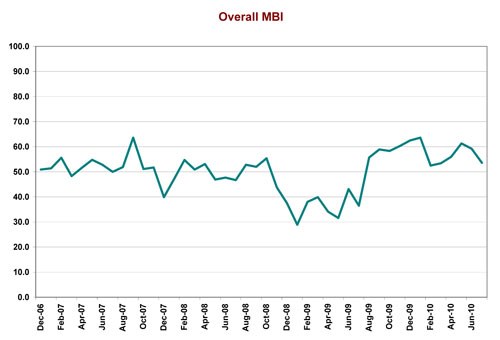

July MBI at 53.6 – Third Straight Month of Slowing Growth

With a reading of 53.6, the MBI showed that the metalworking industry logged its 12th straight month of growth.

Share

With a reading of 53.6, the MBI showed that the metalworking industry logged its 12th straight month of growth. However, July is also the third consecutive month with a slower rate of growth. While the MBI does not have a lot of historical data, it does appear normal for the trend in the overall MBI to flatten or decline slightly in the summer months.

The backlog sub-index was the only sub-index to improve compared to last month. With new orders growing at a faster rate than production, the backlog sub-index should continue to show strength in the upcoming months. The employment sub-index made the sharpest decline in July, dropping to 50.0 from 65.8. This means that the rate of hiring in the metalworking industry has stabilized (not that the employment level was unchanged in July).

The trends in all MBI data (except for backlog) indicate that the industry probably has reached its peak growth for this cycle and is slowing down. But, respondents are the most optimistic they have ever been in the history of the MBI according to the future business expectations sub-index. This optimism seems to go hand in hand with these companies increasing their capital spending plans as the average spending per plant for the next 12 months has increased significantly the last two months. Do the respondents know something that the data isn’t showing?

For more data on the MBI go here. To participate in MBI (and receive additional information on trends in metalworking) go here.

.JPG;width=70;height=70;mode=crop)