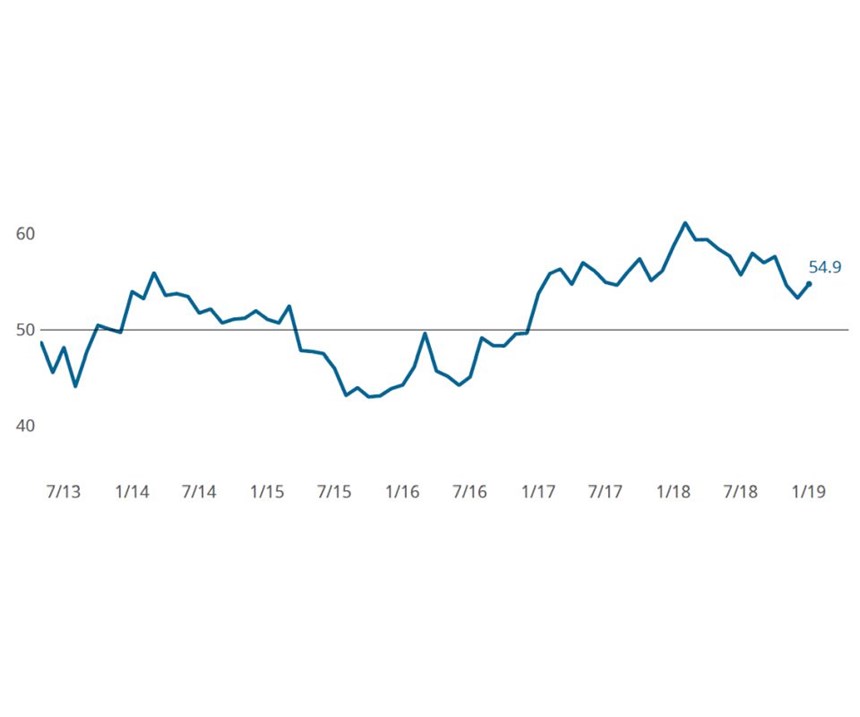

Metalworking Index Starts 2019 with Growth

The Gardner Business Index: Metalworking moves back to former growth levels from earlier in business cycle.

Share

Takumi USA

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

Autodesk, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

The Gardner Business Index (GBI): Metalworking registered 54.9 in January, indicating that the Index’s latest expansion rate is on par with the strong growth levels experienced earlier in the current business cycle. However, compared to the same month one year ago, the Index is 7 percent lower. This is largely due to the run-up in the Index last year, which culminated in a February 2018 all-time-high reading of more than 61.0. Since the start of the current business cycle’s expansionary phase (which began in early 2017), the Index has averaged 56.7.

Gardner Intelligence’s review of the underlying data for the month indicates that the Index—calculated as an average—was supported by production, supplier deliveries and new orders. The components that lowered the Index include employment, backlog and exports. Only exports reported a contractionary reading during the month. For the first time since April 2018, production expanded faster than supplier deliveries. This intersecting of the two readings may be an early indicator that supply chains are close to becoming balanced with current levels of production. This change comes after supplier delivery readings spent most of 2018 attempting to catch up with the usually strong rise in new orders, which peaked in early 2018, yet has been highly elevated by historical standards since early 2017.

January’s expansionary reading for new orders, slight contraction in exports and growth in backlogs suggest that domestic demand for manufactured goods continues to offset exports, which have weakened while the United States is negotiating new international trading rules. Recent macroeconomic indicators in both Asia and Europe have indicated slowing and even contracting economies, making U.S. demand even more important to the growth of domestic manufacturing.

Related Content

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)