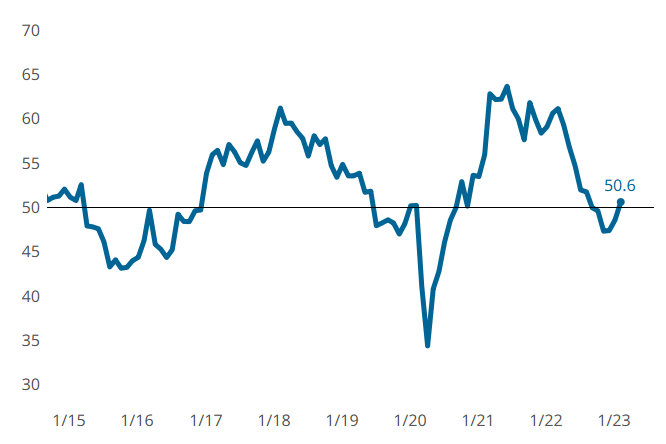

Metalworking Activity Crept Into Growth Mode in February

The GBI closed at 50.6 in February, calling for cautious optimism.

The Gardner Business Index for Metalworking closed at 50.6 in February — up two points versus January. Four of six components still contracted in February, but all of them moved in the right direction by contracting slower.

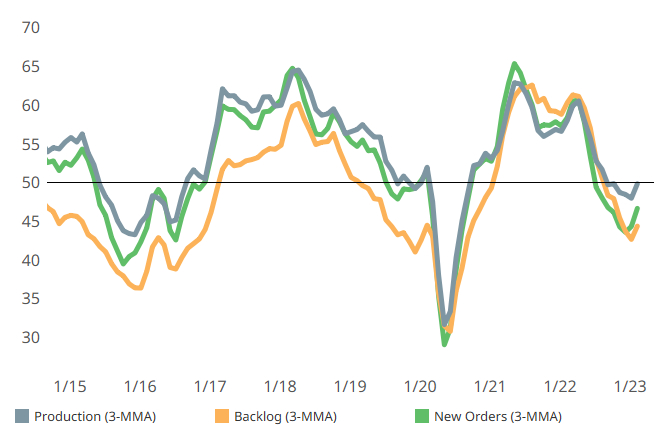

For new orders and exports, February marked the second straight month of at least a slight slowing of contraction. Not surprisingly, given the new orders trend (two months makes a trend!), production and backlog got on board with slowing contraction in February as well. Employment activity and supplier deliveries were about the same in February as January, with employment growing a bit faster and supplier deliveries lengthening a bit slower.

The collective data call for cautious optimism. While February teased that metalworking activity is picking up, indications came more from the number of components with upticks than the position, magnitude or degree of change for any.

Metalworking GBI showed slight growth in February following a three-month detour in contraction.Photo Credit: Gardner Intelligence

New order activity led the way with a second straight month of slowed contraction in February. Production and backlog activity followed suit with slowed contraction for the first time since starting to contract in Fall 2022 (3-MMA = three-month moving averages).

Related Content

-

Metalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

.jpg;maxWidth=300;quality=90)