GBI Metalworking Index Reports First Expansion Under COVID

The GBI: Metalworking has reported its first month of expansion since the COVID-19 pandemic began restricting economic activity in America.

Share

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

Takumi USA

Featured Content

View More

Metalworking Business Index: Registering 52.9, the Metalworking Index reported its first expansionary reading since the COVID-19 crisis reached America. The latest reading is the highest since April of 2019.

The Gardner Business Index (GBI): Metalworking registered 52.9 in October. New orders and production have now posted two consecutive months of expansionary activity readings. Historically, the new orders component of the Index has served as a directional bellwether for most of the other components of the GBI. Therefore, it would seem plausible that the slowing contraction being experienced in employment and backlogs will continue to slow and even begin to expand in the near-term.

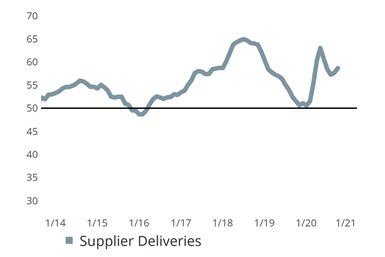

As we approach the end of the year and the typical seasonal rise in consumer sales, it may not be particularly surprising that supplier delivery readings are rising (indicating lengthening delivery times) after reporting improving delivery speeds in previous months. Removing the inflationary effect from the supplier deliveries component, the Metalworking Index would have registered a slightly less expansionary reading of 51.3.

Expanding New Orders May Be Slowed as Delivery Times Lengthen: The last two months of data have seen expanding activity in new orders and production. However, slowing deliveries — seemingly due to overwhelming seasonal shipping demand — may delay the delivery of finished goods and thus stymie the recovery of business activity.

Other encouraging signs in the metalworking manufacturing space include a rebound in per-plant expected spending and a strong rebound in future business outlook over the next 12 months. Per-plant spending, which set a multi-year low in May, has rebounded by 37% (based on a three-month moving average). The latest per-plant spending figure is the highest since the government declared COVID-19 a national emergency in March, and is only 5% below the per-plant spending figure from February 2020. Similarly, business outlook readings are again above 70 and very nearly at the same level as they were pre-pandemic.

Related Content

-

Metalworking Activity Contracts With the Components in June

Components that contracted include new orders, backlog and production, landing on low values last seen at the start of 2023.

-

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

.jpg;width=70;height=70;mode=crop)