense to carry this inventory. While there are options for selling pre-owned tools through a secondary market (eBay is an example), arguably there has not been an option that is easy enough to use for a shop to sell many varieties of tools in small quantities. There also has been no easy way for potential buyers to be aware of surplus tooling available this way so they can quickly find what they need. As a result, the shop’s best practical choice for surplus tooling is to hang onto it, on the chance that some use for it will present itself in the future.

This is the problem that Industrial Surplus Solutions aims to address. This year, the company launched a website, toolingmarketplace.com, which was designed by cutting tool professionals to serve as a secondary marketplace connecting the owners and buyers of discounted surplus tooling.

The idea seemed like an attractive solution for machine shops with excess tooling sitting around, says Brian Nowicki, Industrial Surplus Solutions’ CEO. But cutting tool suppliers have embraced it, too, he says. Brand-name cutting tool OEMs proved to be the first sellers to use the system, and seem likely to account for most of the site’s available tool inventory going forward. After all, these companies have even more surplus tooling on hand than machine shops do.

Mr. Nowicki says simplicity is the key to the system. Buyers and sellers will only use the site if posting tooling for sale and finding tooling to fit a particular need are both intuitively easy to do. And achieving simplicity, he says, is difficult.

More specifically, achieving simplicity has involved a great deal of detail work. The site identifies tools according to the electronic data processing (EDP) number, the stock number assigned to the tool by the manufacturer, so that the seller only has to enter this number from the tool’s packaging in order to identify descriptive details of the tool. On Industrial Surplus Solutions’ end, this has meant that launching any tool category (turning inserts, for example) entails capturing information for most or all of the relevant EDPs from the major tool manufacturers. For this reason, tool categories are coming available on the site in stages.

Another effort Industrial Surplus Solutions makes is monitoring transactions. The company stores no inventory, but instead connects buyers and sellers so that the seller can ship the item directly. Because the seller is likely to be a busy machine shop, one fear is that the shipment might not occur promptly. Part of the job of Jeffrey Newbill, COO, is to make sure that fear is not realized. He receives an alert whenever an order goes three days without the seller logging that the inventory has been shipped, at which point he makes direct contact with the seller to resolve the delay.

Cutting tool OEMs have partnered with the site largely in order to sell surplus inventory that has been eclipsed by these companies’ newer cutting tool offerings. The newest and most advanced products are the focus of these companies’ marketing efforts, says Mr. Nowicki, so a secondary marketplace is helpful for their surplus tooling challenges as well. Currently, the site has over $6 million in cutting tool inventory available to sell, and because the site is too new for many independent shops to have heard of it, almost all of that inventory so far is in the warehouses of cutting tool OEMs.

Organizing the stock by EDP obviously aids these OEMs, as they are the authors of those numbers. In fact, any given collection of tool types does not have to be entered by each individual EDP, but can be entered all at once on a single spreadsheet. The site is able to read CSV-formatted spreadsheet data (from Excel, for example) and automatically split that data into a separate product offering for every spreadsheet line. Machine-shop sellers can take advantage of the same capability if they have a large number of tools, Mr. Nowicki says. The spreadsheet just has to be organized correctly, with EPD, quantity available, asking price and so on, in the appropriate columns of a seven-column table. In this way, he says, a single document that a shop uses to record its remainder tooling could be the same document this shop uses to make that tooling available to the world.

Related Content

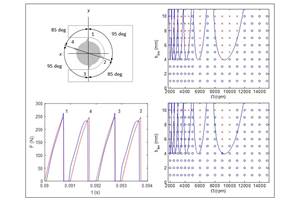

The Impact of Cutting Teeth Spacing on Machining Stability

Many cutter designs are available, and variable teeth spacing (or variable pitch) cutters can be used to influence milling stability. Let’s discuss why teeth spacing affects stability.

Read MoreSelecting a Thread Mill That Matches Your Needs

Threading tools with the flexibility to thread a broad variety of holes provide the agility many shops need to stay competitive. They may be the only solution for many difficult materials.

Read MoreHow to Accelerate Robotic Deburring & Automated Material Removal

Pairing automation with air-driven motors that push cutting tool speeds up to 65,000 RPM with no duty cycle can dramatically improve throughput and improve finishing.

Read MoreHigh-Feed Machining Dominates Cutting Tool Event

At its New Product Rollout, Ingersoll showcased a number of options for high-feed machining, demonstrating the strategy’s growing footprint in the industry.

Read MoreRead Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More

.jpg;maxWidth=300;quality=90)